In this article I will explain the idea after MASR Bands and MASR Stochastic and how to use both of them in your trading.

🎁 The MASR Stochastic is a FREE bonus for loyal customers who buy the MASR Bands.

✅ You can find the MASR Bands here:

https://www.mql5.com/en/market/product/43431

👉 After renting/buying, please leave a fair review and stars on the reviews page of the product.

👉 After that, I will send you the bonus as soon as I am online.

What is MASR Bands

The name is a shortcut to: Moving Average Support Resistance Bands.

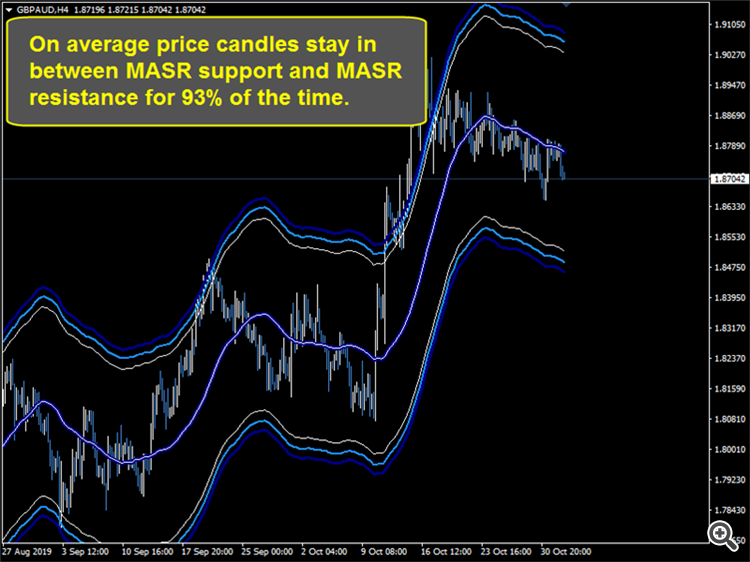

MASR Bands indicator is a moving average surrounded with two bands that work together as a support and resistance levels. Statistically, MASR Bands contain price candles 93% of the time. Here is how it is calculated in steps:

1. The first step is to calculate the highest high (HHV) and the lowest low (LLV) for an X period of time.

2. The second step is to divide HHV by LLV to get how much wide is the distance between them as a percentage. I call the results of this step MASR Filter.

3. MASR Filter = Sum ((HHV / LLV)-1) / Number of Bars

4. I call the upper band MAR which is a shortcut for Moving Average Resistance. I call the upper band MAS which is a shortcut for Moving Average Support. The simple moving average in between the bands is called The Center Line.

5. MAR = MASR Center + (75% x MASR Filter x MASR Center)

6. MASR Center is a moving average.

7. MAS = MASR Center - (75% x MASR Filter x MASR Center)

MASR Bands is like most of Band indicators. It consists of three line studies. The center line is a moving average. The other two line studies are calculated by adding / subtracting a volatility index from the center line.

What make MASR Bands so special is the volatility index, which depend in its calculation on the range of the complete swing movement rather than the movement from on bar to another like Average True Range or Standard Deviation calculations.

After testing MASR Bands, I found that price candles stay in between MASR Bands upper and lower levels 93% of the time on average. This means that MASR Bands have a real support / resistance levels that can generate profits with a good risk to reward ratio. This make MASR Bands good for reversal trading strategies.

MASR Bands as a reversal strategy

MASR Bands is a good trading tool for reversal strategies, because price candles stay in between the bands over 90% of the time. If price candles break outside the MAR or the MAS, then there is a great probability that price candles will revert back to meet the center line.

This strategy works well in low volatility time. Like scalping EURUSD in Asian session. The probability for this strategy to work successfully is 65%, because price candles move in trends 35% of the time.

