Learn to Read the Market -TRADING WITH WEIS WAVE WITH SPEED INDEX

Greetings to all retail traders!

Learn how to read the market, do not trade because an indicator says so. The system presented below will not tell you when to buy or sell but it will teach you how to read the market and when the time is right to enter.

Every retail trader has the following information available: price, volume and time. What we do not have is the inside information that large institutions have and when these people operate.

So, how do we find out what large institution are doing? Not easy! Why? Because they operate little by little (buying or selling) for several days because if the trade fast with huge chunks of volume they reveal their intentions. Remember smart-money needs time and they rely on your impatience trade and make mistakes.

The key to success is volume but it is not enough but itself. Analyzing volume bar by bar is quite hard and not easy to understand what is happening. Fascinated by David Weis theory I started using weis wave. My trading was improved but still had negative results. I knew that there was something missing in order for me to understand what it was happening in the market and this is when I decided to create my own weis wave.

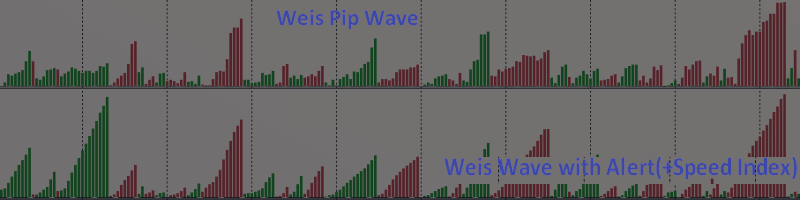

What is so different from a regular weis wave indicator vs my weis wave indicator? The most important thing is the so called "Speed Index".

What is Speed Index? Speed Index is a number which measures the speed of the volume waves. It means nothing by itself but it has a meaning when compared with previous Speed Index numbers on the same chart. Speed Index is helping us to identify Change in Behavior and Effort vs. Result, which both are very important in order to identify what large institutions are doing.

Furthermore, I created Weis Pip Wave, were instead of volume adding and presenting a cumulative histogram of volume, it adds the price moves and presents a cumulative histogram of the price move wave. Very, very important because when you compare the volume waves with the price waves is really easy to visually and identify Effort vs. Result.

Finally, my system uses one more indicator the No Demand No Supply which is basically used as regular volume indicator but it has weighted volume feature that identifies what is a large volume during ASIA session where the volume are very low.

To make the long story sort with these three indicators I can read what the market is doing , identify large institution intentions and follow them to success.

If you are interested to learn more you can visit my YouTube channel: https://www.youtube.com/channel/UCTAzhvsnzPppdqWJS-MWafQ

my site: https://tradethevolumewaves.com

and my Blog: https://tradethevolumewaves.com/blog were I forecast the next move as well as explaining why this move happened.