EUR/USD Susceptible to NFP Pullback- Constructive Above 1.1060

EUR/USD Susceptible to NFP Pullback- Constructive Above 1.1060

https://www.mql5.com/en/market/product/16143

Talking Points

- EUR/USD vulnerable heading into NFP- key support 1.1060

- Updated targets & invalidation levels

EURUSD 60min

Technical Outlook:Earlier in the week we highlighted a key Fibonacci confluence at 1.1228/31 with the Euroreversing off that mark before breaking below the weekly opening range lows. The pair continues to hold within the confines of a well-defined ascending pitchfork formation with a couple of near-term parallels highlighting interim support around 1.1119.

Heading into tomorrow’s highly anticipated U.S. Non-Farm Payroll report, the immediate risk remains lower while below the weekly / monthly open at 1.1170 with a break of interim support targeting 1.1093 & 1.1060- both areas of interest for possible exhaustion / long-entries.

From a trading standpoint, I would be looking fade euro weakness into structural supportwith topside resistance objectives unchanged at 1.1228/31 backed by a more significant median-line confluence around1.1273 (key). For the complete setup and to continue tracking this trade& more throughout the week- Subscribe to SB Trade Deskand take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

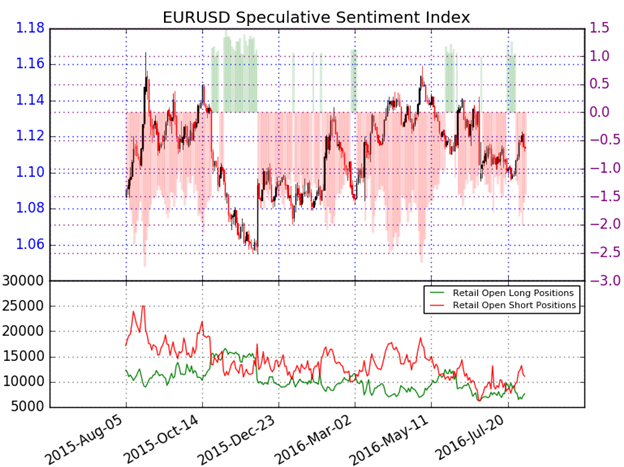

- A summary of the DailyFX Speculative Sentiment Index (SSI)shows traders are net short EURUSD- the ratio stands at -1.45(41% of traders are long)-bullishreading

- Short positions are 13.5% lower than yesterday and 5.1% above levels seen last week.

- Open interest is 5.5% lower than yesterday and 5.8% above its monthly average.

- Although retail positioning remains net short, the recent pullback in short exposure suggests the pair may be vulnerable to a near-term pullback before continuing higher. That said, heading into tomorrow’s NFP release, I’d be looking for a build in short exposure on a move lower to offer more favorable long entries.

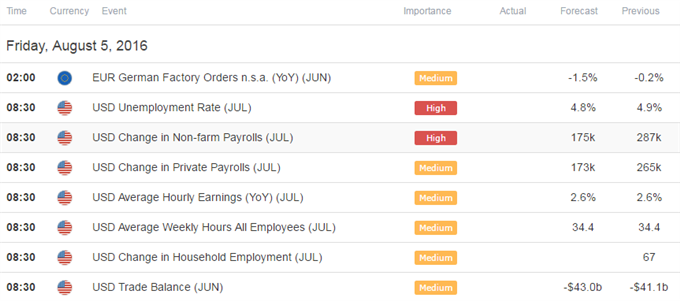

Relevant Data Releases This Week