The pound remains under pressure from Brexit risks. It strengthened slightly earlier in the European session today after the July Purchasing Managers Index (for the UK manufacturing sector) publication. Markit Economics has released updated data that showed the UK manufacturing PMI rose to 53.3 in July. In June, the index was 50.1. A reading above 50 indicates an increase in activity from the previous month.

Despite the rise in the index, rising unemployment, uncertainty about the preservation of jobs, the second wave of coronavirus and continuing social distancing measures will inevitably hold back the recovery in activity in the British economy, economists say.

On Thursday, August 6, a regular meeting of the Bank of England, dedicated to monetary policy, will take place. Central bank officials are likely to use cautious rhetoric amid the uncertain economic outlook, given the risk of a second wave of coronavirus and a possible rise in unemployment after the end of the employment program (on October 31). Any hint of negative interest rates will lead to a sharp downward reversal of the pound, economists say.

At the same time, it is difficult to imagine that the US government will approve of the strengthening of the dollar ahead of the presidential elections scheduled for November, financial market watchers say.

Thus, in the coming months, high volatility with deep multidirectional movements of currencies will remain on the financial markets.

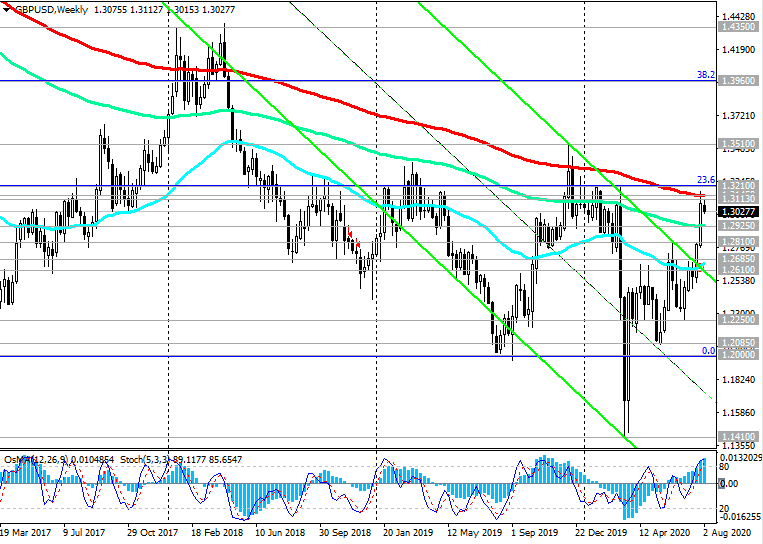

At the end of last week, the GBP / USD briefly broke through the key resistance level 1.3145 (ЕМА200 on the weekly chart), rising to 1.3170 mark. However, the pair was unable to develop the upward dynamics above this resistance level.

Still, the strengthening of the pound and the growth of GBP / USD should be treated with caution.

The pound remains under pressure from fundamental factors, including the risks of a tough Brexit and a subsequent slowdown in the British economy, as well as the consequences of the coronavirus pandemic.

On Monday, the pair is declining, moving (so far within the correction) to the important short-term support level 1.2925 (ЕМА200 on the 1-hour chart).

The breakdown of this support level will increase the risks of further decline towards the support levels 1.2685 (ЕМА200 on the 4-hour chart), 1.2610 (ЕМА200 on the daily chart).

In the zone below support level 1.2610, short positions will again become preferable.

In an alternative scenario and after a confirmed breakdown of the resistance level of 1.3145, GBP / USD will continue its upward trend and head towards resistance levels 1.3210 (Fibonacci level 23.6% of the correction to the decline of the GBP / USD in the wave that began in July 2014 near the level 1.7200), 1.3510 (local highs).

Support Levels: 1.2925, 1.2810, 1.2685, 1.2610, 1.2585, 1.2550, 1.2250, 1.2200, 1.2085, 1.2000

Resistance Levels: 1.3145, 1.3210, 1.3510

Trading Scenarios

Sell by market. Stop-Loss 1.3115. Take-Profit 1.2925, 1.2810, 1.2685, 1.2610, 1.2585, 1.2550, 1.2250, 1.2200, 1.2085, 1.2000

Buy Stop 1.3115. Stop-Loss 1.2920. Take-Profit 1.3145, 1.3210, 1.3510