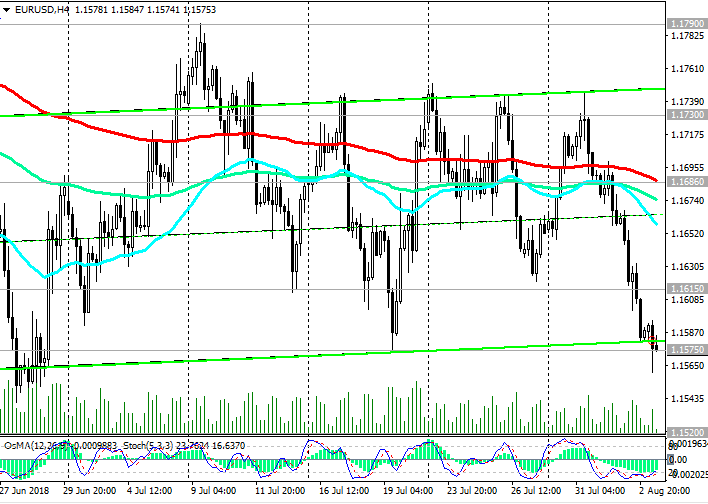

On the eve of the publication of data from the US labor market (12:30 GMT), traders avoid trading in large volumes. Activity of traders is low.

The EUR / USD has been trading in the narrow range near the 1.1580 mark since the opening of the trading day.

Pressure on the Eurodollar remains. If the data from the labor market are better than the forecast (the number of jobs in July increased by 190,000, and unemployment fell to 3.9%), then the dollar will continue to strengthen.

If the data comes out below the forecast, the dollar may fall sharply (in the short term).

In general, the dollar remains strong in anticipation of a further increase in the interest rate in the US.

In an accompanying statement after the meeting, the Fed reiterated its commitment to further tightening monetary policy and pointed to the strength of the US economy.

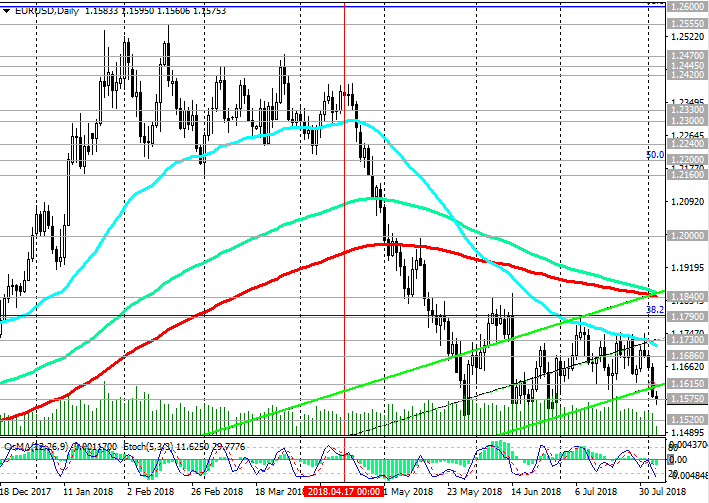

Probably, the EUR / USD will continue to decline and will go towards support levels 1.1520 (annual minimums), 1.1500.

In case of breakdown of these support levels, a more negative scenario may be realized and EUR / USD will go to support level 1.1285 (Fibonacci level 23.6% of the correction to the fall from 1.3900, which began in May 2014 and the bottom line of the descending channel on the weekly chart).

In the alternative scenario and after consolidating above resistance level 1.1615, the EUR / USD will return in to the upward channel on the daily chart and may rise to resistance levels 1.1790 (Fibonacci level 38.2%), 1.1840 (EMA200 and upper line of the upward channel on the daily chart).

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 1.1575, 1.1520, 1.1400,

1.1285

Resistance levels: 1.1615, 1.1686, 1.1730, 1.1750, 1.1790, 1.1850

Trade recommendations

Sell Stop 1.1555. Stop-Loss 1.1610. Take-Profit 1.1520, 1.1400, 1.1285

Buy Stop 1.1610. Stop-Loss 1.1555. Take-Profit 1.1685, 1.1730, 1.1750, 1.1790, 1.1850

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com