AUD/USD: data on inflation did not meet expectations_26/04/2017

After this morning, the Australian Bureau of Statistics and the RBA published the most important inflation indices in Australia (CPI for the first quarter of this year, the RBA index of core inflation by the truncated average method for the first quarter), the Australian dollar declined in the foreign exchange market.

Although the inflation rate returned to the central bank's target range of 2% -3%, the data on the rate of price growth turned out to be weaker than expected. Consumer prices in the first quarter increased by 0.5% compared to the previous quarter (by 2.1% in annual terms). The forecast provided for an increase in consumer prices by 0.6% compared to the fourth quarter of 2016 and by 2.3% compared to the same period last year.

According to economists, the acceleration of inflation caused a sharp rise in prices for gasoline. The rise in prices in the long term is likely to remain slowed due to pressure from record low wages growth rates and deterioration of the labor market situation.

The fall in commodity prices in recent years, a fairly high level of unemployment in the country (the last 10 years, unemployment is close to 6.0%), a weak increase in wages of employees, which does not contribute to the growth of consumer spending, as well as weak, according to the RBA , GDP growth - these are the main risks for the Australian economy.

It is likely that interest rates will remain the same for some time.

Another factor put pressure on commodity currencies, including the Australian dollar, this week. The US decided to introduce import duties on wood from Canada. This news testifies to the strengthening of protectionism in world trade by the US, and this has a negative impact on commodity currencies.

Now investors will focus on Donald Trump's tax reform plan in the US, which he promised to present today. If the plan turns out to be clear in terms of dates and details, this could lead to an increase in the US dollar throughout the market.

On Thursday - the speech of the Governor of the RBA Philip Lowey. The exact time of his speech has not yet been determined. But, most likely, his speech will not contain anything new about the monetary policy of the RBA. It is likely that the comments of Philip Lowe will not affect the quotations of the Australian dollar.

Support and resistance levels

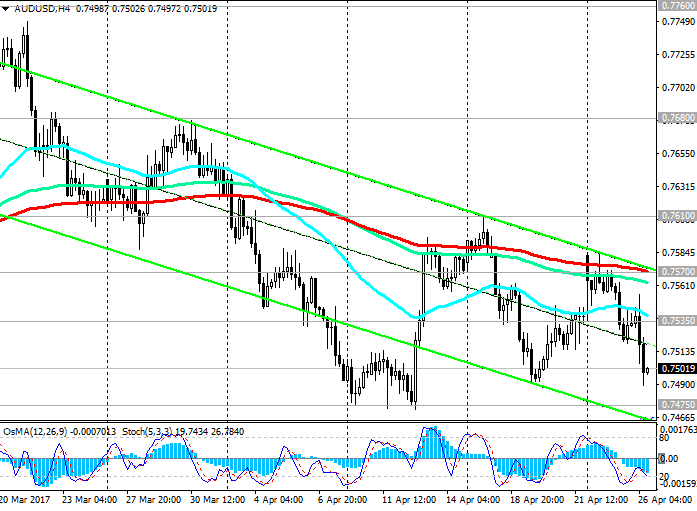

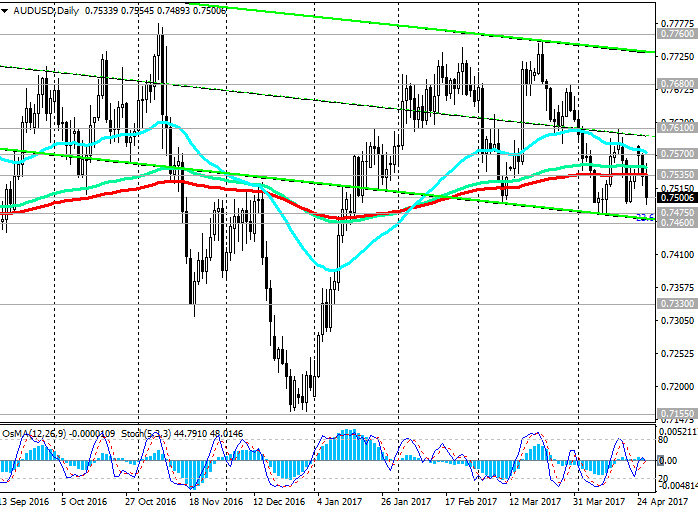

After the publication of inflation indicators, the pair AUD / USD declined during today's Asian session. During the last three trading sessions, the AUD / USD pair is declining. Today, the pair pushed away from the key resistance level 0.7535 (EMA200 on the daily chart) and with the opening of the European session, the decline in the AUD / USD pair continued.

Negative dynamics of the pair, it seems, is growing. The breakdown of support levels of 0.7475 (April lows and the lower border of the downward channel on the daily chart), 0.7460 (the Fibonacci level of a 23.6% correction to the wave of the pair's decline since July 2014) will increase the risks of return to the downtrend of the AUD / USD pair, which began in July 2014 of the year. The medium-term goal of this decline will be the level of 0.7155 (May and December minima of 2016).

The alternative scenario is related to the further weakening of the US dollar and the return of the pair AUD / USD above resistance levels 0.7535, 0.7570 (EMA200 and the top line of the descending channel on the 4-hour chart). If this scenario is implemented, the pair AUD / USD will grow with the targets of 0.7680, 0.7760, 0.7840 (the Fibonacci level of 38.2% correction to the fall wave of the pair from July 2014 and EMA144 on the weekly chart).

The medium-term positive dynamics of the AUD / USD pair may recover already when the AUD / USD pair returns to the zone above the 0.7535 level.

Support levels: 0.7475, 0.7460, 0.7330

Resistance levels: 0.7535, 0.7570, 0.7610, 0.7680, 0.7760, 0.7800, 0.7840

Trading Scenarios

Sell Stop 0.7480. Stop-Loss 0.7520. Take-Profit 0.7460, 0.7400, 0.7330

Buy Stop 0.7520. Stop-loss 0.7480. Take-Profit 0.7535, 0.7570, 0.7610, 0.7680, 0.7760, 0.7800, 0.7840

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics