Speaking today at the opening of the conference dedicated to structural reforms held at the ECB headquarters, the president of the European Central Bank, Mario Draghi, did not concern the monetary policy decisions expected from the ECB on October 26.

Nevertheless, the head of the ECB said that the research "has not revealed convincing evidence that high interest rates promote more active reform. The reverse statement seems more plausible: lower rates usually contribute to reforms, since they create more favorable macroeconomic conditions".

Thus, Draghi once again recalled the propensity to continue the extra soft monetary policy of the ECB, whose meeting will be held on October 26.

All the attention of investors will now be focused on the speeches of the bank's leaders before this date. To date, two more presentations by ECB representatives are planned: Peter Prat (at 11:45 GMT) and Benoit Car (at 14:15).

Also it is worth paying attention to the speech of representatives of the Fed Robert Kaplan and William Daly (12:00 GMT). As the president of the Federal Reserve Bank of Dallas and the member of the FOMC with the right to vote Robert Kaplan stated yesterday, "Given the good state of the US economy, I expect progress (in relation to inflation), which in turn will allow us to continue the gradual abandonment of stimulus measures".

Last Sunday, the head of the Federal Reserve, Janet Yellen, also spoke in the same vein, saying that "the observed strength of the economy justifies a gradual increase" in short-term interest rates in the US.

Published yesterday, data on industrial production in the US for September, confirmed the statements of Kaplan and Yellen. Industrial production grew by 0.3% compared to the previous month and by 1.6% compared to the same period of the previous year, despite strong hurricanes that last month. The data indicated a favorable situation in the US industry and strengthened arguments in favor of higher interest rates by the US Federal Reserve at the end of this year.

At the same time, the euro remains under pressure amid an uncertain situation with the independence of Catalonia.

The head of Catalonia, Carles Puigdemont, did not clarify the question of his declared independence of Catalonia, and now, from October 19, Madrid threatens to end the autonomy of this region of Spain. Any escalation of tension around the situation in Catalonia will negatively affect the euro.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

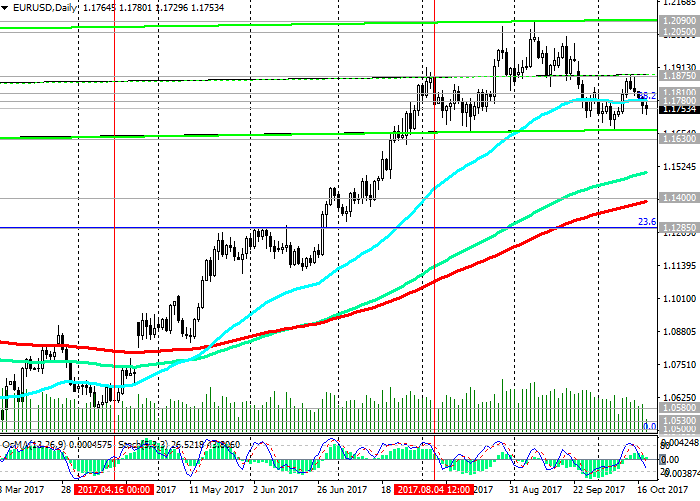

With the annual peaks in September close to 1.2090, the EUR/USD is steadily declining to the lower border of the upward channel on the weekly chart and support level 1.1630 (EMA200 on the weekly chart).

Indicators OsMA and Stochastics on the daily, weekly, monthly charts were deployed to short positions.

At the beginning of the European session, the EUR/USD is trading below the important level of 1.1780 (the Fibonacci level of 38.2% of the corrective growth from the lows reached in February 2015 in the last wave of the global decline of the pair from the level of 1.3900), and the trend towards further decline remains.

The signal for resumption of growth will be a breakdown of the short-term resistance level 1.1810 (EMA200, EMA144 on the 4-hour chart) and the local resistance level 1.1875. In this case, the EUR/USD growth will resume within the uplink on the weekly chart, the upper limit of which is near the resistance level 1.2340 (EMA144 on the monthly chart). The growth targets are level 1.2090 (September highs), 1.2180 (Fibonacci level 50%), 1.2340.

Support levels: 1.1700, 1.1630, 1.1400, 1.1285

Resistance levels: 1.1780, 1.1810, 1.1875, 1.1900, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180

Trading Scenarios

Sell Stop 1.1720. Stop-Loss 1.1785. Take-Profit 1.1700, 1.1670, 1.1630, 1.1600, 1.1400

Buy Stop 1.1785. Stop-Loss 1.1720. Take-Profit 1.1810, 1.1875, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com