(23 FEBRUARY 2019)WEEKLY MARKET OUTLOOK 1:Potential China Trifecta

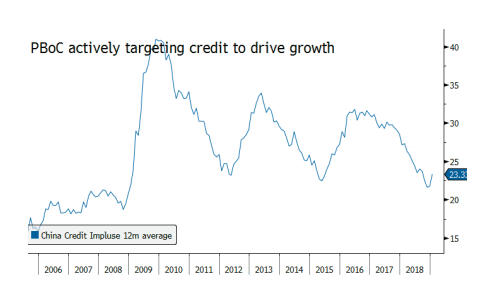

China needs some good news. Judging from incoming data China’s economy has lost significant momentum. The bright side is that US-China trade discussions are making progress. Six memoranda of understanding are in draft that cover technology transfer and cyber-theft, intellectual property rights, currency, agriculture and non-tariff barriers to trade. Expectations are that a 1st March tariff-hike will be avoided. A US-China deal is unlikely to spark a double-digit rally, but it will support Chinese shares. Chinese top line GDP numbers are worryingly, not concerning. The official Chinese GDP expanded by 6.6% y/y in 4Q 2018. Growth is slower then prior quarters it does not indicated an economic “hard landing” some had predicted. However, Chinese official data is noticeably fuzzy. A more reliable indicator of economic activity, in our perspective, is foreign trade. Data which can be crossed checked against other nation’s data. Imports of manufactured goods fell considerably in the 2H 2018, signaling that domestic demand was weaker than GDP numbers indicated. Yet recent imports growth rate suggest that domestics demand is stabilizing. Chinese authorities have taken wide-ranging actions to revive the economy. Chinese early response was to trigger fiscal stimulus measures. Fiscal policy has largely focused on shadow budgets of local governments. Yet due to lower credit impulse has had a lesser affect then official had hoped. While the PBoC has focused on micro tuning marketbased rates, increasing credit growth and lowering borrowing costs. There are signal that PBoC actions are helping. Loans have risen while housing prices across much of the nation are rising. We anticipate that the PBoC will cut key policy rate will provide the push the Chinese economy needs to stabilize. In view of these encouraging signals, Chinese economic policy should succeed in stabilising the domestic economy, which should also benefit manufacturing in the global economy.

Conditions are developing for a strong Chinese equity rally. Recovery of the Chinese consumer, loser interest rates and easing of trade tension with the USA would be a Chinese trifecta.

BY Peter Rosenstreich