So the idea is so simple like that:

Low volatility + a breakout from MAS or MAR = revert to the center line

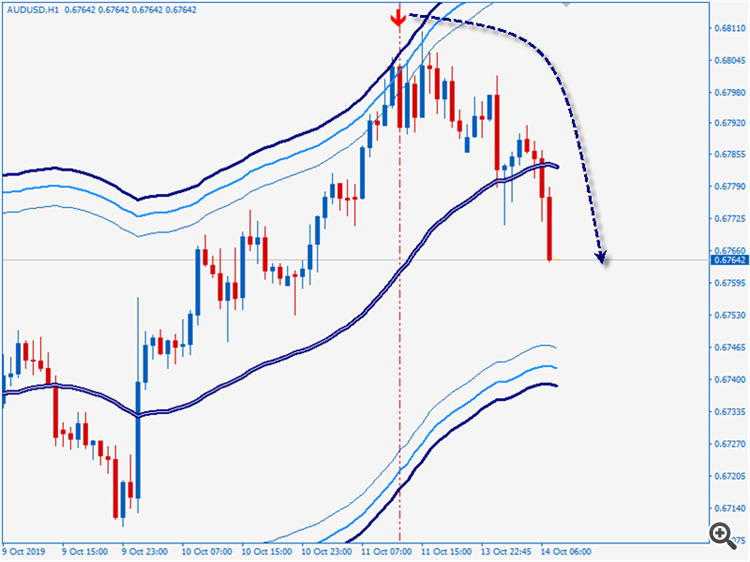

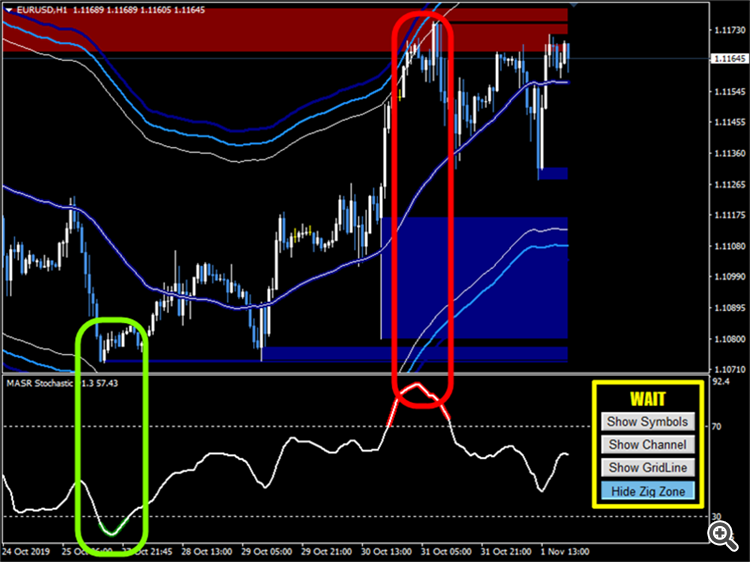

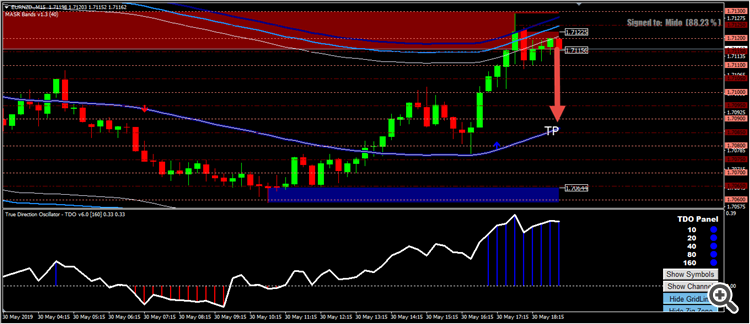

Sell example

As you can see in the next chart. When price candles cross the MAR to the upside it gave a good sell signal. Price target can be a predetermined level or it could be the MASR Center.

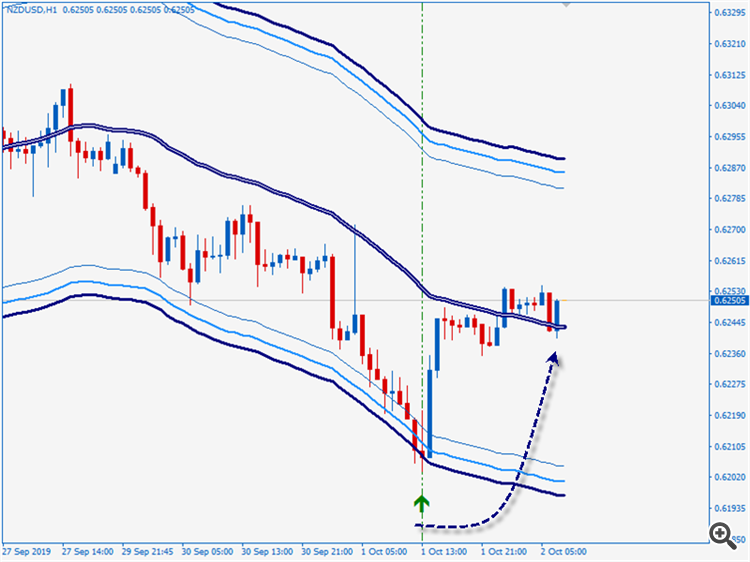

Buy example

As you can see in the next chart. When price candles cross the MAS to the downside it gave a good buy signal. Price target can be a predetermined level or it could be the MASR Center.

