Discussion of the synthetic trading system YPY EA Sacramentum (FAQ)

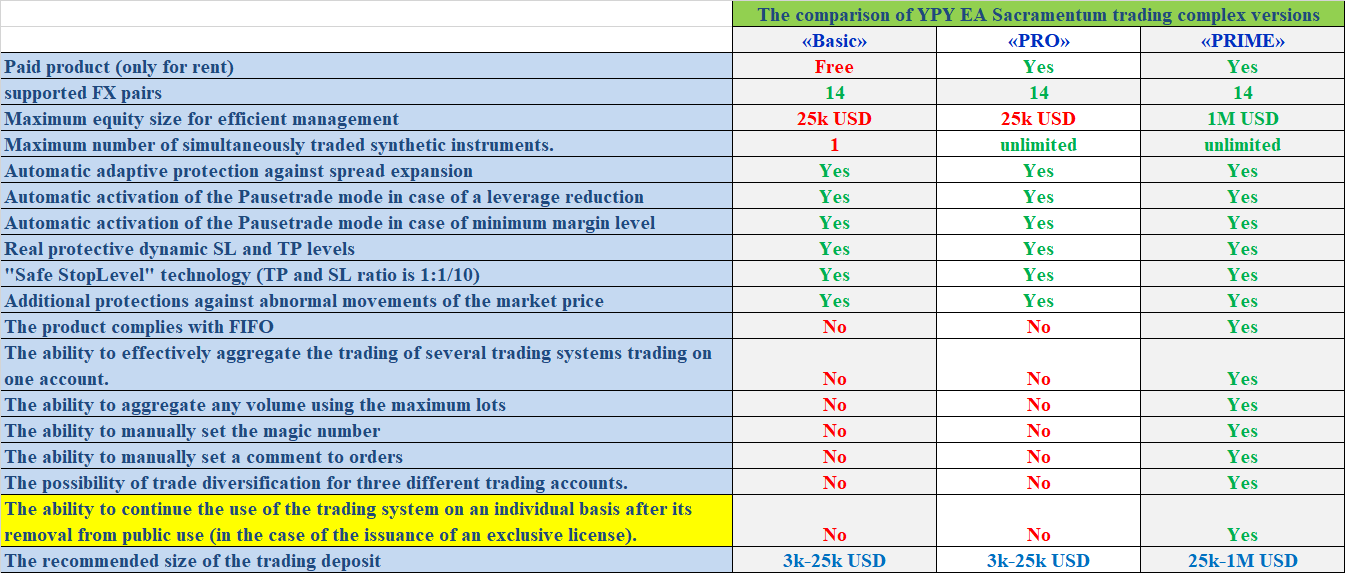

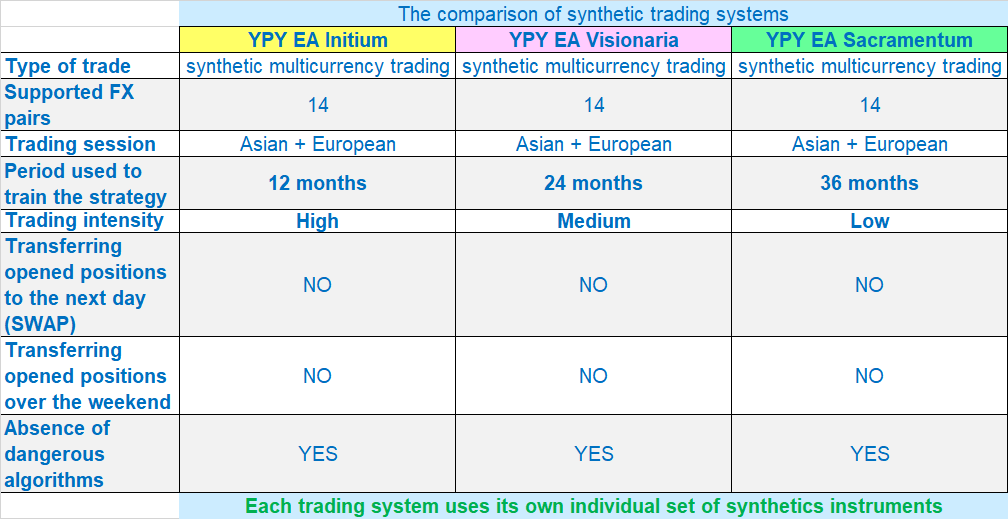

Dear users, here we will publish the main questions and answers about the trading system YPY EA Sacramentum for synthetic trading, which uses an adaptive scalping strategy in a quiet night market after banking rollover (during the Asian and early European sessions without charging swaps) based on virtual trading of synthetic instruments from various currency pairs. The period used to train strategies: 36 months. Trading intensity: Low .

