On Wednesday, commodity currencies strengthened against the US dollar against the backdrop of favorable statistics from China.

At 12:30 GMT Statistics Canada and the Bank of Canada will present data on foreign trade in Canada and data on inflation. Consumer prices in February rose by 1.5% (+ 1.4% in January) in annual terms and the base consumer price index rose by + 1.5%. If the data for March are worse than the previous values, then this will negatively affect the CAD. Data better than the forecast and above the previous values will strengthen the Canadian dollar.

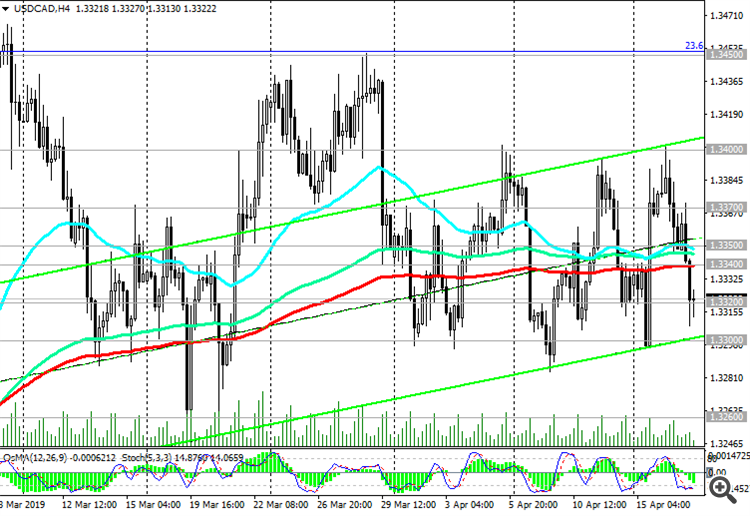

Despite the current decline, USD / CAD maintains a long-term positive trend, trading above key support levels of 1.3260 (EMA144), 1.3210 (EMA200 on the daily chart).

USD / CAD declined during the Asian session, breaking short-term strong support levels of 1.3350 (ЕМА200 on the 1-hour chart), 1.3340 (ЕМА200 on the 4-hour chart).

The breakdown of the local support level of 1.3300 may increase the risks of further USD / CAD decline with targets at the support levels of 1.3260, 1.3210.

The signal for the resumption of purchases will be the return of USD / CAD to the zone above the levels of 1.3340, 1.3350 with growth targets at resistance levels of 1.3450 (Fibonacci 23.6% of the downward correction to the pair's growth in the global uptrend since September 2012 and 0.9700), 1.3660 ( the highs of 2018), 1.3790 (the highs of 2017).

Support Levels: 1.3320, 1.3340, 1.3300, 1.3260, 1.3210, 1.3155, 1.3090, 1.3045

Resistance Levels: 1.3340, 1.3350, 1.3370, 1.3400, 1.3450, 1.3600, 1.3660, 1.3790

Trading scenarios

Sell Stop 1.3290. Stop Loss 1.3340. Take-Profit 1.3245, 1.3200, 1.3155, 1.3090, 1.3045

Buy Stop 1.3340. Stop Loss 1.3290. Take-Profit 1.3370, 1.3450, 1.3600, 1.3660, 1.3790