Trading recommendations

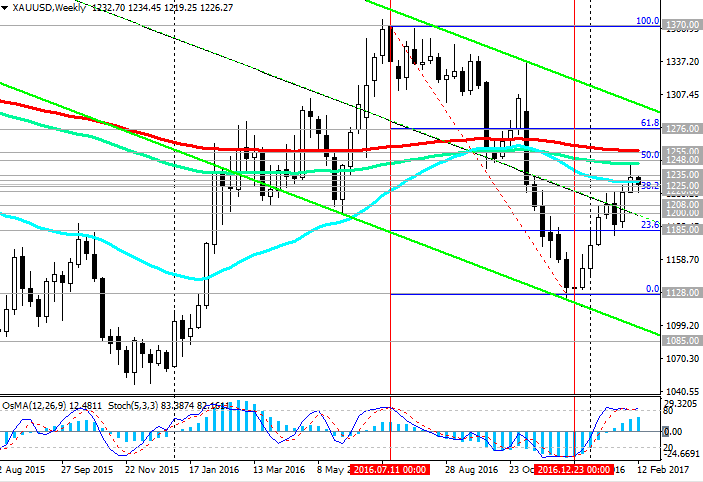

Buy Stop 1228.00. Stop-Loss 1223.00. Objectives 1230.00, 1235.00, 1248.00, 1255.00, 1276.00

Sell Stop 1223.00. Stop-Loss 1228.00. Objectives 1220.00, 1215.00, 1208.00, 1185.00, 1177.00, 1162.00, 1128.00

Overview and Dynamics

After yesterday's rapid growth in the statements made by the head of the Federal Reserve Janet Yellen, today the US dollar, mainly is trading with no clear trend. Speaking yesterday with the semi-annual report before the Senate Banking Committee, Janet Yellen said that a rate hike would be appropriate "to our next meetings" provided employment and inflation. But not Yellen pointed to the rate increase was in March.

At the same time, the market takes into account the potential risks of protectionism on the part of the administration of Donald Trump, which calls for a weaker dollar in order to enhance the competitiveness of American goods.

In the context of political and economic uncertainty in the price of gold rose to highs for nearly the last three months. February's maximum was recorded near the mark of 1244.00 dollars per ounce of gold. However, past few days the pair XAU/USD is trading in a narrow range near the mark of 1225.00. Under the conditions of a rate hike in the price of gold down, because gold does not bring interest income and can not compete with the bearing assets such income, such as government bonds.

Today, in the period from 16:30 to 17:15 (GMT + 3) will be published the most important macroeconomic indicators in the USA in January. Among these - the inflation index of consumer prices and industrial production data. If the data are weak, the dollar has significantly strengthened yesterday on the foreign exchange market may decline. The market may start a correction in the dollar, causing a rise in gold prices.

At 18:00 start performance Janet Yellen. However, the market reaction to her performance may be weak after yesterday's speech. Investors have already taken into account in the quotations of the dollar 18% chance of a rate hike in March. It is more likely that in the US the rate can be increased only in June.

From the US received mixed signals. Also, market participants take into account the political uncertainty in the euro area, due to the elections in several key countries, and the possibility of the collapse of the unwinding process or reduce the euro area.

It is likely that rising dynamics XAU / USD pair will continue. The uncertainty surrounding the political situation in Europe and the US is that it supports the price of gold and the uptrend pair XAU / USD, which began in December last year.

Technical analysis

At the beginning of today's European session, gold is trading at the support level near the mark of 1225.00 dollars per ounce (EMA200 the 1-hour chart, EMA50 and the bottom line of the rising channel on 4-hour chart, the daily chart EMA144). Positive dynamics of the XAU / USD pair is maintained above the level of 1208.00 (EMA200 on 4-hour chart). Fundamental factors (political uncertainty in Europe and the US, the low probability of a rate hike in the US in March) supporting the gold price. Growth may resume when attached above the nearest resistance level of 1235.00 to 1248.00 goals (Fibonacci level of 50%), 1255.00 (EMA200 on the weekly chart), 1276.00 (61.8% Fibonacci level).

On the other hand, on the daily and 4-hour charts indicators OsMA and Stochastic crossed over to the sellers. Breakdown level of 1225.00 could trigger a further decline in XAU / USD pair. The immediate objective are - the level of 1220.00 (38.2% Fibonacci level of the correction to the wave decline from July 2016).

Breakdown level of 1220.00 could trigger a further decline in XAU / USD pair back to the descending channel on the daily chart and a further decline in this channel.

The objectives of reduction in this case will be the levels 1208.00, 1200.00, 1185.00, 1128.00 (December low). The lower boundary of the channel is below the level of 1085.00.

Support levels: 1225.00, 1220.00, 1208.00, 1200.00, 1185.00, 1177.00, 1162.00, 1128.00

Resistance levels: 1230.00, 1235.00, 1248.00, 1255.00, 1276.00

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.