Gold Prices Rise Amid Lingering US Fiscal Policy Uncertainty

Gold Prices Rise Amid Lingering US Fiscal Policy Uncertainty

Talking Points:

- Gold prices rise as “Trump trade” unwinding resumes

- Crude oil prices unable to fully capitalize on weak USD

- Follow-through likely but headline risk a potent threat

Gold prices are on the upswing to start the trading week as “Trump trade” unwinding returns with gusto. The US Dollar is facing heavy selling pressure, which has understandably translated into support for anti-fiat assets including the yellow metal.

Crude oil prices managed to find a bit of support in a weakening of the US but the move appeared decidedly more restrained relative to other beneficiaries of the greenback’s woes across the asset spectrum. Skepticism about the supportive powers of OPEC’s supply cut deal may explain this apparent inability to capitalize.

A relatively uneventful docket of scheduled event risk in the hours ahead suggests established momentum has scope to continue. The markets’ sensitivity to headline risk is almost certainly elevated however, warning that the threat of snap reversals is an especially acute one.

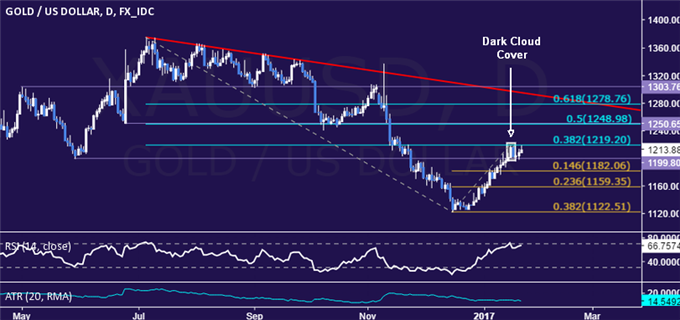

GOLD TECHNICAL ANALYSIS – Gold prices may be topping after putting in a bearish Dark Cloud Cover candlestick pattern but follow-through has been lacking thus far. From here, a break below 1199.80 on a daily closing basis targets the 14.6% Fibonacci expansion at 1182.06. Alternatively, a push above the 38.2% Fib retracement at 1219.20 targets the 1248.98-50.65 area (50% level, June 24 low).

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices still look as though a Head and Shoulders topping pattern may be taking shape. A daily close below the 50.25-69 area (38.2% Fibonacci retracement, January 10 low) would confirm the setup, exposing the 50% level at 48.72 as the next downside threshold. Alternatively, a break above the 23.6% Fib expansion at 53.75 targets the 55.21-65 zone (January 3 high, 38.2% expansion).