GBP/USD: Week of publication of important macro data for Great Britain

The focus of traders trading in the British pound, this week will be the publication of important macro data on the UK. On Tuesday (08:30 GMT), a block of inflation indicators for the UK for September (indices of producer prices, consumer price indices) will be published. It is expected that annual inflation in September rose to 3.0%, reaching the highest level in more than five years. The increase in inflation was triggered by the weakening of the British pound after the referendum on Brexit, held in the summer of 2016.

Inflation, outstripping the growth of wages, forces the British to limit their spending, which leads to a slowdown in the growth of the British economy, which is largely oriented toward the domestic market.

Also on Tuesday (10:15 GMT) the speech of the head of the Bank of England Mark Carney is scheduled.

On Wednesday (08:30) there will be data on the UK labor market for September, and data may show a drop in the unemployment rate below 4.3%, and on Thursday strong retail sales data may be published.

If the data really justifies expectations and will prove to be strong, market participants will be able to more confidently take into account the increase in the key interest rate at a meeting of the Bank of England on November 2.

Now the probability of an increase in the rate in November is taken into account at the level of 85%. It is likely that the British pound will rise, as the prospect of an increase in interest rates in the UK temporarily pushed fears about Brexit into the background.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

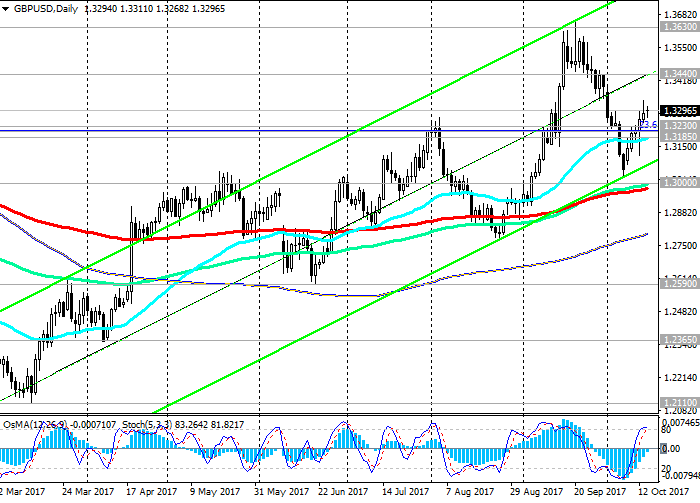

Since the beginning of the year, the GBP/USD has been rising in the upward channel on the weekly chart, the upper limit of which is near resistance level 1.3760 (EMA144 on the weekly chart).

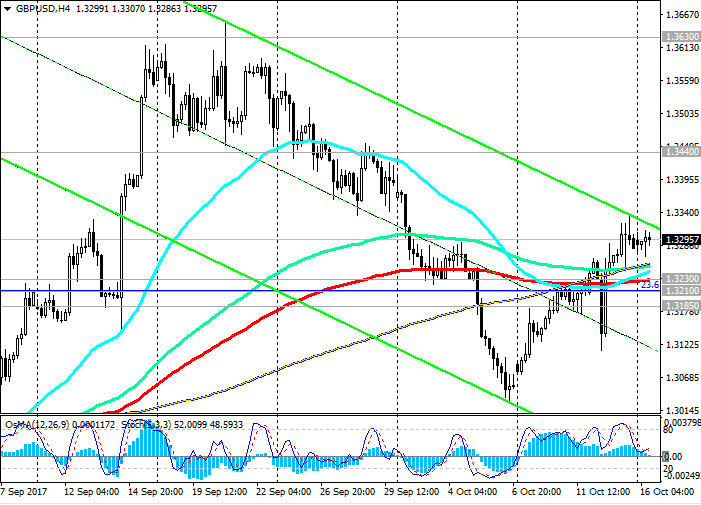

As a result of the 5-day growth, the GBP/USD is once again trading above the important support levels of 1.3185 (EMA50 on the daily chart), 1.3210 (Fibonacci level of 23.6% correction to the GBP/USD decline in the wave, which began in July 2014 near the level of 1.7200 ), 1.3230 (EMA200 on the 4-hour chart).

Positive dynamics of the pair supported by positive macro data and the expectation of a rate increase in the UK. If the growth continues, the targets will be the resistance levels 1.3440 (local highs and the middle of the upward channel on the daily chart), 1.3630 (annual highs), 1.3760.

While the GBP/USD is trading above the support level of 1.3000 (EMA144, EMA200 on the daily chart, EMA50 and the bottom line of the uplink on the weekly chart), positive medium-term dynamics is maintained.

To review short positions, you can return after the breakdown of the support level of 1.3185. The breakdown of the support level of 1.3000 will increase the risks of GBP/USD return to the global downtrend, which began in July 2014.

Support levels: 1.3230, 1.3210, 1.3185, 1.3100, 1.3000, 1.2975

Resistance levels: 1.3300, 1.3440, 1.3500, 1.3630, 1.3760

Trading Scenarios

Sell Stop 1.3250. Stop-Loss 1.3340. Take-Profit 1.3230, 1.3210, 1.3185, 1.3100, 1.3000

Buy Stop 1.3340. Stop-Loss 1.3250. Take-Profit 1.3400, 1.3440, 1.3500, 1.3630, 1.3760

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com