Trading recommendations

Sell Stop 0.7280. Stop-Loss 0.7340. Take-Profit 0.7240, 0.7115, 0.7100, 0.7085, 0.6975, 0.6900, 0.6860

Buy in the market. Stop-Loss 0.7280. Take-Profit 0.7380, 0.7420, 0.7500, 0.7550

Technical Analysis

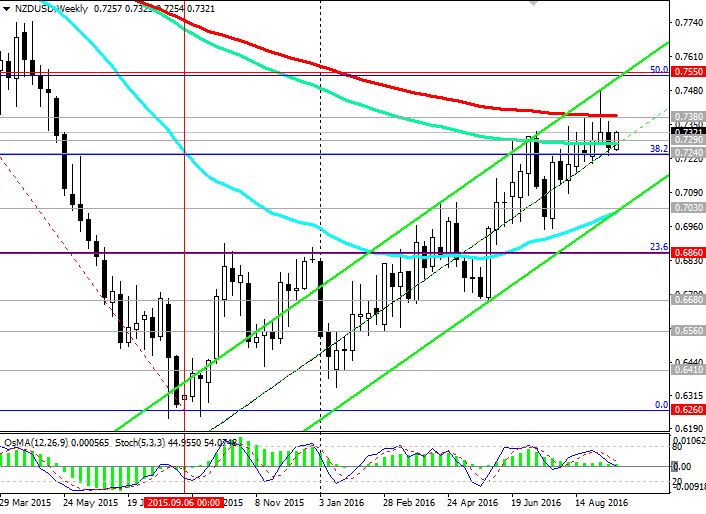

The pair NZD / USD remains in a steady upward channel on the weekly chart above strong support levels 0.7290 (EMA144 on the weekly chart), 0.7240 (38.2% Fibonacci level of upward correction to the global wave of decrease in pair with the level of 0.8800, which began in July 2014). The upper boundary of the rising channel passes near the level of 0.7550 (Fibonacci level of 50.0%). A strong constraint on further growth of the pair NZD/USD is the resistance level 0.7380 (EMA200 on the weekly chart).

In the event of a confirmed break of resistance level 0.7380 is likely further increase pair NZD / USD to the 0.7550 level that would signal the end of a downward correction and return to the global upward trend (in monthly scale).

This scenario, however, can be realized only with the support of the fundamental factors (preservation of interest rates in the United States and New Zealand at the current levels, the rise in prices of commodities, including dairy products, strong macro New Zealand data and weak US). If we come to the fore different directions of the monetary policy of the Fed and RBNZ, then the pair NZD / USD above the highs reached earlier this month near the 0.7485 mark may not take place.

In the reverse scenario, the reduction in the case of breaking the support level of 0.7240 is more likely to further reduce the level of 0.7030 (EMA200 on the daily chart and the lower line of the rising channel on the weekly chart). The breakdown of the level 0.6860 (23.6% Fibonacci level) may cancel the uptrend.

Support levels: 0.7290, 0.7240, 0.7200, 0.7115, 0.7085, 0.7030, 0.6975, 0.6930, 0.6900

Resistance levels: 0.7380, 0.7420, 0.7550

Overview and Dynamics

With the opening of today's trading day the US dollar is almost unchanged. Trading volume in the currency market are low and the low activity of traders. Market participants adjust their trading positions before the Fed's decision on interest rates, which will be published tomorrow at 18:00 (GMT). Most market participants believe that the two-day Fed meeting begins today will not change the interest rates. Mixed macro data from the US eased expectations of an increase in key interest rates by the Fed's September meeting, which also puts pressure on the dollar. If the rate will remain low, the dollar will lose its attractiveness for investors. Currently, futures on interest rates estimate the probability of a rate hike of 12% in September. The probability of a rate hike is estimated at 55% in December.

Apart from the Fed tomorrow are two world's biggest central bank decides on interest rates - Bank of Japan (03:00 GMT) and RB of New Zealand (21:00).

At least 20% of all products manufactured in New Zealand and intended for export, and an important export sector of the economy is considered to be agriculture. An export of dairy products is not less than 18% of total exports. Low world commodity prices and a relatively high rate of the national currency impact painful on the state of the New Zealand economy.

Earlier in August, the RBNZ cut its official interest rate by 0.25% to a new low of 2.0% and announced a commitment to loose monetary policy. The head of the RBNZ Graeme Wheeler said later that the central bank expects another moderate decline in official interest rates, as well as the fact that the RBNZ is still committed to achieving the inflation target. Continuing a long time, low inflation and a high rate of New Zealand currency, increasing pressure on the milk and the processing industry, is a negative factor for the development of the national economy. Graham Wheeler also noted that "the need to further easing of monetary policy to ensure that the average inflation rate in the region of the middle of the target range", which is 1% -3%.

According to most market participants, tomorrow RBNZ left interest rates in New Zealand at the current level of 2.0%. But a much greater impact on the pair NZD / USD will the Fed decision on US interest rates.

If the Fed and RBNZ will not yet change their monetary policy, then the pair NZD / USD will retain its positive dynamics. Also be aware that the interest rate in New Zealand is so far one of the highest among the countries with the largest economies. This will attract investments in more profitable New Zealand dollar. Also in its trading strategy today is taken into account after the publication of 13:00 (GMT) data from another dairy auction. Around mid-July prices for dairy products began to grow again. And it supports the New Zealand dollar.

According to the latest publication (September 6) price index for dairy products (from Global Daily Trade) increased by 7.7%. If prices rise again, the New Zealand dollar will receive an additional positive momentum, and vice versa.

Author signals - https://www.mql5.com/en/signals/author/edayprofit