All examples of signals for this system:

Here are some examples of the combined trading of three different trading systems (Sacramentum + Initium + Visionaria) for maximum diversification:

https://www.mql5.com/en/signals/821365

https://www.mql5.com/en/signals/821357

If you use several trading systems on one account at the same time, then you need to reduce the risk level as follows:

In order to adhere to the desired level of max drawdown, it is necessary to set the AUTOMM level one step lower when using two systems, or two levels below when using three systems.

About the installation process and loading the quotes history

The robot is installed only on EURUSD M15 chart and automatically uses for multicurrency trading the following instruments: AUDJPY, AUDUSD, CHFJPY, EURCHF, EURGBP, EURJPY, EURUSD, GBPCHF, GBPJPY, GBPUSD, NZDUSD, USDCAD, USDCHF, USDJPY, XAUUSD.

If you see this message "There is no quotes. Please load more quotes for M15 time frame(2500 bars)", it means that you need to load a history for the specified instrument to the terminal.

The easiest way is to open the M15 chart and press the "HOME" button to scroll the chart six weeks ago.

This will need to be done for each supported instruments: AUDJPY, AUDUSD, CHFJPY, EURCHF, EURGBP, EURJPY, EURUSD, GBPCHF, GBPJPY, GBPUSD, NZDUSD, USDCAD, USDCHF, USDJPY, XAUUSD.

We showed how to do this on video

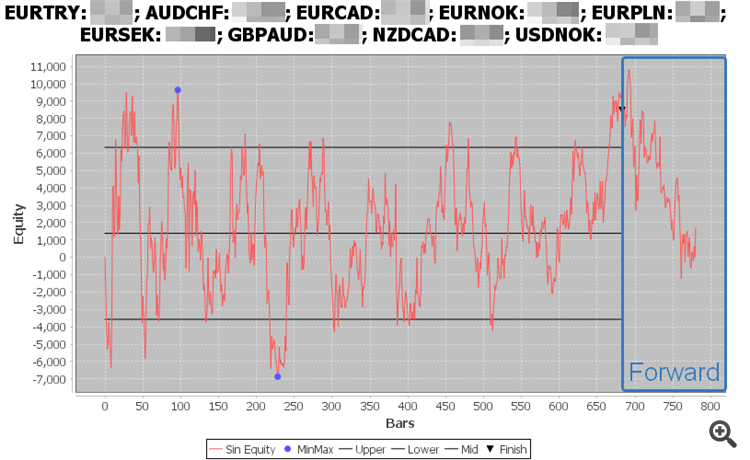

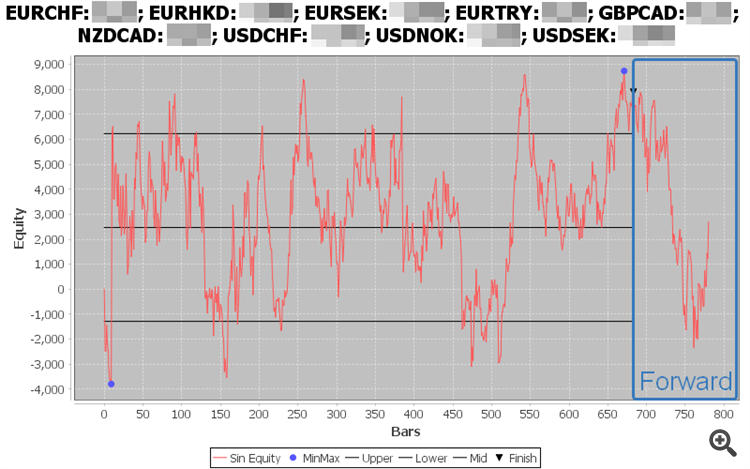

Below are a few examples of a synthetic hedge (a three-year chart) in which nine FX pairs interacting with each other do not allow the hedge to go beyond the limits of the global channel.

