Trading recommendations

Buy Stop 1298.00. Stop-Loss 1288.00. Objectives 1300.00, 1324.00, 1350.00, 1370.00

Sell Stop 1287.00. Stop-Loss 1298.00. Objectives 1283.00, 1268.00, 1250.00, 1218.00, 1200.00

Unexpected turn in the case of the private correspondence of the candidate for the US presidency, Hillary Clinton made an imbalance in the financial markets and the dollar has shaken. Boosted demand for safe-haven assets such as gold, yen, franc. Recent results of a public opinion poll in the US showed that Hillary Clinton would vote 44.5% of voters, for Donald Trump - 45.2%. Again there was a lack of confidence in the outcome of the vote in the United States, and again investors are in safe assets.

If the results of the election further destabilize the markets, the Fed may refrain from raising rates in December. And it weakens the dollar in the foreign exchange market.

Gold does not interest earning more difficult to compete with other relatively safe assets while increasing the cost of borrowing. If the rates remain low, the demand for it is growing steadily.

On Tuesday, the strong economic data was released in the US. Index of business activity in the manufacturing sector ISM came out with a value of 51.9 (the forecast 51.7) in October. A similar PMI index from Markit in October reached an annual high of 53.4.

However, these and previously unreleased strong data from US provides little support for the dollar. Investors' attention switched to the US presidential elections, to be held on 8 November. Their outcome will largely depend on further economic policy in the US and the dynamics of the US stock market and the dollar.

The central point of attention of traders today will be the Fed's decision on interest rates in the US, which will be published in the 21:00 (GMT + 3). The likelihood that the Fed will raise rates today, tends to zero. Few expect that the central bank will raise interest rates before the presidential election. Nevertheless, market participants will be watching the Fed's rhetoric of leaders to understand the future plans of the US central bank and catch the signals of future policy tightening.

Also today at 15:15 will be published the report on the change in the number of people employed in the US (report on employment from ADP) in the private sector in October. Generally, the report has a strong impact on the market and the dollar quotation, however, the direct correlation with the Non-Farm Payrolls, as a rule, are not marked. Strong data positively impacts on the dollar. Previous value of the 154,000 workers in the US private sector (forecast 165 thousand). Reducing result would weaken the US dollar, and vice versa.

Technical analysis

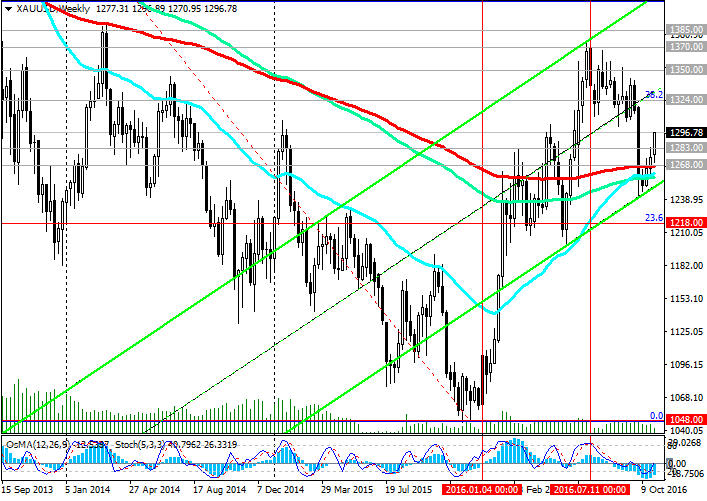

For grown in recent uncertainty in the outcome of the US vote dollar is losing its position in the foreign exchange market. The pair XAU / USD begins the month and a new trading week in positive territory. After a bad break the support level of 1268.00 (EMA200 on daily and weekly charts) pair XAU / USD rising in an upward channel on the weekly chart, the upper limit, passing near the 1410.00 level (Fibonacci level of 50.0% correction to the wave decline from October 2012).

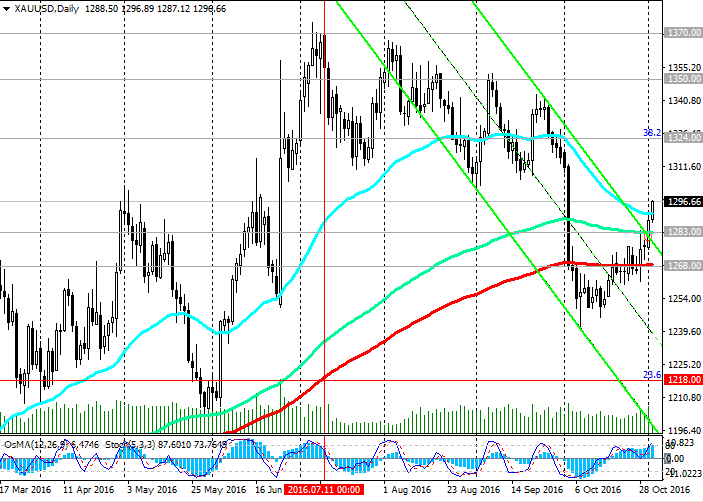

The upper line of the descending channel on the daily chart was broken at the level of 1283.00 (EMA144 on the daily chart, EMA200 on 4-hour chart).

OsMA and Stochastic indicators turned on long positions on weekly, daily and 4-hour charts.

Positive dynamics of the XAU / USD pair will rise above the level of 1283.00.

In the case of the further growth of the pair XAU / USD immediate goal may be the resistance level 1324.00 (38.2% Fibonacci level). In case this level will be broken, there is possible further rise in the rising channel on the weekly chart with the purposes 1385.00 (highs of the year), 1410.00.

However, if the Fed will confirm its intention to tighten monetary policy in the United States in December, while the number of supporters of this position among investors the Fed is above 70%, the price of gold and the pair XAU / USD resumed its decline.

When returning below 1268.00 may be assumed further decline in the price of gold and the pair XAU / USD within the descending channel on the daily chart with the immediate goal of 1218.00.

Break of the support level of 1218.00 (23.6% Fibonacci level) will create preconditions for the further decrease in pair XAU / USD and return to the downward global trend, which began in October 2012.

Support levels: 1283.00, 1268.00, 1250.00, 1218.00

Resistance levels: 1324.00, 1350.00, 1370.00, 1385.00, 1400.00

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.