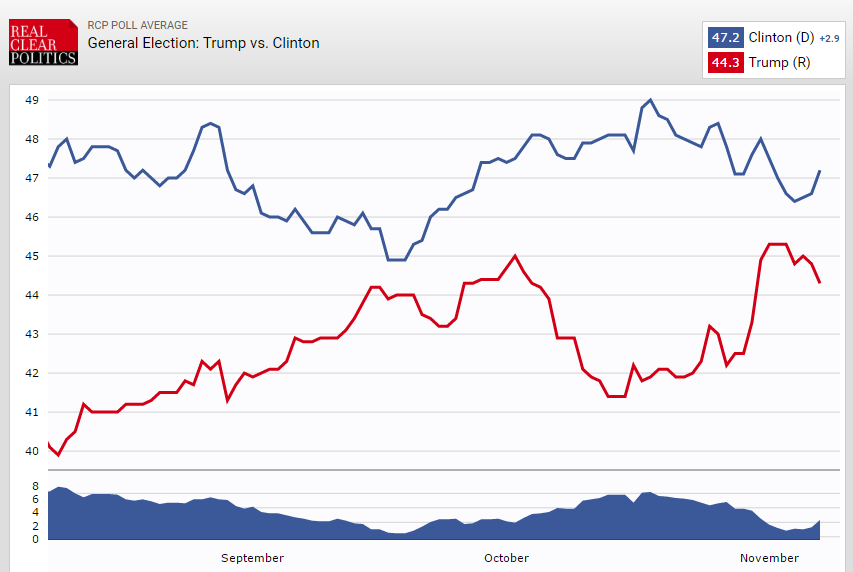

Tomorrow, on 8th November, the US presidential elections begin. Up until now, the dispute on the presidential race between Hillary Clinton and Donald Trump has been a fierce battle. The polls have been mostly in favor of Hillary, although Trump has been gaining terrain in the last 3 months. Three months ago, Hillary had an advantage, in average, of +8pts ahead of Trump in the polls, but mostly due to Clinton’s scandal with the confidential emails which involved an FBI investigation, Clinton now leads Trump by just 3 points. On some polls such as LA Times/USC Tracking, Trump is the leader... Read more US Elections Effects in the Forex Markets http://www.analyticaltrader.com/us-elections-effects-in-the-forex-markets/

What are the effects in the Forex markets?

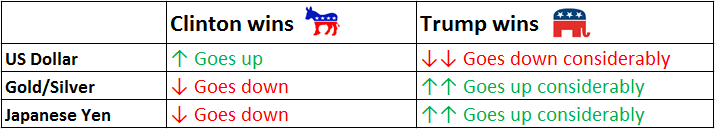

This is a unique presidential race – Donald Trump is a man with many diverging ideas from the mainstream Republican ideology, such as on protectionism, foreign policy, and immigration policies, and so, the latest presidential races (such as George W. Bush election) aren’t a reliable indicator of what’s going to happen to the markets if the Republican candidate wins this one. Personal opinions aside, what everyone can agree on is that if Trump wins, he would bring quite some changes and unpredictability, at least at the beginning, to US politics and economy. Unpredictability brings volatility, and that’s what we can expect on a Trump’s victory. US Dollar would fall sharply, due to an expectation of a capital flight out of US Dollars to safe-haven commodities and currencies, such as gold and the yen respectively.

Clinton, on the other hand, is a more predictable candidate, and the markets know what to expect from her presidency if she wins. US Dollar will be strengthened since the unpredictableness from the elections will be gone, and safe-haven currencies and commodities (Yen and gold), would weaken for the same reason. The movements are skewed, though – a Trump win would give rise to extreme movements, while Clinton’s victory would mean more moderate movements. The table below resumes these effects:

A way to approach these elections could be to bet for a Trump’s win, as his win would move the markets more sharply than Clinton’s win (and hence, would give a favorable risk to reward), but since his election probability is also lower due to the polls results, it would certainly be a very risky shot. The wisest thing to do is to stay out of these assets until the votes are counted, as a period of high volatility is to be expected during the voting day, and after the candidate is chosen.