About supported deposit currencies

The AutoMM system supports the following account currencies:

"USD","EUR","GBP","AUD","NZD","XAU","GLD","CAD","JPY","CHF","DKK","NOK","SEK","SGD","RUB","RUR","CNH","CNY","MXN","PLN","ZAR","HKD","CZK","UAH","HUF"

If quotes for the user's account currency are not available in the terminal, the currency is considered unknown and the AutoMM system will use a fixed rate 1USD=100 account currency units.

About the size of the lot

This trading system uses more than two hundred strategies different trading strategies at a virtual level.

Thus, several hundred virtual experts are working inside this expert.

The built-in virtual liquidity aggregator combines virtual orders into real orders that you can see on your account.

In this regard, for trading at the virtual level of 0.01 lot, you need about 100000-200000 free funds.

We recommend users to always use the system of automatic lot size calculation system ( AutoMM), which allows to calculate the size of a virtual lot very accurately (using values much smaller than the microlot size 0.01), which allows using the trading system for trading starting from small deposits of $3000 (cents for cent accounts).

About the drawdown and level of risk (AutoMM)

As a rule, the EXTREME level of risk is used on a separate account where part of the profit received from trading on the main account with low risk is used.

It is impossible to know what will happen in the future, but you can conduct a trade analysis on history in order to understand what can be expected in the future.

For this you can take into account the following information:

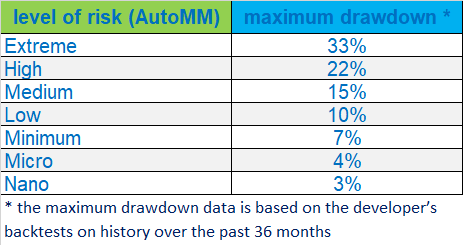

The MEDIUM risk level shows the maximum drawdown of approximately 15% for the entire strategy portfolio in our tests for the past 36 months (current market).

Each level of risk changes the value by one and a half times.

This means that for example, for an HIGH risk level, the maximum drawdown is approximately 22% for the entire strategy portfolio in our tests tests for the past 36 months (current market), and for the LOW level of risk shows a maximum drawdown of approximately 10% for the entire strategy portfolio in our tests for the past 36 months (current market).

If you prefer a calm trading or if you are not familiar with the product, we recommend using AutoMM=Minimum

About the number of trades

The main thing is that you should understand that the number of trades and the frequency of trading do not matter.

Our know-how AutoMM system allows you to trade at the same level of risk with the same efficiency using different deposit sizes.

For example, consider two examples of trading for the same month:

1. Initial deposit: 3000 USD, AutoMM=Medium

Trades: 205

Profit: 156 USD (Gain: +5.2%)

Drawdown: 63 USD (DD: 2.1%)

2. Initial deposit: 10000 USD, AutoMM=Medium

Trades: 975

Profit: 515 USD (Gain: +5.15%)

Drawdown: 217 USD (DD: 2.17%)

From these examples you can see that the efficiency of trade is the same.

About hedge and percentage of profitable trades

This is not ordinary trade, this is unique synthetic trade.

In ordinary trading, a bet is made on a specific currency pair. Therefore, there is an important % of profitable trades.

In synthetic trading, we focus on a synthetic instrument, which consists of several currency pairs. Therefore, for synthetic trading, it does not matter where the price of an individual currency pair will move.

Let's look at a simple example:

For example, we use a synthetic instrument that consists of four ordinary currency pairs.

