Brent: the number of active drilling rigs in the United States has again risen

The general weakening of the US dollar, observed on Friday, helped the oil prices to adjust at the end of last week. The price of Brent oil after reaching a new local minimum during the Asian session of Friday near the level of 46.70 dollars per barrel could grow by the end of the American trading session to the level of 49.69. The price increase on Friday continued even after the data from the American oil service company Baker Hughes were published. The number of active oil drilling rigs in the US increased again last week (by 6 units to 703 units).

The victory of Emmanuel Macron in the French presidential election helped to ease concerns about the prospects of the European economy. The investors' mood also improved the information that Saudi Arabia will support the extension of OPEC arrangements with the participation of Russia and other major oil-producing countries on the reduction of production.

Nevertheless, some investors still doubt that a reduction in production will lead to a rapid and significant reduction in world reserves.

The growth in the production of shale oil in the US significantly alleviates OPEC's efforts to create an artificial deficit and stabilize prices in the oil market. Moreover, the US is increasing its oil exports to Asia. Approximately 40% of US oil exports were sent to Asia in February. At the same time, US oil companies have significant reserve capacity.

Last month, the EIA raised its forecast for oil production this year and next year to 9.2 million barrels per day and 9.9 million barrels per day, respectively. Against the backdrop of the growth of active drilling rigs the last three months production in the US remains above 9 million barrels per day.

On Tuesday, a monthly report is expected from the Energy Information Administration (EIA) with a short-term forecast on the dynamics of oil production in the US. It is expected that EIA will again raise the forecast for oil production in the US, which could significantly worsen the mood of investors and increase the pressure on prices.

But the main current risks are connected, first of all, with the extension of OPEC agreements on oil production reduction. If the agreement on limiting production is not extended (the OPEC meeting will be held on May 25), the oil market may again rapidly return to the lows of 2016, when the barrel of Brent crude oil was just above $ 27.00.

Support and resistance levels

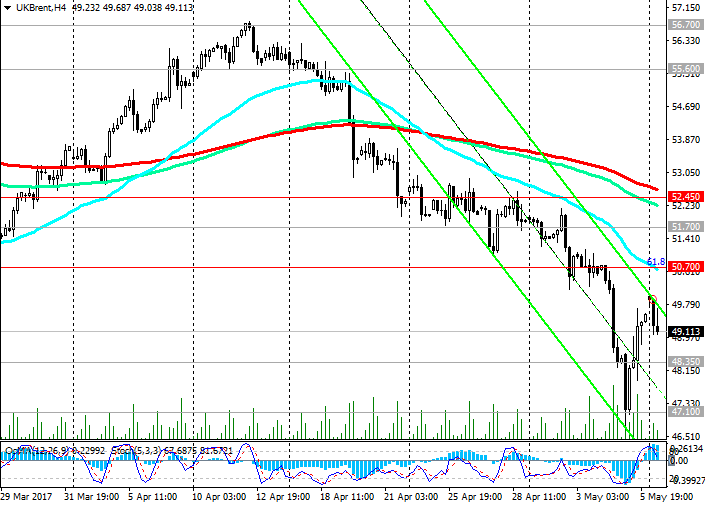

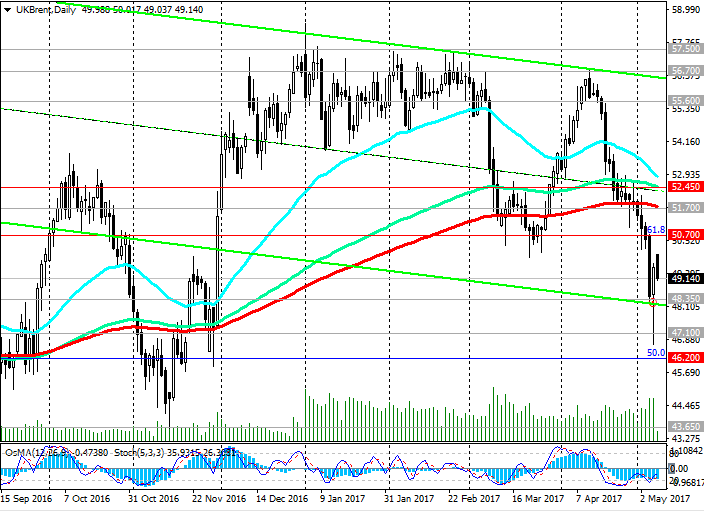

Since the middle of last month, the price for Brent crude oil has fallen sharply and has lost almost 15% to the current moment. Negative dynamics prevails. The price of Brent crude oil broke through the most important mid-term support levels of 52.45 (EMA144 on the daily chart), 51.70 (EMA200 on the daily chart, EMA50 and the bottom line of the uplink on the weekly chart), 50.70 (Fibonacci retracement level of 61.8% From June 2015 to the absolute minimums of 2016 near the mark of 27.00) and decreases in the descending channel on the 4-hour chart.

In case of repeated testing of the support level of 48.35 (the bottom line of the descending channel on the daily chart), the price reduction may resume.

Indicators OsMA and Stochastics on the monthly, weekly, daily charts went to the side of sellers.

In the case of consolidation below 46.20 (50% Fibonacci level), the upward trend in the price of Brent crude oil will be canceled.

An alternative scenario for growth is associated with a price return above the level of 52.45. So far, there has been a strong negative dynamics.

Support levels: 48.35, 48.00, 47.10, 46.20

Levels of resistance: 50.00, 50.70, 51.70, 52.45

Trading scenarios

Sell Stop 48.90. Stop-Loss Section 50.10. Take-Profit 48.35, 48.00, 47.10, 46.20

Buy Stop 50.10. Stop-Loss 48.90. Take-Profit 50.70, 51.70, 52.45, 55.60, 56.70, 57.00, 57.50

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics