GBP/USD: pound declines on the eve of the Bank of England meeting, dollar - rising

The US stock indexes again decline on Wednesday after some recovery on Tuesday. Futures on the DJIA fell 1% to 24550.0 points, futures for the S & P 500 fell by 1.1% to 2665.0 points. Investors once again buy the dollar on unwillingness to risk after a sharp drop in shares in recent days. At the beginning of the European session, the dollar strengthened against euro-currencies, including against the pound. However, with large-scale purchases of the dollar is worthwhile to wait.

Apparently, few investors pointed out yesterday's publication of data pointing to a "significant deterioration" in the US trade balance. Data showed that in December, the foreign trade deficit amounted to 53.1 billion dollars (against the forecast of -52.0 billion and

-50.4 billion dollars in November), reaching the highest level in nine years. This is a strong structural negative factor for the US dollar in the long term.

Earlier, US President Donald Trump was extremely negative about the huge US foreign trade deficit, explaining this, in particular, by an expensive dollar. And he's right. An expensive national currency makes goods produced in a given country less competitive on the external market.

Back at the end of last month, the White House decided to impose restrictions on the importation of certain imported goods in the US produced in Asian countries. And a statement by US Treasury Secretary Stephen Mnuchin, who said that "the weakening of the dollar is favorable for trade", caused an even weaker dollar. If the upward trend in the deficit persists, then this may heighten investor fears of trade protectionism, which the administration of President Donald Trump promises to implement. And this is a negative factor for the dollar.

Meanwhile, the pound is down on the eve of tomorrow's meeting of the Bank of England. It is expected that the Bank of England will maintain the current soft monetary policy, given the slowdown in the most important sectors of the British economy, but may signal a stronger tendency of the Bank of England to tighten monetary and credit policy, including because of sharply increased inflation.

It is characteristic that today the National Institute for Economic and Social Research (NIESR) has raised the forecast for GDP growth in the UK in 2018 to 1.9% against the November forecast of 1.7%. NIESR also expects that the Bank of England will raise the key interest rate by 25 basis points in May and will continue to raise it every six months until the rate reaches 2%. It is expected that the annual inflation of consumer prices, which in December was 3%, will fall to 2% over the next eight quarters.

On Tuesday, the House of Representatives of the US Congress approved a bill that will extend government funding until March 23. Uncertainty about the approval of the lower house of the US Congress until Friday of government funding can put pressure on the dollar.

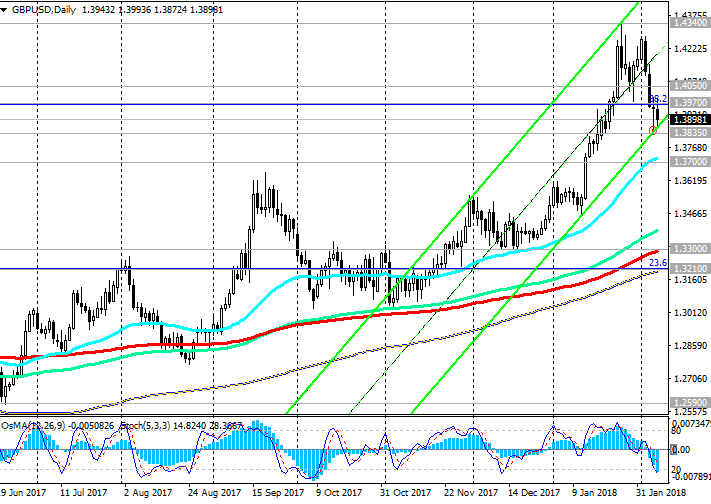

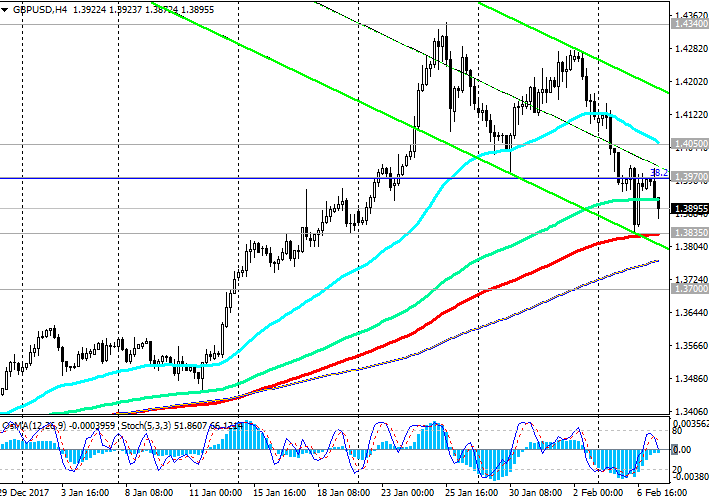

Thus, the fall of the GBP / USD against the background of the current recovery of the US dollar creates favorable conditions for buying the British pound against the dollar, already from current levels, below the level of 1.4000.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 1.3875, 1.3835, 1.3800, 1.3700, 1.3630, 1.3550, 1.3420, 1.3300, 1.3210

Resistance levels: 1.3970, 1.4050, 1.4100, 1.4270, 1.4340, 1.4400, 1.4500, 1.4575

Trading Scenarios

Sell Stop 1.3850. Stop-Loss 1.3940. Take-Profit 1.3835, 1.3800, 1.3700, 1.3630, 1.3550, 1.3420, 1.3300, 1.3210

Buy Stop 1.3940. Stop-Loss 1.3850. Take-Profit 1.3970, 1.4050, 1.4100, 1.4270, 1.4340, 1.4400, 1.4500, 1.4575

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com