We open the following synthetic order: EURUSD (Lot 1.0 BUY) + GBPUSD (Lot 1.0 SELL) + USDCAD (Lot 1.0 BUY) + AUDUSD (Lot 1.0 SELL)

Further, when it is time to close positions, there may be the following different scenarios:

-------

Scenario №1

EURUSD (Lot 1.0 BUY) result= +200 USD

GBPUSD (Lot 1.0 SELL) result= -250 USD

USDCAD (Lot 1.0 BUY) result= +100 USD

AUDUSD (Lot 1.0 SELL) result= +150 USD

Total overall result: +300 USD (75 % profitable trades)

-------

Scenario №2

EURUSD (Lot 1.0 BUY) result= +300 USD

GBPUSD (Lot 1.0 SELL) result= -250 USD

USDCAD (Lot 1.0 BUY) result= -100 USD

AUDUSD (Lot 1.0 SELL) result= +350 USD

Total overall result: +300 USD (50 % profitable trades)

-------

Scenario №3

EURUSD (Lot 1.0 BUY) result= -50 USD

GBPUSD (Lot 1.0 SELL) result= -150 USD

USDCAD (Lot 1.0 BUY) result= -50 USD

AUDUSD (Lot 1.0 SELL) result= +550 USD

Total overall result: +300 USD (25 % profitable trades)

-------

On the example of these scenarios, you can see that the percentage of profitable trades is not significant for synthetic trading. Some constituent currency pairs always play the role of hedge within a synthetic instrument.

About deposit protection levels

We pay particular attention to the maximum security and stability of trade during the development and testing.

For this we necessarily integrate several independent levels of protection into this trading system to protect the deposit and ensure the most safe trade:

1. Protective real stop-loss and take-profit levels for all open real orders. As a rule, we try to use short levels of stop-loss (ten times less than the levels of take-profit)

2. Individual virtual levels of stop-loss and take-profit for all open virtual orders.

3. Forced automatic closing of positions and stopping trade in case of detection of abnormal dangerous movements of market prices.

4. Forced automatic closing of positions in case of exceeding the volatility limits that are acceptable for trading logic.

5. Automatic closing of virtual orders when a virtual strategy exceeds its maximum allowable drawdown. This works for each virtual strategy independently.

6. Automatic adaptive spread expansion control, which does not allow opening new orders under inadequate trading conditions.

7. Automatic activation of the "PauseTrade" mode if the actual size of the leverage is less than the allowable size.

8. Automatic activation of the "PauseTrade" mode in case of detection of margin level of less than acceptable size.

About spread levels

The expert panel displays the current spread level for synthetic instruments (SynSpreadLevel)

About the difference in trading between accounts

We specifically demonstrate trading on several different brokers in order to show the same trading dynamics, but not the same trades (this is not so important).

One of the tasks of the AutoMM system is to automatically adapt to any trading conditions in order to effectively use the funds for the maximum possible positive dynamics of trading at the same risk level.

At the same time, the results of trading will always differ due to the following factors independent of the trader and the trading system:

1. Different trading conditions:

2. Different quotes (different liquidity providers)

3. Freezing by bad brokers of quotations in the terminal.

4. Disconnecting the connection of the terminal with the trading server (an effective method often used by bad brokers)

Our engineers carry out round-the-clock monitoring of the tick flows of several dozen trading servers of different brokers, which allows us to understand where trading will be as efficient as possible and where safe.

It is also worth noting that sometimes trades may differ even on the same trading server for the following reasons:

Different start times of the trading system starts the calculation cycle, which is processed by each terminal into one stream. The performance of the processor cores and the load on the processor cores significantly affect this process. Much more substantial than the ping to the trading server.

P.S. As such, there is no sense in comparing the trades, it is more important to value the monthly effectiveness and trading results in times of dangerous price movements.

About broker time settings

We added the BrokerDST parameter in which each user needs to set the daylight saving time system used by the broker (USA or Europe)

Also, information about the control time has been added to the expert panel (Control Time, UTC 0).

This time allows the user to independently verify the correctness of the settings used for the two parameters (BrokerWinterTimeZone and BrokerDST).

If this time coincides with the current time of UTC (Coordinated Universal Time), then the parameters of the trading system are configured to work correctly.

We remind that if all the parameters are configured by the user once correctly, then it is don't need to to adjust the time for daylight saving time and winter time (it is enough to check the relevance of the control time data in the expert panel).

For information:

The default setting (BrokerWinterTimeZone=2) is suitable for most brokers who use the GMT +2 time offset in winter.

Also, most brokers use the American Daylight Saving Time System (BrokerDST=US)

Each user can find out this time, as well as the DST system directly from their broker.