Last Thursday, the pound strengthened sharply, while the GBP / USD pair reached an intraday and 3-week high near 1.2273. The pound was strengthened by statements by Fed Chancellor Angela Merkel that the EU and Britain could come to an agreement on Brexit by October 31. Earlier media reported that Merkel invited Britain to find a solution to the Irish problem within 30 days.

Optimism regarding the prospect of an agreement on Brexit after negotiations between British Prime Minister Boris Johnson and the heads of Germany and France caused the pound to rise late last week.

However, economists have warned that the growth of the pound "has no fundamental justification".

At the Jackson Hole summit, Bank of England head Mark Carney said the UK’s prospects "depend on the timing and nature of Brexit".

The risks of the “hard” Brexit are high. On October 31, Great Britain will withdraw from the EU with or without an agreement.

This creates the prerequisites for the resumption of the weakening of the pound and the fall of the pair GBP / USD.

There are no important macro data today. The focus of the traders will be the speeches of two representatives of central banks. From the vice president of the European Central Bank, Luis de Gindos, investors are waiting for signals to approve stimulus measures at the September meeting. Earlier in August, ECB board member Olli Rehn said markets could count on a “very serious set of measures”.

The second speaker (at 12:00 GMT), Bank of England representative Sylvanas Tenreiro, can talk about how interest rate policy will depend on the course of negotiations on Brexit.

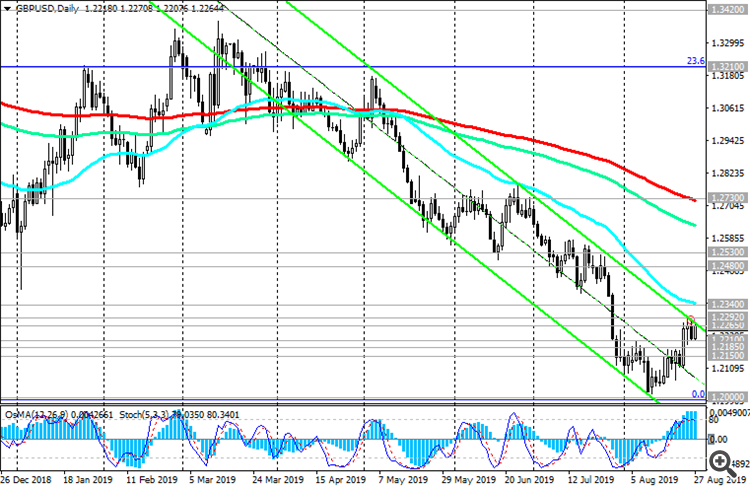

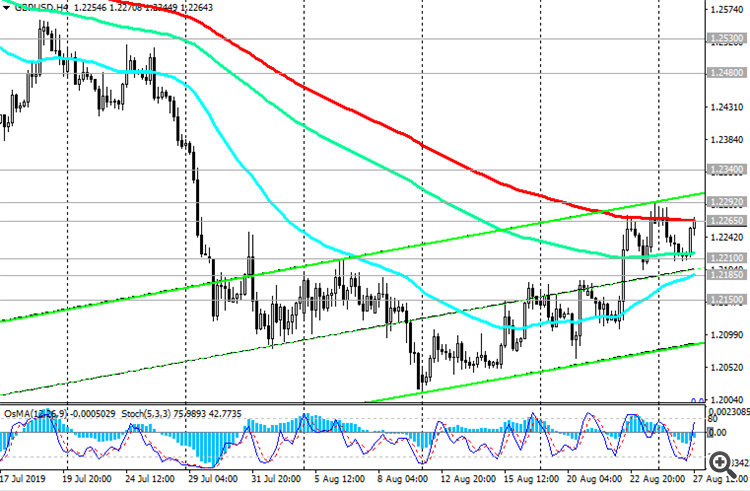

At the beginning of the European session on Tuesday, the GBP / USD pair is trading at an important resistance level of 1.2265 (EMA200 on the 4-hour chart).

A breakdown of the local resistance level of 1.2292 may trigger further growth of GBP / USD with the target at the resistance level of 1.2340 (ЕМА50 on the daily chart).

In any case, an increase above the resistance levels of 1.2480, 1.2530 is unlikely.

A signal for the resumption of sales may be a breakdown of the short-term support level of 1.2185 (ЕМА200 on the 1-hour chart).

The immediate goal of the decline is the support level of 1.2000 (2017 lows and the Fibonacci level 0% of a correction to the GBP / USD pair decline in a wave that began in July 2014 near the level of 1.7200).

Long-term negative dynamics prevail. Short positions are preferred.

Support Levels: 1.2210, 1.2185, 1.2150, 1.2100, 1.2000

Resistance Levels: 1.2265, 1.2292, 1.2340, 1.2480, 1.2530, 1.2730

Trading Scenarios

Sell by market. Stop-Loss 1.2310. Take-Profit 1.2175, 1.2150, 1.2100, 1.2000

Buy Stop 1.2310. Stop-Loss 1.2190. Take-Profit 1.2340, 1.2480, 1.2530