US and world stock indexes continue to grow. Investors were encouraged by reports that the US and Mexico were approaching the conclusion of a treaty on the revision of the North American Free Trade Agreement (NAFTA), ignoring the possibility of excluding Canada from the trade union.

On the eve of Nasdaq, in which the technological sector has a lot of weight, for the first time overcame the mark of 8,000 points. The S&P 500 also reached new absolute record levels.

DJIA rose from the beginning of the week by 1.16% to 26105.0, the mark at which it traded at the beginning of the European session on Tuesday.

All three major US indices are growing on Tuesday for 3 consecutive days after Friday, Fed Chairman Jerome Powell said that the gradual increase in interest rates remains appropriate. However, Powell did not signal that the central bank will accelerate rates of rate hikes in the coming months. He said that the Fed plans to raise rates to a level that will neither stimulate nor slow economic growth.

The main risk for the economy and the stock market at the moment are trade conflicts. As they weaken, the growth of US stock indices is likely to accelerate.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

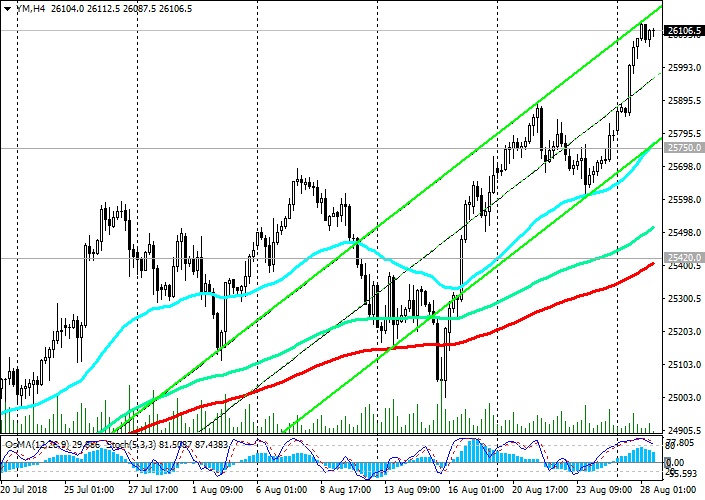

DJIA retains positive dynamics, trading in the ascending channels on the daily and weekly charts. Above the short-term support level 25420.0 (EMA200 on the 4-hour chart and the bottom line of the upward channel on the daily chart), only long positions should be considered.

The breakdown of the support level of 25420.0 may provoke a deeper correction decrease to the key support levels of 24830.0 (EMA144 on the daily chart), 24530.0 (EMA200 on the daily chart). Near these levels also passes the bottom line of the rising channel on the weekly chart.

In general, the positive dynamics remains. Only the breakdown of the support level of 24050.0 (Fibonacci level of 23.6% of the correction to the increase with the level of 15650.0 in a wave that began in January 2016. The maximum of the wave and Fibonacci level of 0% are near the mark 26620.0) could jeopardize the bullish trend of the DJIA.

DJIA is growing, heading toward resistance level 26620.0 (absolute and annual highs).

Support levels: 26000.0, 25750.0, 25420.0, 25000.0, 24830.0, 24530.0, 24050.0

Resistance levels: 26200.0, 26620.0

Trading Scenarios

Buy in the market. Stop-Loss 26000.0. Take-Profit 26200.0, 26620.0

Sell Stop 26000.0. Stop-Loss 26140.0. Take-Profit 25750.0, 25420.0, 25000.0, 24830.0, 24530.0, 24050.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com