MASR Bands by its own is a good indicator if used correctly, but if it is combined with MASR Stochastic results get much better. The reason for this is that MASR Stochastic is a 5 in 1 indicator that gives its user different types on confirmation tools. If MASR Stochastic and MASR Bands synchronized together the probability of success increase.

What is MASR Stochastic

MASR Stochastic is an oscillator that try to define strong overbought and oversold areas on the chart. It tells you in percentage where is the close price relative to the MASR Bands. Here is the formula:

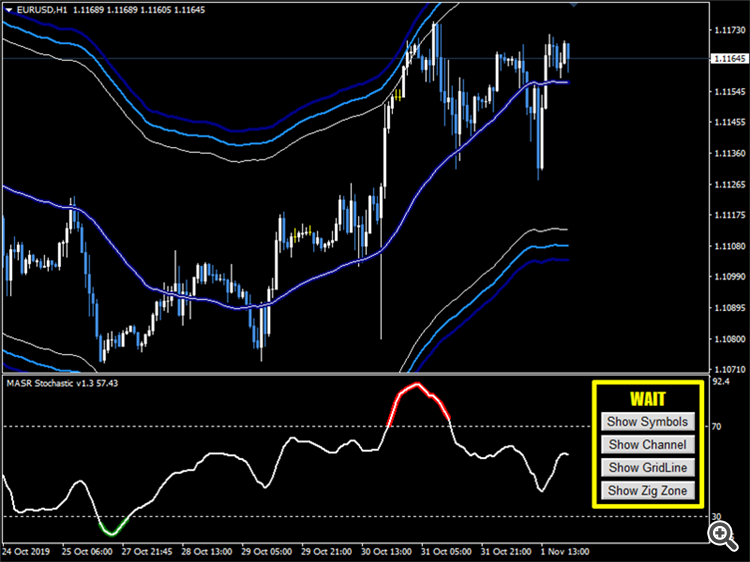

MASR Stochastic oscillate most of the time between overbought and oversold levels. The indicator panel border will be in yellow with a "Wait" label.

If MASR Stochastic penetrate the oversold level (30% by default) a warning message will pop up (you can also receive mobile notification or e-mail) and the panel border will be in green with a "OverSold" label.

Also,if MASR Stochastic penetrate the overbought level (70% by default) a warning message will pop up (you can also receive mobile notification or e-mail) and the panel border will be in red with a "OverBought" label.

MASR Stochastic have a built in panel that contain four useful tools. those tools facilitate the analysis of the chart and make it much easier to find price reversal zone (PRZ). So, let us talk a little about those levels and how to use them.

Zig Zone Levels

Some people like to call them " Supply and Demand Levels". The idea of those levels is to find important peaks and valleys on the chart, then to use them to draw horizontal areas that form a kind of support and resistance on the chart.

When prices move in an uptrend this indicate that demand is above supply and when the opposite happen and price move in a downtrend this indicate that supply exceed demand. But when a peak or a valley forms, balance between supply and demand happen, and a support or a resistance area is established.

Next chart shows how Zig Zone Levels confirm MASR Stochastic at finding overbought and oversold near MAR and MAS.

