As follows from yesterday's July minutes of the Fed meeting, there is no consensus among US central bank executives about further interest rate hikes. Slowing inflation forced some Fed officials to propose to refrain from further raising rates. "In the current conditions, the Fed can show patience", the protocols say. Earlier, the Fed planned to raise rates three times this year, but the protocols published on Wednesday make it doubtful.

After the publication of the minutes, the dollar fell sharply in the foreign exchange market. The index of the US dollar, WSJ, estimating the value of the dollar against 16 other major world currencies, fell by 0.4%, to 86.33.

Nevertheless, today the dollar is recovering its positions during the European trading session. This applies to the pair GBP / USD, which is declining after the publication of data on retail sales in the UK for July. According to the National Bureau of Statistics (ONS), presented today at the beginning of the European session, retail sales growth in the UK in July was modest (+ 0.3% vs. +0.2 forecast). The estimation of sales growth for June was reduced to 0.3% from 0.6%. In annual terms, growth was also modest (+ 1.3% vs. + 1.4%, according to the forecast).

The British economy, largely dependent on domestic consumption, grew by just 0.3% in the second quarter (+ 0.2% in the first quarter).

According to data published earlier this week, real British salaries in June declined for the fourth consecutive month. Because of the sharp increase in inflation against the backdrop of a sharp weakening of the pound after the referendum on Brexit, the real income growth of the British lags behind inflation, which is confirmed by the almost zero increase in personal expenses of the British and the level of retail sales.

Sales in all categories, except for food and household goods, in comparison with the previous month decreased.

In July, inflation was 2.6% against a nearly four-year high of 2.9% in May, well above the Bank of England's target of 2%.

We are waiting for the data from the USA today. At 12:30 (GMT), the US Department of Labor will publish a weekly report on the number of initial applications for unemployment benefits. The forecast is expected to decline to 240,000 versus 244,000 for the previous period, which should positively affect the dollar. If the data is confirmed or better, the dollar will receive additional support.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

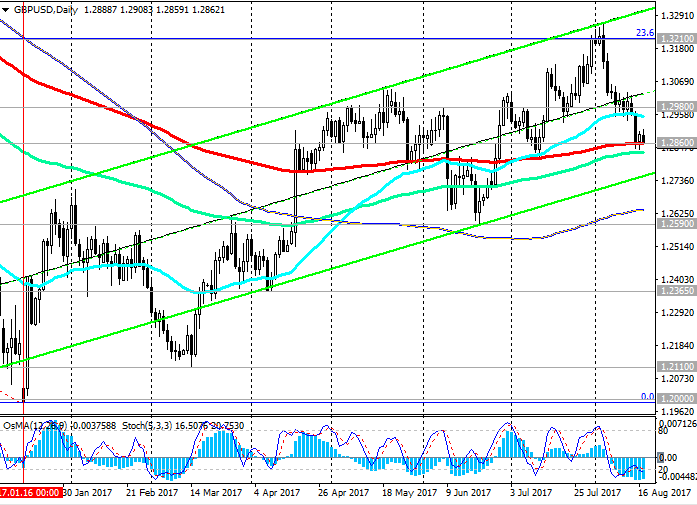

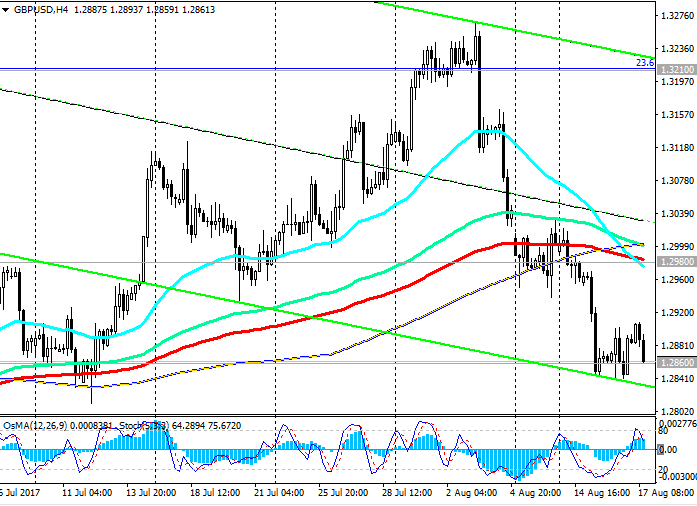

Since the beginning of August, the GBP / USD pair is actively declining. On the daily chart, GBP / USD fell back to the key support level of 1.2860 (EMA200). Downward dynamics prevails. Breakdown of this level will strengthen the risk of GBP / USD returning to a downtrend.

Indicators OsMA and Stochastic daily, weekly, monthly charts were deployed to short positions.

An alternative scenario relates to the return of GBP / USD to the zone above the level of 1.2980 (EMA200 on 1-hour and 4-hour charts) and the resumption of growth. The closest target in this case will be the resistance level 1.3210 (Fibonacci level 23.6% correction to the decline in the GBP / USD pair in the wave, which began in July 2014 near the level of 1.7200). Levels of 1.3300 (the upper limit of the channel on the weekly chart), 1.3460 (July and September highs) will be the next growth target.

Support levels: 1.2860, 1.2800

Resistance levels: 1.2980, 1.3000, 1.3100, 1.3210, 1.3300, 1.3400, 1.3460

Trading scenarios

Sell Stop 1.2850. Stop-Loss 1.2910. Take-Profit 1.2815, 1.2765, 1.2700, 1.2640, 1.2590, 1.2550, 1.2365

Buy Stop 1.2910. Stop-Loss 1.2850. Take-Profit 1.2960, 1.3000, 1.3100, 1.3210, 1.3300, 1.3400, 1.3460

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com