The Canadian dollar has strengthened significantly in the last two months, receiving support both from the global economic recovery after the coronavirus pandemic, and amid rising oil prices.

Quotes of WTI oil futures on Nymex rose on Tuesday by 3.9%, to 36.80 dollars per barrel. This is the highest level of trading closure since early March.

The volatility in the quotes of the Canadian dollar today may again sharply increase at 14:00 (GMT), when the decision of the Bank of Canada on the interest rate will be published.

It is expected that the rate will remain at the same level of 0.25%. Investors will be interested in the comments contained in the accompanying statement of the Bank of Canada. Any unexpected statements regarding the bank's monetary policy will cause a surge in volatility in CAD quotes and, accordingly, in the USD / CAD.

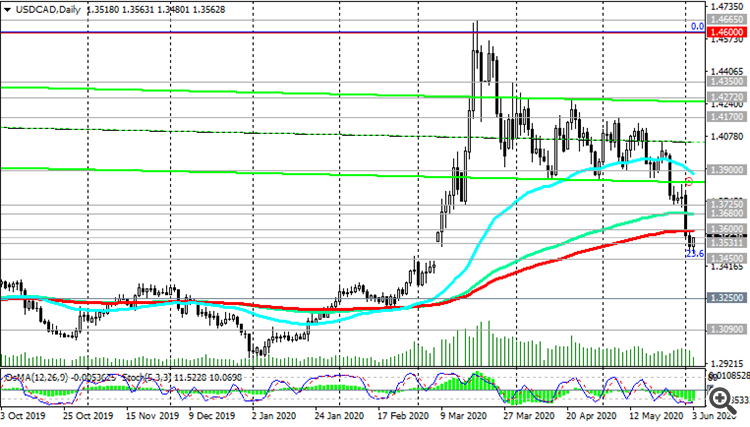

A break into the zone above key levels 1.3600 (ЕМА200 on the daily chart), 1.3680 (ЕМА144 on the daily chart) can give the pair USD / CAD strength and return it to the uptrend.

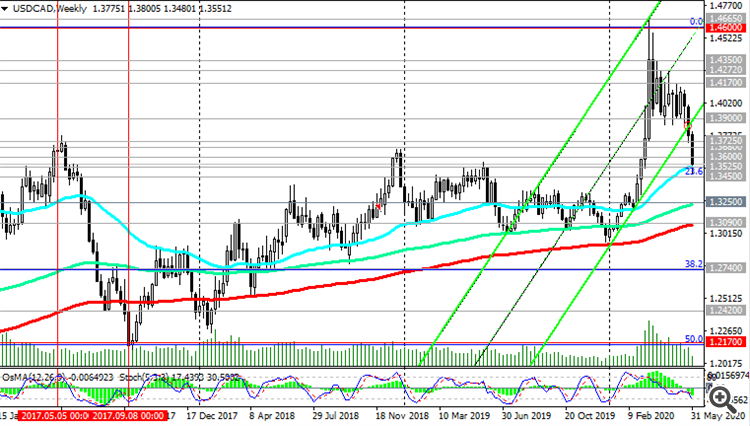

In an alternative scenario, and after the breakdown of support levels 1.3525 (EMA50 on the weekly chart), 1.3450 (Fibonacci level 23.6% of the downward correction in the wave of USD / CAD growth from 0.9700 to 1.4600), the USD / CAD decline may continue to the support levels 1.3250 ( EMA144 on the weekly chart), 1.3090 (EMA20 on the weekly chart).

Support Levels: 1.3450, 1.3250, 1.3090

Resistance Levels: 1.3600, 1.3680, 1.3725, 1.3900

Trading Scenarios

Sell Stop 1.3475. Stop-Loss 1.3610. Take-Profit 1.3450, 1.3250, 1.3090

Buy Stop 1.3610. Stop-Loss 1.3475. Take-Profit 1.3680, 1.3725, 1.3900, 1.4000, 1.4170, 1.4272, 1.4350, 1.4600