DJIA: indexes fall amid the escalation of the trade conflict

After last week, Washington imposed import duties on Chinese goods worth $ 50 billion, Beijing immediately threatened with retaliation for particularly significant US exports, such as oil, agricultural products and cars.

In both cases, import duties in the United States and China come into force on July 6. Markets responded quite cautiously to this step from Washington. On Monday President of the United States Donald Trump appealed to the administration with the task to make a list of Chinese goods worth $ 200 billion, for which duties will be imposed, thus increasing pressure on China.

Trump blames China for violating intellectual property rights and stealing technology. The White House clarified that the new fees will be levied if China does not change its position or will itself announce new tariffs for American goods. By such actions, Trump tries to create the most favorable conditions for the American economy, limiting the import of goods from China.

China reacted almost instantly. "If the US side completely loses its mind and publishes a new list, the Chinese side will be forced to take comprehensive quantitative and qualitative measures and give a decisive response", the Chinese trade department said in a statement.

Thus, the trade conflict between the US and China comes to a new level. This time the world stock markets have painfully reacted to the possible escalation of the conflict.

This next round in the aggravation of the situation may be a harbinger of a trade war between the two largest economies of the world.

News about the new trade disagreements between the US and China at the beginning of the trading day on Tuesday exerted strong pressure on European and world stock indices.

Shanghai Composite fell by 3.8% to a minimum in almost two years. Stoxx Europe 600 at the auction in the morning sank by 1.1%. Futures on the S & P 500 and Dow Jones Industrial Average indicate a loss of 1.3% and 1.6% respectively at the opening of trading.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

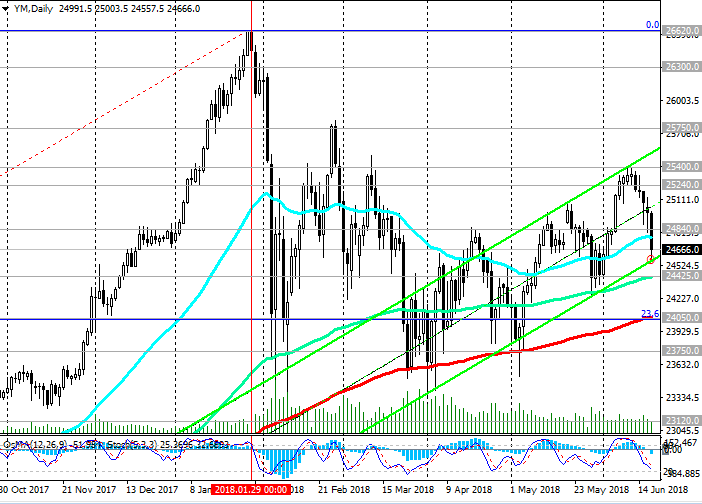

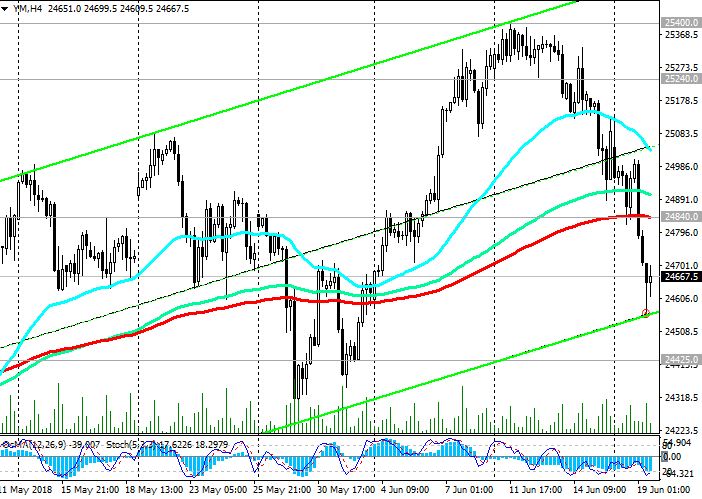

Support levels: 24425.0, 24050.0, 23750.0

Resistance levels: 24840.0, 25240.0, 25400.0, 25750.0, 26300.0, 26620.0

Trading Scenarios

Buy Stop 24860.0. Stop-Loss 24550.0. Take-Profit 25240.0, 25400.0, 25750.0, 26300.0, 26620.0

Sell Stop 24550.0. Stop-Loss 24860.0. Take-Profit 24425.0, 24050.0, 23750.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com