The intention of the dashboard is to provide a quick overview of the daily, weekly and monthly range of configured assets. In "single asset mode" the dashboard shows you possible reversal points directly in the chart, thus making statistics directly tradable. If a configured threshold is exceeded, the dashboard can send a screen alert, a notification (to the mobile MT4/MT5) or an email.

There are various ways of using this information. One approach is that an asset that has completed nearly 100% of its average daily movement shows a tendency to reverse. Another approach is to observe the assets, which has a very low volatility compared to the average. Now the challenge is to trade the breakout from this low volatility.

In this post, I would like to briefly talk about the visuals and variables of the dashboard. If you have further questions, please contact me.

You find the free version of the dashboard for MT4 here (https://www.mql5.com/en/market/product/33913) and the full featured version for MT4 here (https://www.mql5.com/en/market/product/33805) and the full featured version for MT5 here https://www.mql5.com/en/market/product/52708.

Visuals

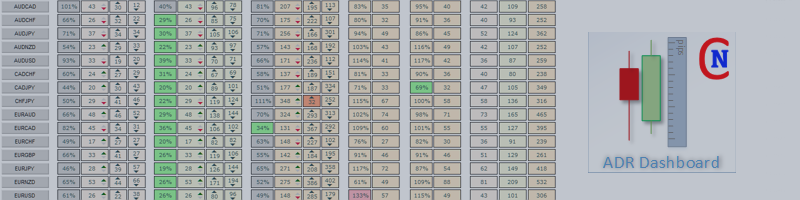

| Element | Description |

|---|---|

| | This is a button (in dashboard mode) or a label (in single asset mode). In dashboard mode you can open a chart using this asset and a configured template (see OF14/OF15/OF16) |

| | Current daily range in percent of reference ADR (63% in this picture), current daily range in pips (26), daily candle bullish/bearish (bearish), room up in pips (26), room down in pips (31) |

| | Current weekly range in percent of reference AWR (43% in this picture), current weekly range in pips (46), weekly candle bullish/bearish (bearish), room up in pips (92), room down in pips (79) |

| | Current monthly range in percent of reference AMR (81% in this picture), current monthly range in pips (207), monthly candle bullish/bearish (bearish), room up in pips (194), room down in pips (113) |

| | Previous (yesterday) day range in percent of reference ADR (102% in this picture), previous day range in pips (43) |

| | Previous x (3 in this picture) days average range in percent of reference ADR (108% in this picture), previous x days average range in pips (45) |

| | Reference ADR (average daily range) in pips (42 in this picture), reference AWR (average weekly range) (109), reference AMR (average monthly range) (258) |

| | Alert buttons (if you use the "alert locks" function) - Place the mouse over the buttons to see the meaning. In this case we have 5 active (still valid) alerts |

Chartelements (in "Single Asset Mode")

| Element | Description |

|---|---|

| | Label with the currently activated asset. Left upper is a small button (labeled with "-"). Use this button to hide/show the visuals except the target lines. |

| With the button upper right you can temporary activate or deactivate the target lines (in this picture the target lines are activated for daily). |

| In this case the target lines for weekly are deactivated. |

| You see all the possible target lines in this picture. This is a really exciting tool to trade range reversals directly in the chart. |

Variables for Assets and "Single Asset Mode"

| Variable | Description |

|---|---|

| (SY01) Symbols/Assets | A list of symbols/assets separated by commas. Please note that all selected assets must be active in MT4/MT5 market watch. |

| (SY02) prefix | Add a prefix to your symbols in SY01 (eg. you have sEURUSD instead of EURUSD - you have to put a s here) |

| (SY03) suffix | Add a suffix to your symbols in SY01 (eg. you have EURUSDpro instead of EURUSD - you have to put a pro here) |

| (SAM) Single Asset Mode | Activate (true) or deactivate (false) the single asset mode. Use this mode to watch various single assets instead of the dashboard overview. |

| (TAM) Targetmode "locked range" | If you are using ADR-Dashboard in "Single Asset Mode" as a tool to find trading targets, this mode can be very helpful. It uses the exact value for the daily/weekly/monthly range, depending on the position of price in relation to the daily/weekly/monthly open. Check it out (Variable TAM) - it is a very cool feature. |

