According to the data published on Thursday, the growth of the Eurozone economy in the second quarter (in annual terms) was 2.3% (the forecast was + 2.2%). The data show that the economy of the Eurozone grew faster than in early 2017.

In the 1st quarter, according to GDP growth, the Eurozone outperformed the US, and in the second quarter, growth accelerated.

This data came out on the eve of the publication of the ECB's decision on the interest rate (at 11:45 GMT). It is expected that the rates will remain at the same level. A little later (12:30 GMT) the ECB press conference will begin.

It is likely that following the meeting of the Governing Council, the president of the central bank, Mario Draghi, will signal that the bank will begin to reduce the program for the purchase of assets, the amount of which is 2.3 trillion euros.

Prospects for the growth of the Eurozone economy are becoming increasingly positive. Nevertheless, the inflation rate remains well below the target level set by the central bank.

ECB executives decide what to do with the asset purchase program in conditions of low inflation and the limited availability of available for purchase assets on the stock market. The ECB may postpone a decision on this issue.

Nevertheless, the euro is growing on expectations of the ECB's statement about the curtailment of the incentive program. The euro is still trading below the five-year average. At the same time, there are positive changes in the Eurozone economy.

Investors' opinions as to whether the ECB will today indicate the possibility of curtailing the QE program were divided approximately 50/50.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

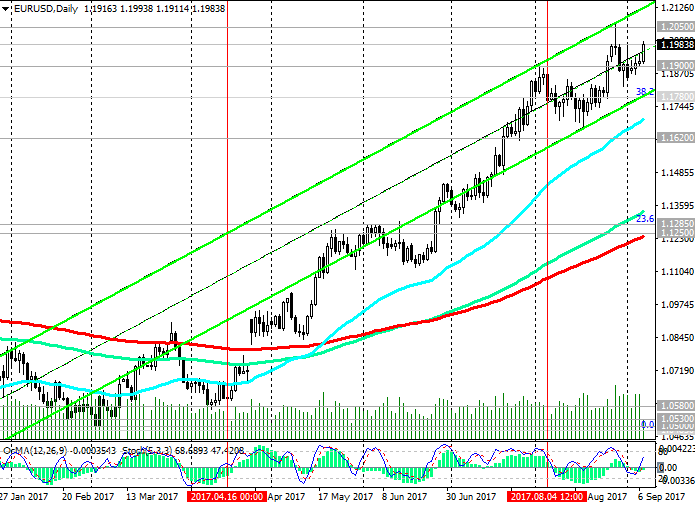

The pair EUR / USD continues to grow in the uplink on the daily chart, the upper limit of which runs near the 1.2100 mark.

In the period from 11:45 to 13:00 (GMT), a surge in volatility is expected across the financial market. The reaction of the market to Mario Draghi's speech can be unpredictable. And so far it is unclear what Mario Draghi will say, but he can develop the markets.

The lower boundary of the channel passes through the support level 1.1780 (the Fibonacci retracement level of 38.2% of the corrective growth from the minimums reached in February 2015 in the last wave of the global decline of the pair from the level of 1.3900).

If Mario Draghi declares the start and the deadline for the curtailment of the QE program, the euro will become sharply stronger on the foreign exchange market. In this case, the targets for the EUR / USD growth will be the levels of 1.2050 (July 2012 low), 1.2100.00, 1.2180 (Fibonacci level of 50% corrective growth from the minimums reached in February 2015 in the last wave of global decline from 1.3900), 1.2370 (EMA200 on the monthly chart).

If the ECB postpones the solution of the issue or extends the terms of QE, the euro will fall under pressure.

The breakdown of the support level 1.1780 will create prerequisites for a deeper decline in EUR / USD and the opening of short positions. So far, long positions on EUR / USD are relevant.

Support levels: 1.1900, 1.1880, 1.1800, 1.1780, 1.1720, 1.1670, 1.1620

Resistance levels: 1.2000, 1.2050, 1.2070, 1.2100, 1.2180

Trading Scenarios

Sell Stop 1.1930. Stop-Loss 1.2010. Take-Profit 1.1900, 1.1880, 1.1800, 1.1780, 1.1720, 1.1670, 1.1620

Buy Stop. Stop-Loss 1.1930. Take-Profit 1.2050, 1.2070, 1.2100, 1.2180, 1.2370

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com