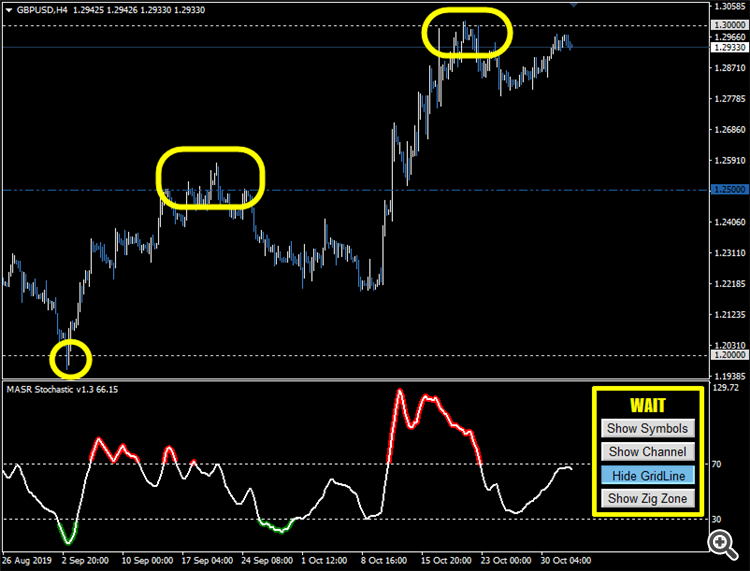

Rounded Numbers Grid

Rounded numbers are numbers that end with zeros like (1.2000 – 1.2100 – 1.2200…etc.) Price candles have a great tendency to reverse near a rounded number because of their psychological value for the traders in the market.

As an example if you follow other traders on twitter or any other social media platform you will find them talking about Bitcoin and if it will penetrate 10,000 back again or the Dow Jones and the 30,000 level. Nobody their will tell you the Dow Jones will target 296621 as an example or that Bitcoin will reverse from 10,063, because round numbers can be figured easily between public. Also, people believe that trading is not a rocket science where an erroneous calculation of one millimeter make a big difference.

At next chart I made yellow circles around pivots and valleys that occurs with round numbers grid.

Standard Deviation Channels

This is one of the most important tools you have with MASR Stochastic, because price candles stay inside the two standard deviation channel 89% of the time and stay inside the one standard deviation channel 68% of the time. This mean that standard deviation channels have extreme importance to confirm MASR Stochastic overbought and oversold area.

Next example show how price candles reverse their direction each time that go through the standard deviation channels.

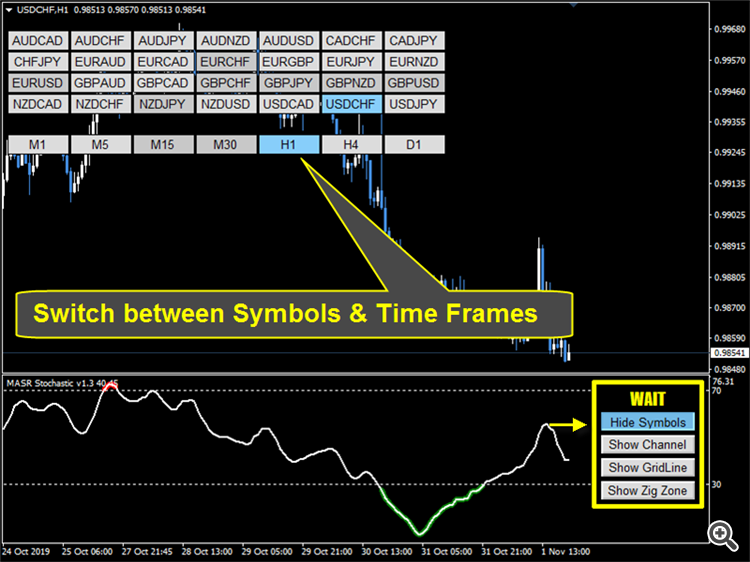

Symbol Switch

MASR Stochastic have a symbol switch panel that pop up on the main chart window when you click on its button. You can use the panel to easily switch between different symbols and time frames. This is helpful in many ways. You can use it to compare high correlated symbols like EURUSD & GBPUSD. You can use it to analyze different time frame before taking any decision.

Alerts

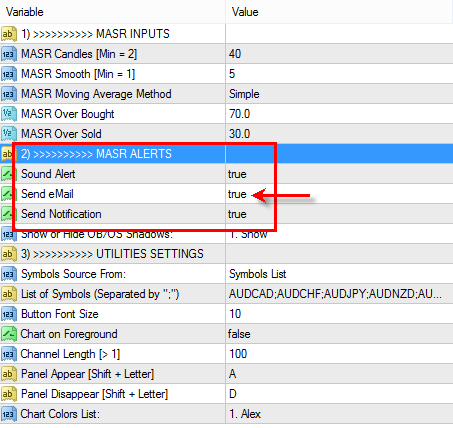

MASR Stochastic come with four alerts which are:

- Alert when enter Overbought area

- Alert when exit Overbought area

- Alert when enter Oversold area

- Alert when exit oversold area

Alert messages can be received via three different methods:

- Pop up message with sound

- Mobile notification

- Email message

How to receive Email messages?

