Since the opening of today's trading day, the price of gold has resumed its decline amid the strengthening of the dollar. Spot gold prices in London fell by 0.2% to 1309.40 dollars per ounce. Since last month, gold prices have fallen by 0.2%.

At the same time, the dollar continues to strengthen. After reaching the current year's low in February, the WSJ dollar index, reflecting the value of the dollar against a basket of 16 currencies, rose by more than 4%.

It is known that at the meeting which came to the end on Wednesday, the Fed confirmed intention to adhere to the plan for gradual tightening of monetary policy. The PCE personal consumption expenditure price index (the Fed's preferred inflation indicator) showed an annual growth of 2% in March. Tax cuts and increased government spending this year will help to strengthen domestic demand. The imposition of import duties would increase the cost of imports, which could also put pressure on inflation. Now many people are interested in how the Fed will act if inflation exceeds 2%.

"Too slow a rate hike will lead to the fact that at some point will need to sharply tighten monetary policy, putting at risk GDP growth”, - Fed Chairman Jerome Powell said last month.

According to the quotes of futures on interest rates of the Fed, investors estimate the probability of a rate hike in June at about 100%, and the probability of three more rate hikes this year at 50% (against 32% a month earlier).

On Thursday, another series of positive macro statistics on the United States was published. Among other things, it should be noted a significant relative decrease of foreign trade deficit of the United States (nearly $ 9 billion or 17%). This is a very positive development in favour of further strengthening the dollar.

Meanwhile, investors are watching the trade talks between the US and China, which will be held this week. USA gave China a long list of requirements from the immediate reduction of the imbalance in trade to 100 billion dollars a year to the suspending of support by the Chinese government advanced technologies. The US trade deficit with China last year amounted to $ 375 billion. US President Donald trump has repeatedly said about the need to reduce this figure by 100 billion dollars a year. In the document, the US demands that Beijing reduce its trade surplus by at least $ 200 billion by the end of 2020.

In addition, the US demands that Beijing guarantee that it will not take retaliatory measures against the United States under intellectual property disputes.

If the negotiations are successful, the dollar will probably growth up again.

Today, the focus of traders will be the publication of data from the US labor market at 12:30 (GMT). Strong performance is expected (the number of new jobs in the non-agricultural sector of the US economy in April increased by 192 000 against +103 000 in March, and unemployment fell by 0.1% to 4.0%, to the lowest level in 18 months). In the short term, the dollar may react with restraint to the report from the labor market, since 3 rate hikes this year have already been included in the quotes. However, if the data will be better, the dollar will receive another strong support amid positive macro statistics coming in recent weeks from the United States. Probably, gold will continue to fall in price. At the same time, geopolitical risks will continue to "keep the tone" of gold buyers, and the demand for gold will resume with the next aggravation of the geopolitical or domestic political situation in the United States.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

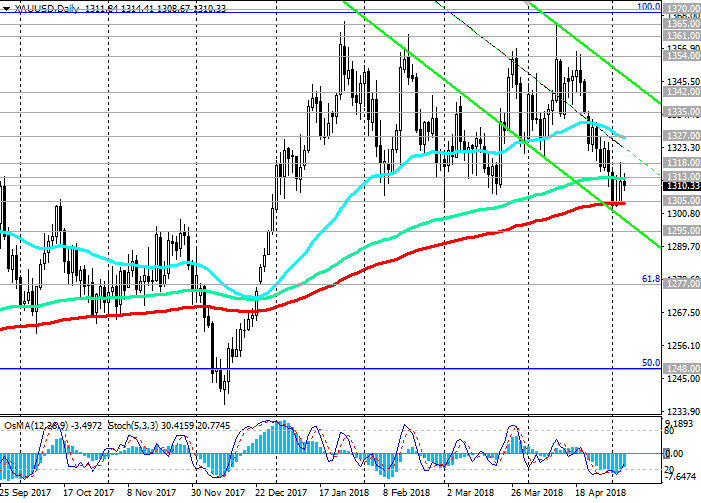

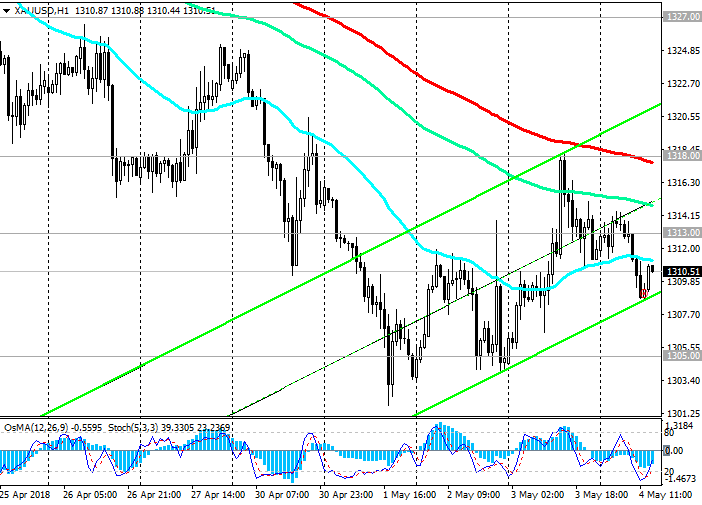

Support levels: 1305.00, 1295.00, 1277.00,

1248.00

Resistance levels: 1313.00, 1318.00, 1327.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00, 1370.00, 1390.00

Trading Scenarios

Sell Stop 1307.00. Stop-Loss 1319.00. Take-Profit 1305.00, 1295.00, 1277.00

Buy Stop 1319.00. Stop-Loss 1307.00. Take-Profit 1327.00, 1335.00, 1342.00, 1354.00, 1361.00, 1365.00, 1370.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com