GBP/USD: pound remains vulnerable against the background of Brexit

The resignation of Deputy Prime Minister Teresa Mei Damian Green, as it became known on Wednesday, caused a decline in the pound. Damian Greene was Teresa May's companion, and his departure changes the balance of power in the Cabinet. Now this is just as bad for the conservatives, as the UK conducts the most important negotiations about Brexit. The British government still has no common opinion on further actions and future relations with the EU. The Prime Minister of Great Britain is trying to smooth the differences in the government over Brexit, but, at the same time, is looking for ways to maintain close trade ties with the EU.

According to official data released on Thursday, in November of this year, compared with November last year, the net borrowing of the UK public sector decreased and reached a minimum in ten years (8.7 billion pounds, 0.2 billion pounds less than in November last year) . The National Bureau of Statistics of Great Britain noted that in the last months of the financial year, which ends in March 2018, tax revenues are expected to slow down.

Philip Hammond, the UK finance minister, announced more gloomy forecasts for the economy in November, and on Wednesday the IMF published a forecast that UK GDP growth in 2018 will slow down to about 1.5% amid the declining consumer and company costs due to Brexit.

Meanwhile, in the financial markets, there has been a slowdown in trading activity and a decline in trading volumes ahead of the Catholic Christmas and the celebration of the New Year.

From the news for today, we are waiting for the publication of important macro data from the United States. At 13:30 (GMT), the US Department of Labor will publish a report on the number of new applications for unemployment benefits. This indicator determines the state of the labor market. The growth is expected to reach 231,000 (against 225,000 last week). The result above the expected indicates a weak labor market, which will negatively affect the US dollar.

Also at this time annual data on US GDP for the 3 quarter (updated values) and the price index (for 3 quarter), which is an indicator of inflation, will be published. Data on GDP are among the key, along with data on the labor market and inflation, for the Fed in determining its further monetary policy. A high result strengthens the USD. Forecast: GDP for the 3rd quarter increased by 3.3%. If the data prove to be better, the dollar will be strengthened.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

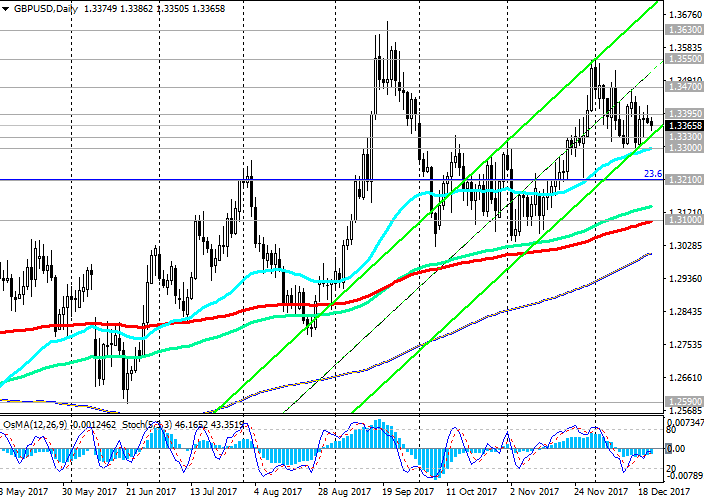

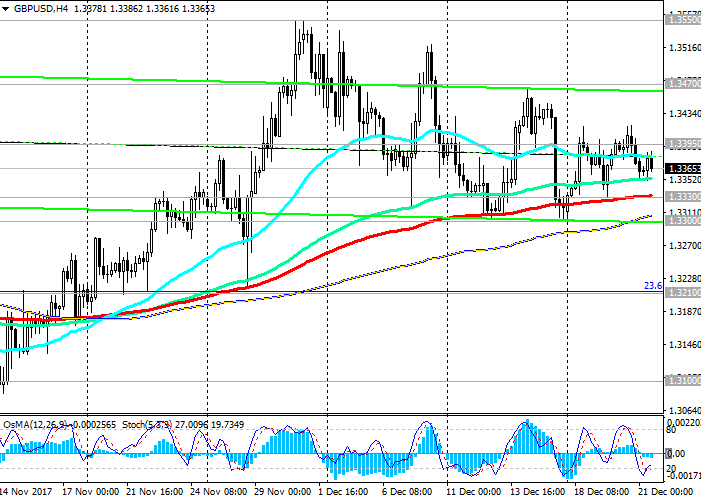

Support levels: 1.3330, 1.3300, 1.3280,

1.3210, 1.3100

Resistance levels: 1.3395, 1.3470, 1.3500, 1.3550, 1.3630, 1.3720, 1.3970, 1.4050

Trading Scenarios

Sell Stop 1.3340. Stop-Loss 1.3410. Take-Profit 1.3300, 1.3280, 1.3210, 1.3100

Buy Stop 1.3410. Stop-Loss 1.3340. Take-Profit 1.3470, 1.3500, 1.3550, 1.3630, 1.3720, 1.3970, 1.4050

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com