AUD/USD NFP Game Plan- Constructive Above of 7280

Talking Points

- AUD/USD targeting resistance ahead of NFPS

- Updated targets & invalidation levels

Welcome to my products:

https://www.mql5.com/en/users/soubra2003/seller

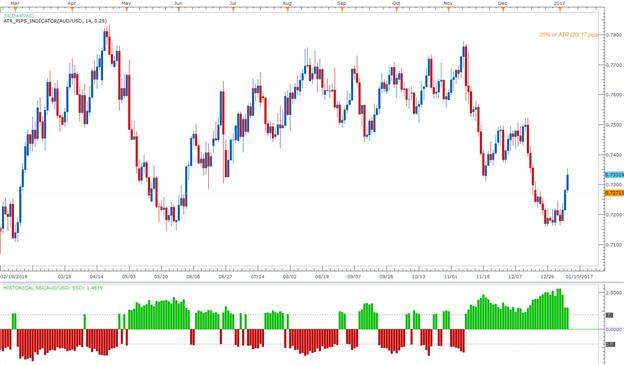

AUD/USD Daily

Technical Outlook: Aussie failed to break through the lower median-line parallel last month with the subsequent rebound breaking through confluence resistance today at 7282. This level is defined by the 2016 open and the 50-line of the operative descending pitchfork formation. Note that daily RSI broke above a multi-month resistance trigger yesterday and keeps our focus weighted to the topside while above this threshold. Resistance is now eyed at 7397 where the 38.2% retracement converges on the median-line (area of interest for exhaustion / short-entries).

AUD/USD 120min

Notes: A closer look at price action highlights a breach & retest of the 7282 resistance zone with immediate topside resistance objectives eyed at 7370 & 7397. A breach above this mark would be needed to suggest a larger reversal is underway in the pair.

Bullish invalidation rests with the weekly / monthly open at 7200- a break below this level would shift the focus back to the short-side with such a scenario targeting 7144/60 & the 100% extension of the November decline at 7088. A quarter of the daily average true range (ATR) yields profit targets of 17-20pips per scalp. Added caution is warranted heading into tomorrow’s highly anticipated U.S. Non-Farm Payrolls report with the release likely for fuel added volatility in the dollar crosses. Follow the real-time news feed for live updates during the release.

AUDUSD Speculative Sentiment Index (Daily Chart)

A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are long AUD/USD- the ratio stands at +1.46. While the current SSI profile remains bearish, it’s important to note that the pullback in long positioning from the November extreme of 2.55 has been accompanied by a broader turn in the exchange rate and a flip to net-short in the coming days could further validate this near-term reversal play. That said, I’ll be looking for a continued build in short positioning to suggest a more significant low may be in place.

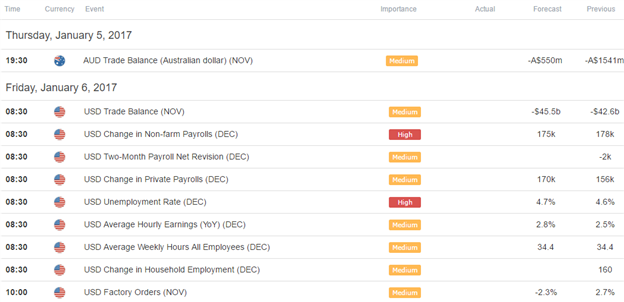

Relevant Data Releases