Sell Stop 0.7620. Stop-Loss 0.7670. Take-Profit 0.7570, 0.7530, 0.7475, 0.7445, 0.7325, 0.7290, 0.7200

Buy in the market. Stop-Loss 0.7630. Take-Profit 0.7685, 0.7730, 0.7750, 0.7800, 0.7820, 0.7900

Technical analysis

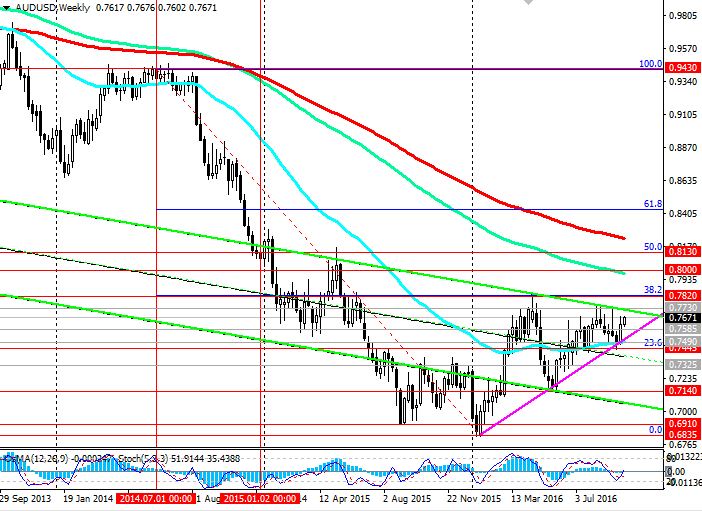

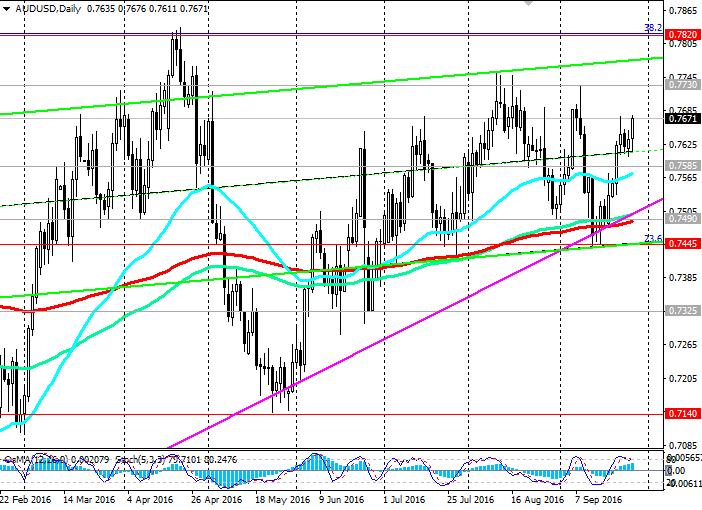

Last week, the AUD / USD rebounded from important support level 0.7490 (EMA200 on the daily chart and the lower line of the rising tapered triangle).

The upper boundary of the triangle passes through the level of 0.7730 (highs in August, September, and the upper line of the descending channel on the weekly chart).

The AUD/USD is gaining upward momentum after the Fed's decision not to change interest rates in the US and rising towards the next resistance level of 0.7730.

Indicators OsMA and Stochastic on the 4-hour and daily charts went over to the buyers on the weekly chart - also deployed on long positions.

The upward tapering triangle is a continuation of the trend. Break its upper boundary at 0.7730 level could create conditions for the further growth of the pair AUD / USD. In case of breaking the resistance level 0.7820 (38.2% Fibonacci level of the correction to the wave of decrease in pair in July 2014, the April highs), the pair AUD / USD is heading to 0.8000 levels (EMA144 on the weekly chart), 0.8130 (50.0% Fibonacci level), 0.8200 (EMA200 on the weekly chart).

Reverse the scenario associated with the breakdown of the support level 0.7445 (23.6% Fibonacci level). In this case, a negative trend can prevail, and the goals of further reducing the pair AUD / USD may be levels 0.7325, 0.7140 (May lows).

Support levels: 0.7585, 0.7490, 0.7445, 0.7325, 0.7290, 0.7200, 0.7140

Resistance levels: 0.7730, 0.7820, 0.7900, 0.8000

Overview and Dynamics

Against the backdrop of the weakening of the US currency after the first debate between the candidates in the US presidential pair AUD / USD rose on Tuesday during Asian session. It seems that prevailed Democratic candidate Hillary Clinton, Republican Donald Trump lost. According to some economists, in case of victory Trump dollar for 12 months would increase by over 10%. During the election campaign in the United States Trump promised tax cuts to companies that could support the growth of the economy and the US dollar.

A weaker dollar leads to an increase in commodity prices, including oil and metals. And it supports the commodity currencies, including the Australian dollar. Oil and gas and mining and processing are the main sector in the Australian economy, and liquefied natural gas and iron ore - one of the main export commodities. Therefore, fluctuations in the price of these commodities significantly affect the quotations of Australian currency.

At the beginning of week of important economic news from Australia is expected. Therefore, the dynamics of the pair AUD / USD will mainly depend on the dynamics of the US dollar.

Also pay attention to the beginning in Algeria's oil and gas conference. Saudi Arabia has announced that he does not expect to reach an agreement between OPEC and Russia. It is widely expected that the upcoming meeting will be signed any agreement because of the continuing struggle between the world's largest oil producers for their share of the oil market. However, the intrigue about the outcome of the OPEC meeting is saved, and it will support oil prices.

Today at 20:30 the American Petroleum Institute (API) will publish its report on the change in US oil inventories last week. In the US stocks fell sharply last week, which also contributed to higher oil prices.

From the news today as we wait for data from the US. At 13:45 (GMT) will be published index of business activity in the service sector and a composite index of business activity in September by Markit in the USA (pre-release), and at 14:00 - the level of consumer confidence in the US in September (forecast 99.8 vs. 101.1 in August, which could negatively impact on the US dollar).

At 15:15 will be the speech Fed Vice Chairman Stanley Fischer, which can also increase the volatility in the pair with the US dollar.

Author signals - https://www.mql5.com/en/signals/author/edayprofit