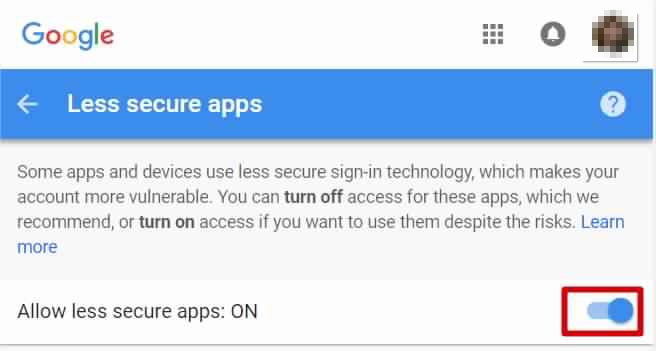

Here is an example about how to setup Gmail with MT4.

1. Log in as usual via browser.

2. Enable Less Secure Apps feature. Gmail has additional security protection in the form of "Less Secure Apps", enable the feature by going to the page https://myaccount.google.com/lesssecureapps then activate by clicking the button on the right to ON.

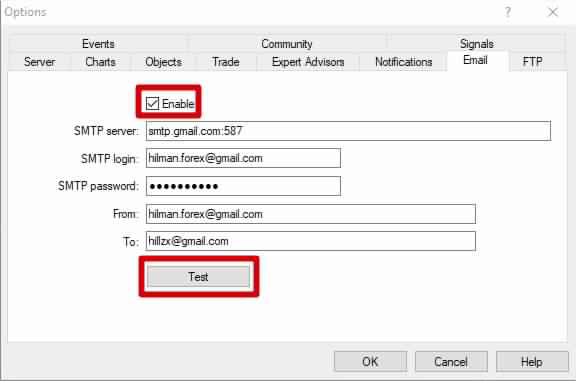

3. Enable email features in Metatrader 4. (Tools > Options).

4. Fill in email identity .

- SMTP server: Fill in smtp.gmail.com:587

- SMTP login: Fill with your email address (Sender)

- SMTP password: Fill with your email password

- From: Fill with your email address (Sender)

- To: Fill with the target email address (Receiver)

The recipient address may be the same as the sender's address. When done, click Test button to try it out. Notice in Tab Journal, whether there appears error message or not. If in the Journal, it says "Message has been sent" that mark email successfully sent.

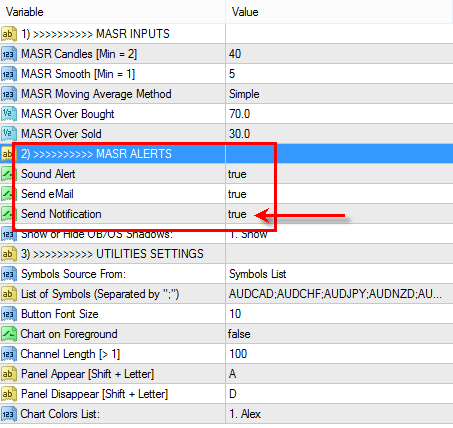

5. Set email parameters to ( true).

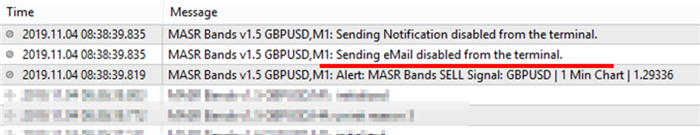

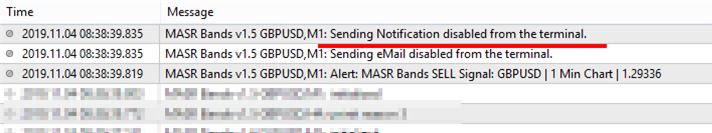

If an error happens during the process of sending the mail, then a message will print in the Terminal (CTRL+T) Journal Section.

How to receive mobile notifications?

