USD/JPY: amid the victory of Prime Minister Shinzo Abe's party

After the results of the parliamentary elections in Japan became known, in which Prime Minister Shinzo Abe's party won a convincing victory, the Japanese Nikkei stock index rose to new highs. This year, the Nikkei index grew by 13%, with almost the growth coming in the period after the beginning of September. The Nikkei Stock Average rose to 21810.00 amid the strengthening of shares of export-oriented companies, ending on a positive 16th consecutive day and setting a record for the duration of continuous growth (6 consecutive weeks).

The renewed growth of the Japanese economy and the growth of stock markets helped the ruling coalition to get more than two-thirds of the seats in the lower house of parliament. Abe's victory inspired investors who are investing in the growth of the Japanese stock market, lagging behind other world stock markets. Abe supports soft monetary policy, which will promote the growth of the stock market and the reduction of the yen.

During his reign, Abe will have to decide, in particular, the issue of appointing a new manager of the Bank of Japan. In any case, economists believe that even if Abe replaces the current governor Haruhiko Kuroda, who turns 73 on Wednesday, the central bank will basically maintain an extremely soft monetary policy, including asset purchases of 6 trillion yen in year.

The next meeting of the Bank of Japan, dedicated to monetary policy, will be held on October 31. Last month, the Bank of Japan reiterated its commitment to buy government bonds in the amount of 80 trillion yen a year, and the head of the Bank of Japan at a subsequent press conference promised that "we will patiently adhere to the policy of powerful easing in order to achieve inflation of 2%" and "will take additional mitigation measures, if necessary".

At the same time, the dollar continues to grow in the foreign exchange market after it became known about the decision of the US Senate, which approved the draft budget from the presidential administration. The index of the ICE dollar rose to its highs from October 6, above the level of 93.70. Expectations of continued soft monetary policy in Japan and tightening of monetary policy in the US will contribute to the growth of the pair USD / JPY in the medium term.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

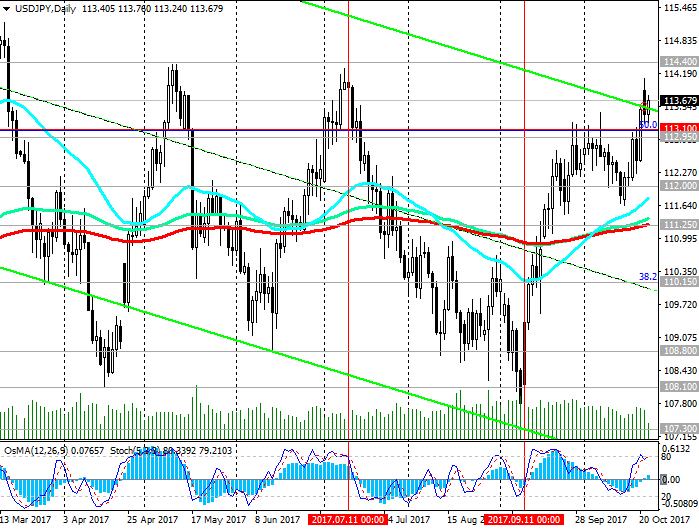

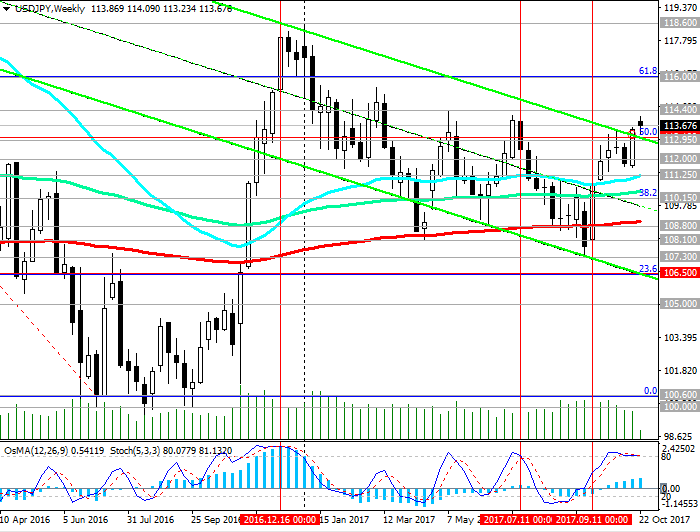

On Monday, trading on the pair USD / JPY opened with a gap up. Then the pair adjusted to the marks near the closing level of Friday. Today, with the opening of the trading day, the pair USD / JPY is growing again and is trading at the beginning of the European session near the level of 113.80, the opening price of trading on Monday. A strong positive momentum continues to push the pair USD / JPY up to the upper boundary of the range between the levels of 108.10 and 114.40.

While USD / JPY is trading above the key support level of 111.25 (EMA200, EMA144 on the daily chart, EMA50 on the weekly chart), its positive dynamics persists.

The alternative scenario implies a return of USD / JPY to the level of 113.10 (the top line of the descending channel on the weekly chart, as well as the Fibonacci level of the 50% correction to the pair growth since August of last year and the level of 99.90) and the resumption of the decline in the downward channel on the weekly chart. The lower boundary of this channel passes near the level of 106.50 (Fibonacci level of 23.6%). The immediate targets will be support levels of 111.25, 111.00, 110.15 (Fibonacci level of 38.2%).

The breakthrough of the short-term support level 112.95 (EMA200 on the 1-hour chart) will be a signal for opening of short positions.

Support levels: 113.50, 113.10, 112.95, 112.00, 111.25, 111.00, 110.15, 110.00, 108.80, 108.10, 107.30, 107.00, 106.50, 105.00

Resistance levels: 114.00, 114.40, 115.00, 116.00

Trading Scenarios

Buy Stop 113.85. Stop Loss 113.20. Take-Profit 114.00, 114.40, 115.00, 116.00

Sell Stop 112.90. Stop Loss 113.40. Take-Profit 112.00, 111.25, 111.00, 110.15, 110.00, 108.80, 108.10, 107.30, 107.00, 106.50, 105.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com