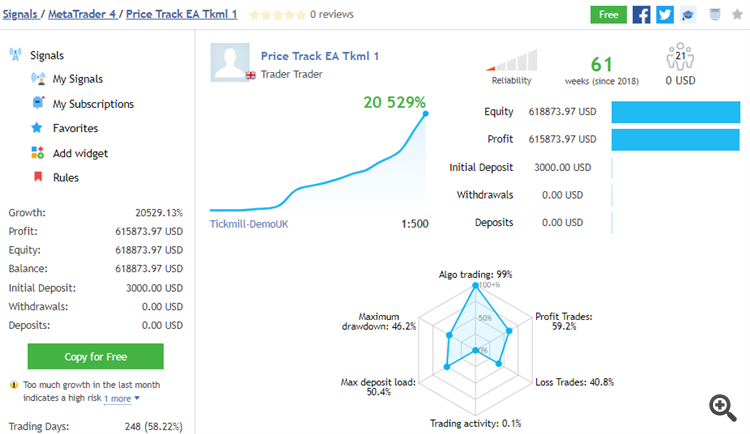

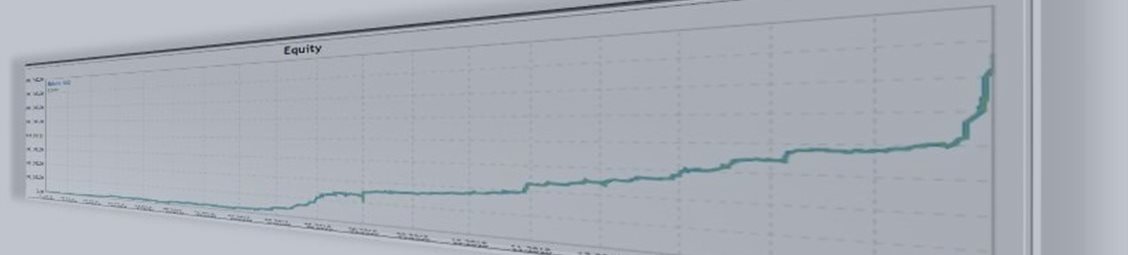

PRICE TRACK UP 20,000%!!* - A TRULY SAFE, RELIABLE AND SUSTAINABLE OVERCLOCK SYSTEM

*Demonstration signal. Please note that performance in live accounts may not be exactly same due to broker/VPS specifics, among others.

Product page: https://www.mql5.com/en/market/product/32397

Overclock in Forex

What is Deposit Overclock?

Overclock is the ability to multiply a small deposit in a short span of time in order to move to a more rational strategy in terms of risks.

Overclocking is typically characterised by:

1. trading without stop loss (however, Price Track EA does trade with hard stop loss for every order);

2. starting with small capital; and

3. high yield (hundreds of percent per month).

The primary goal of overclocking is to, from a small deposit, considerably grow an account equity so much that it will be possible to move on to a more reliable trading approach which will surely be able to yield consistent and sustainable income over a long period of time.

Adequate risk control and money management is paramount for the success of overclock systems.

What is Price Track EA?

Price Track EA is a multi-settings, multi-strategies trading system specifically developed to safely seek hyper profits with minimal drawdowns.

Price Track EA is a highly quantitatively-driven automated trading system with underlying strategies based on the rigorous implementation of proprietary price tracking algorithms developed for the identification of areas of price momentum exhaustion and momentary unsustainable price movements, with the end objective of generating low-risk hyper-alphas. The algorithms model the microdynamics of price movements as a function of the behaviour of buyers and sellers in an infinitesimal time space to a given variation in demand and supply balance, allowing for the identification of extreme unsustainable imbalance and potentially favourable micro-conditions for trading opportunities.

The Price Track EA prioritises on shorter time frame charts, and its focusing on the immediate action allows for heavier lot sizing offset by small holding periods (sometimes fractions of a minute) to manage risk. The underlying strategy does not employ any indicator and does not use any grid/martingale system. Every trade is protected by a stop loss and once in the profit zone, profits are protected by trailing stops.

Price Track EA has been rigorously tested with real tick data, with 99.9% modelling quality with $8.2 commission per lot round trip, real variable spreads and realistic slippages (65% chance of slippage at open and close of orders, of which 75% non-favourable).

Usage:

Price Track EA comes with over 600 in-built user-selectable rigorously tested pre-sets, thereby allowing for extra robustness and flexibility of use with different brokers. Simply select the pre-sets that performs best with your broker, or manually input your own settings. User can activate up to 10 sets to trade simultaneously, allowing for potential hyper growth in the accounts equity. The in-built account management system ensures risks are properly managed when working with multi-sets according to user specified preferences. The EA comes with 2 strategies, and users can select either of the strategies to use. The EA can be used in multi-currency mode, setting it on different charts. Note that sometimes this EA may not trade for days depending on the input settings.

Live monitoring/signal:

- Live monitoring/signals can be found here: https://www.mql5.com/en/signals/383951 (for GBPUSd and USDJPY pairs) and here: https://www.mql5.com/en/signals/460960 (for EURUSD).

These signals, which show the demonstration of the EA in action, is for combined GBPUSD+USDJPY and EURUSD+USDJPY respectively, using only 1 set each, and using Strategy 1.

Requirements:

- Minimum deposit: $200, recommended $1000

- Broker type: Low spread, fast execution, low commission fast and reliable ECN broker, non-FIFO

- Fast VPS a most.

- Currency: EA developed for EURUSD, USDJPY, GBPUSD

- Time frame: EA Developed for M1

Parameters:

- DynamicLot (If True, lots will be auto-calculated based on RiskLevel).

- RiskLevel: VeryLow, Low_, Moderate, Aggressive, VeryAggressive, Nuts

- RiskDistribution: NoDistribution, EvenDistribution, CustomDistribution

- MaxLotSize

- Lots (Active only if DynamicLot == False)

- DisplayInfo: True, False

- bgColorOfDisplayInfo:

- Settings for Set n (n = 1 to 10):

- ActivateSet_n: True, False. Activates or deactivates this set n

- magic_n (Magic number if ActivateSet_n==True)

- StrategyToUse_n: Strategy 1, Strategy 2

- Set_n_Risk_percent (Risk in % for this set, only if RiskDistribution==CustomDistribution)

- PresetToUseForSet_n (Select 1 of 650 in-built pre-sets or select "Use No Presets" for manual setting of the remaining input parameters for this set n if active).

- Clearance_n (Pending order clearance for this set n if active)

- TakeProfit_n (Takeprofit in pips for this set n if active)

- StopLoss_n (StopLoss in pips for this set n if active)

- TrailingStop_n (Trailing Stop in pips for this set n if active)

- LockProfitBeforeStartOfTrailingStop_n (Profits pips to lock before start of trailing for this set n if active)

- MaxSpreadPoints_n (Maximum allowable spread for this set n if active)

- Set_n_Param1 (Strategy parameter for this set n if active)

- Set_n_Param2 (Strategy parameter for this set n if active)

- Set_n_Param3 (Strategy parameter for this set n if active)