Last Friday, the US dollar again attempted to interrupt its multi-week decline after investors got acquainted with the report of the US Department of Labor, published at the beginning of the American trading session. According to this report, the number of jobs outside of agriculture in the United States in July rose by 1.763 million, while unemployment fell to 10.2% from 11.1% in June. Economists were looking for 1.6 million jobs growth.

Early last week, the DXY dollar index hit a new 26-month low around 92.48. However, after the publication of more positive than expected data from the American labor market, the dollar strengthened, and the DXY dollar index closed last week in positive territory with an increase of several points.

A report from the US Department of Labor indicates that the economic recovery continues, albeit at an uneven pace.

Before the pandemic, unemployment was at its lowest level in 50 years at 3.5%. While US unemployment was still high in July, it is still low by historical standards, and overall hiring rates have exceeded expectations; the number of jobs continues to grow, and unemployment is also declining.

Although new outbreaks of coronavirus have forced some states to postpone easing restrictions or even introduce new ones, after the publication of the labor market report, cautious optimism and hopes that the worst is over was revived among investors.

During today's Asian session, DXY dollar futures were traded in a tight range near 93.43, 2 points above today's opening price.

One of the important events of the past week was also the meeting of the Bank of England, following which the central bank of Great Britain decided to leave interest rates unchanged, not showing much desire to resort to negative interest rates.

New economic forecasts by the Bank of England were also quite optimistic.

However, investors are still pricing in the fact that the Bank of England may ramp up its quantitative easing (QE) program towards the end of the year.

The Bank of England, after its regular meeting last Thursday, stressed the presence of "significant uncertainty around the prospects for the UK economy".

Free movement of people in the UK has not yet been restored to the same extent as in other European countries, while economic stimulus measures have been less aggressive than in Europe, and the number of cases of coronavirus is growing.

Most likely, the Bank of England will remain inclined to pursue soft policies, given the uncertainties associated with the pandemic and Brexit.

The pound strengthened last Thursday, when the meeting of the Bank of England ended. However, the GBP / USD pair finished last week with a slight loss, given the strengthening of the dollar after the publication of the report from the American labor market.

Thus, the conclusion suggests itself that the main dynamics of the GBP / USD pair will still be associated with the dynamics of the dollar. As soon as the dollar stops weakening, the GBP / USD pair will move to decline.

At the time of this posting, DXY dollar futures are traded near 93.51, 10 pips above today's opening price, while GBP / USD is traded near 1.3062, in a tight range.

Important news is not expected today, but on Tuesday (at 08:30 GMT) the National Statistics Office will present data from the UK labor market, and on Wednesday (06:00 GMT) data on industrial production in the UK (for June) and the country's GDP in the 2nd quarter will be published. Economists expect GDP to fall by more than 20% in the reporting period, which is certainly a negative factor for the pound.

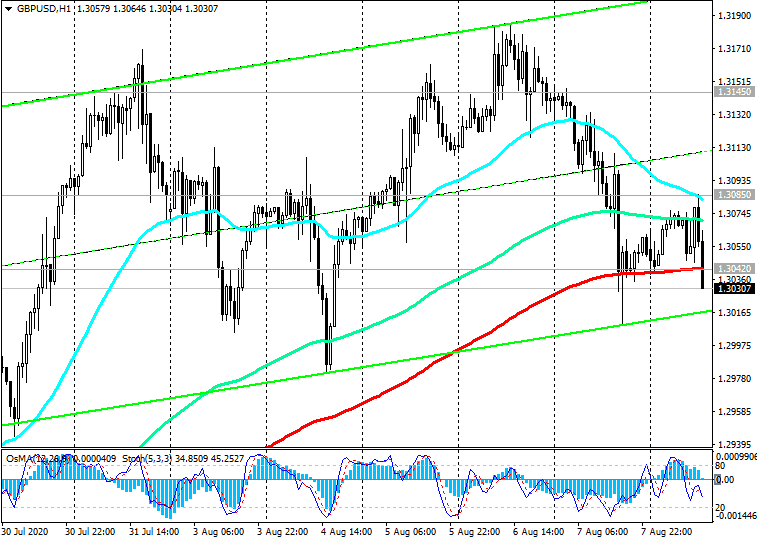

In July, the GBP / USD managed to rise significantly. At the end of last month, the GBP / USD pair broke through the key resistance level 1.3145 (ЕМА200 on the weekly chart), briefly rising to 1.3170 mark. However, the pair was unable to develop the upward dynamics above this resistance level.

Still, the strengthening of the pound and the growth of GBP / USD should be treated with caution.

The pound remains under pressure from fundamental factors, including the risks of a tough Brexit and a subsequent slowdown in the British economy, as well as the consequences of the coronavirus pandemic.

GBP / USD spent the previous week in a range near 1.3150 mark.

During today's Asian session, the pair was unable to resume its growth, although it remained trading in the zone above the important short-term support level 1.3042 (ЕМА200 on the 1-hour chart).

A breakdown of this support level will increase the risks of further decline towards the support levels 1.2925 (ЕМА144 on the weekly chart), 1.2792 (ЕМА200 on the 4-hour chart and June highs).

In the zone below the key support level 1.2635 (ЕМА200 on the daily chart), short positions will again become preferable.

In an alternative scenario and after a confirmed breakdown of the resistance level 1.3145, GBP / USD will continue its upward trend and head towards resistance levels 1.3210 (Fibonacci level 23.6% of the correction to the decline of the GBP / USD in the wave that began in July 2014 near the level 1.7200), 1.3510 (local highs).

Support Levels: 1.3042, 1.2925, 1.2792, 1.2635, 1.2600, 1.2585, 1.2550, 1.2250, 1.2085, 1.2000

Resistance Levels: 1.3085, 1.3145, 1.3210, 1.3510

Trading Scenarios

Sell by market. Stop-Loss 1.3115. Take-Profit 1.2925, 1.2792, 1.2635, 1.2600, 1.2585, 1.2550, 1.2250, 1.2085, 1.2000

Buy Stop 1.3115. Stop-Loss 1.2990. Take-Profit 1.3145, 1.3210, 1.3510