1. Set Notification parameters to ( true).

2. follow instruction as written here

https://www.metatrader4.com/en/trading-platform/help/setup/settings_notifications

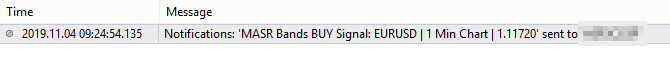

If no error happens during the process of sending the mobile notification, then a copy from the message will appear in the Expert Section in the Terminal (CTRL+T).

If there are problems a message will be printed in the Journal with the error code.

If you still not able to receive the notification message on your MT4 mobile app then there may be an issue with your mobile server, or that you passed the limit of sending mobile notification per minute (30 message per min.).

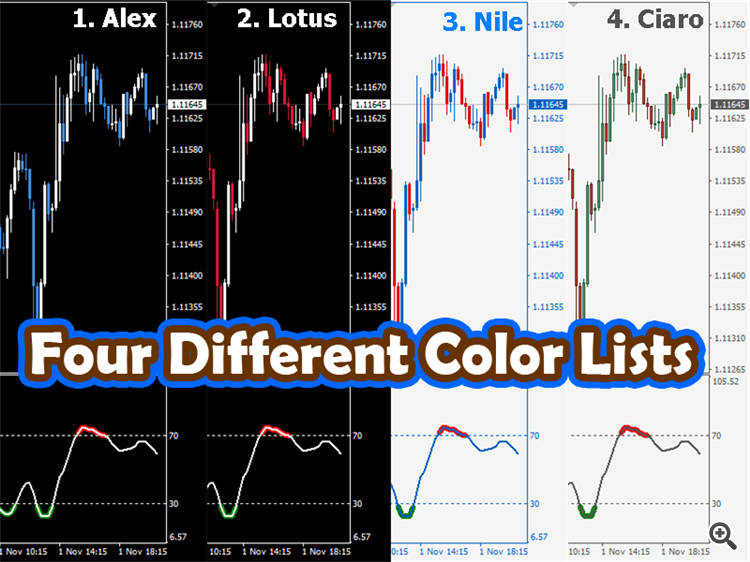

MASR Stochastic Color Lists

All my current and future products will have four different color list for the user to make choice from. There are two reason for color lists.

- First is to reduce the number of unnecessary parameters and concentrate on important parameters only.

- Second is to give chart a professional format similar to that found on high technical analysis platforms like Tradestation, Tradingview and stockCharts

Take in note that the user can switch to his own color list by choosing (Do Nothing) from the list.

Does MASR Bands or/and MASR Stochastic repaint?

None of my indicators repaint or change their signals after they appear for the first time.

What time frames/ currency pairs that give the best results?

- You can use MASR Tools to analyze currency pairs like Euro, British Pound and Japanese Yen.

- You can use MASR Tools to analyze commodities like Gold and Silver.

- You can use MASR Tools to analyze any index like Dow Jones and DAX.

- You can use MASR Tools to analyze any crypto currency like Bitcoin and Ethereum.

Do I need to purchase your indicators for each PC that I own?

You do not need to, because all my products on this website have 1000 activation limit. Which mean that you can activate it on any number of PCs you want.

How can I download your indicator after I purchase it?

- Go to your Metatrader 4 Terminal

- Open the Terminal (CTRL+T) > Market

- Search for MASR Bands and MASR Stochastic.

- Download.

Note 1: The indicator can be reached from the Navigator (CTRL+N) and it will appear in the extension (Indicators > Market)

Note 2: Metatrader 4 does not support MAC

Note 3: You should login to the ML5 community to access its services. This can be done by clicking on Options > Community then enter your MQL5 user's name and password.

I want refund because I purchase your indicator by mistake

I can't help you in this because of the money policy restrictions of the MQL5 website. If you need help, then return to their Service Desk.

Note:

I don’t exchange TDO with other products.

I don't use payment methods rather than mentioned on the website.

Can I use your indicator to build my own EA?

Yes you can. Here are two blogs to explain in details how to use both indicators to build your own EA.

👉 MASR Bands Expert Advisor Example: https://www.mql5.com/en/blogs/post/731139

That is all for now. I hope you read this manual about MASR Tools because they will help you to understand them much better.

If you have any other questions, then inbox me and I will answer you as soon as I am online.

Best regards

Muhammad Al Bermaui, CMT

![[MANUAL] - MASR Bands & MASR Stochastic [MANUAL] - MASR Bands & MASR Stochastic](https://c.mql5.com/6/816/splash-721889.png)