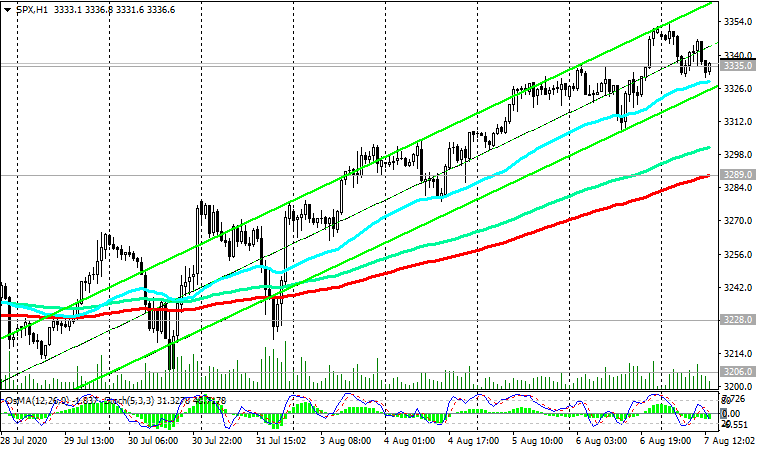

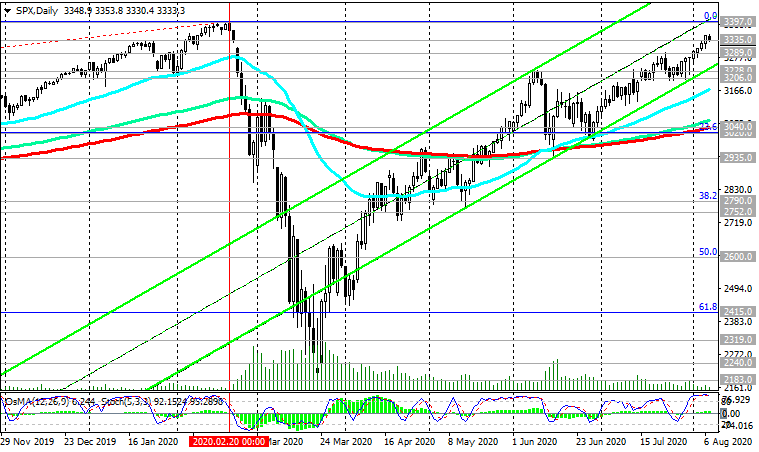

The S&P 500 continues to develop an upward trend in the upward channel on the daily chart, traded above important short-term support levels 3289.0 (EMA200 on the 1-hour chart), 3206.0 (EMA200 on the 4-hour chart) and above key support levels 3020.0 (Fibonacci level 23.6 % of the downward correction to growth since February 2016 and the level of 1807.0), 3040.0 (ЕМА200 on the daily chart).

As the global and American economies recover, stock indices will continue to rise. Long positions are preferable in the current situation.

The S&P 500 hit a new 6-month high on Thursday near 3352.0, continuing to move towards the record high of 3397.0 set in February this year.

Investors are guided by the Fed's ultra-soft policy and the continued positive corporate reporting of American companies.

Investors also hope that lawmakers will agree on the terms of a new package of state aid related to the coronavirus. The White House on Wednesday put pressure on Democrats, calling for an agreement: government representatives said that if no agreement is reached by the end of the week, they can withdraw from discussions, after which they will act through Trump's decrees.

In an alternative scenario, a breakdown of the support level 3289.0 may become a signal for selling.

Below support level 3020.0, short positions will become relevant again.

Support Levels: 3289.0, 3228.0, 3206.0, 3040.0, 3020.0, 2935.0

Resistance Levels: 3397.0

Trading Recommendations

Sell Stop 3280.0. Stop-Loss 3355.0. Targets 3228.0, 3206.0, 3040.0

Buy by market. Stop-Loss 3280.0. Targets 3397.00, 3400.00, 3500.00