EUR/GBP at Risk for a Larger Pullback- Bearish Invalidation 8822

EUR/GBP at Risk for a Larger Pullback- Bearish Invalidation 8822

Talking Points

- EUR/GBP responds to confluence resistance- interim support 8664

- Updated targets & invalidation levels

EUR/GBP Daily

Technical Outlook: EURGBP has responded to confluence resistance at 8723/39- this region is defined by the 100% extension of the advance off the 2015 low, the 50% retracement of the October decline & the August swing high. Note that today’s stretch high saw a perfect tag of basic trendline resistance extending off the October 11th high and if we close at these levels would constitute a daily pin bar -further highlighting the risk of a pullback from these levels.

Interim support rests with the ascending median-line (~8664) with more significant support seen at 8526/47–are of interest for exhaustion / long-entries. A break below this level would be needed to suggest that a more meaningful reversal is underway. A breach above near-term resistance still has to contend with a key technical barrier at 8815/22 where the 2013 high & 61.8% retracement converge on slope resistance.

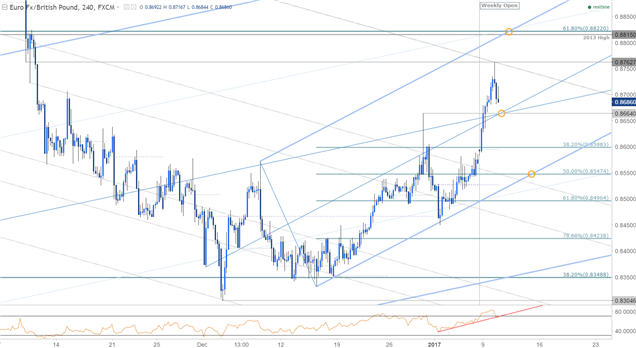

EUR/GBP 240min

Notes:The pair has been trading within the confines of an ascending pitchfork formation off the December lows with the median-line highlighting a near-term support confluence at 8664. A break below this region validates the short-bias with subsequent support targets eyed at 8598 & 8547.

Bottom line: the risk remains for a move lower while below the 161.8% extension at 8763 with a break below support to validate our near-term bearish outlook. Ultimately we’ll be looking to buy a larger set-back into structural support. A quarter of the daily average true range (ATR) yields profit targets of 19-22 pips per scalp. Added caution is warranted tomorrow with a string of UK data & BoE Governor Carney’s testimony before Parliament’s Treasury Select Committee likely to fuel added volatility in the Sterling crosses.

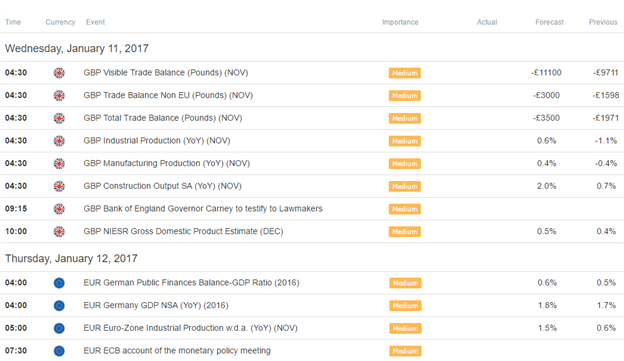

Relevant Data Releases