Variables for Daily/Weekly/Monthly targets

| Variable | Description |

|---|---|

| (DT01) Show DTH/DTL from this time frame | Show the target line in chart beginning with this time frame (Applicable in "Single Asset Mode") |

| (DT02) Show DTH/DTL to this time frame | Show the target line in chart ending with this time frame (Applicable in "Single Asset Mode") |

| (DT03) Line style DTH/DTL | Configure the line style of the target lines |

| (DT04) Line thickness | Line thickness (if using line style "Solid") of the target lines |

| (DT05) Ray DTH lines | Ray target lines to the right |

| (DT06) Color of DTH | Color of the target line high (the upper one) |

| (DT07) Color of DTL | Color of the target line low (the lower one) |

| (DT08) Warning threshold for distance to DTH/DTL in pips | This is the distance threshold in pips for color marking in dashboard and alerts (if configured) |

| (DT09) Alerts for DTH/DTL | Activate (true) or deactivate (true) alerts for targets (see variable AL01 for the method of alert - you have to configure this variable too) |

| (DT10) Days back to show (max.20) New in V4.1 | Activate lines for the visual backtest (please only select a maximum of 20 periods to remain performant) |

| (DT11) Line style DRH/DRL New in V4.1 | Style for visual backtest lines (daily range high, daily range low) |

| (DT12) Line thickness DRH/DRL New in V4.1 | Line thickness for visual backtest lines (daily range high, daily range low) |

The settings for weekly and monthly targets are similar to daily.

Variables for Average Daily/Weekly/Monthly ranges

| Variable | Description |

|---|---|

| (AD01) Number of days for the ADR reference range | Configure the count of days for the reference ADR. All daily based values will compared with this reference ADR |

| (AD02) Warning if daily range is less than this value (%) | Configure the lower threshold for the daily range in percent of the reference ADR |

| (AD03) Warning if daily range is greater than this value (%) | Configure the higher threshold for the daily range in percent of the reference ADR |

| (AD04) Background color for daily range | This is the background color for the daily range rows |

| (AD05) Alerts for ADR | Activate (true) or deactivate (false) alerts for daily range (see variable AL01 for the method of alert - you have to configure this variable too) |

The settings for weekly and monthly ranges are similar to daily.

Variables for Previous day range

| Variable | Description |

|---|---|

| (PD01) Warning if PDR is less than this value (%) | Configure the lower threshold for the previous day range in percent of the reference ADR |

| (PD02) Warning if PDR is greater than this value (%) | Configure the higher threshold for the previous day range in percent of the reference ADR |

| (PD03) Background color for PDR | This is the background color for the previous day range rows |

| (PD04) Alerts for PDR | Activate (true) or deactivate (false) alerts for previous day range (see variable AL01 for the method of alert - you have to configure this variable too) |

Variables for previous x days range

| Variable | Description |

|---|---|

| (PX01) Number of days for the PXR | Configure the count of days for the x days range. This value will compared with the reference ADR (see AD01) |

| (PX02) Warning if PXR is less than this value (%) | Configure the lower threshold for the previous x days range in percent of the reference ADR |

| (PX03) Warning if PXR is greater than this value (%) | Configure the higher threshold for the previous x days range in percent of the reference ADR |

| (PX04) Background color for PXR | This is the background color for the previous x days range rows |

| (PX05) Alerts for PXR | Activate (true) or deactivate (false) alerts for previous x days range (see variable AL01 for the method of alert - you have to configure this variable too) |

Variables for Colors / General

The variables in this section are self explained, i think.

Variables for Offset / Fonts / System

| Variable | Description |

|---|---|

| (OF01) Vertical offset | Move the dashboard vertical |

| (OF02) Horizontal offset | Move the dashboard horizontal |

| ... | Fonts and Colors are self explained, i think |

| (OF14) Chart template | This chart template will be used, if you open a chart with the dashboard buttons |

| (OF15) Chart time frame | This time frame will be used, if you open a chart with the dashboard buttons |

| (OF16) Open each chart in new window | If you want, that the indicator opens a new chart for each asset - true, otherwise false |

| (OF17) GUI Resolution | Change the resolution of the dashboard to "LowRes" to fit better on small screens |

Variables for Alerts

| Variable | Description |

|---|---|

| (AL01) Type of Alerts | Choose the type of alerts (No Alert, Notification, Mail or Screen alert) |

| (AL02) Alert timeout in minutes | If you do your analysis in single asset mode and change the timeframes, no more alerts will be triggered until this timeout in minutes is over |

| (AL03) Use alert locks? | If you set this to true, every alert occurs only one time and activates a button on the right side of the dashboard. You can activate the alert with these buttons again |

| (AL04) Alert locked | Set the color for the button, when an alert has occured, but is not still valid |

| (AL05) No Alert | Set the color for the button, when no alert has occured |

| (AL06) Alert active | Set the color for the button, when an alert has occured just now (before alert timeout is over) |

Variables for Alert text templates

Use your own texts for the generated alerts by the dashboard (if you want).

What means vobD and vobU?

Known problem in MT5 version

When you restart the MT5 and Dashboard, you may need to change the timeframe on which the Dashboard was installed. This will update the synchronization of the underlyings.

Thanks for reading. I wish you much success and lot of green pips.