AUD/USD to Mount Broader Recovery on Strong Australia Retail Sales

3 August 2016, 18:00

0

130

AUD/USD to Mount Broader Recovery on Strong Australia Retail Sales

Talking Points:

- AUD/USD to Mount Broader Recovery on Strong Australia Retail Sales Report.

- USDOLLAR Stages Lackluster Recover As Mixed U.S. Data Persists.

AUD/USD

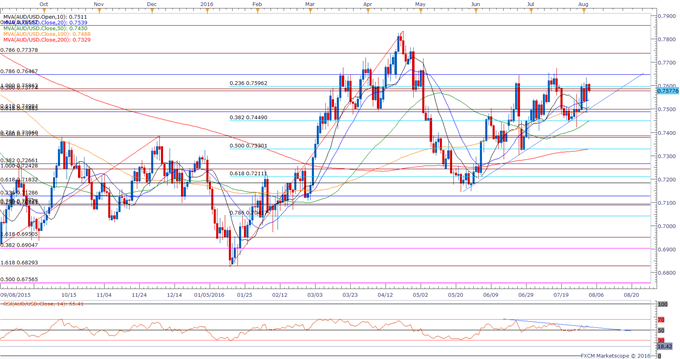

- The pullback in AUD/USD may be short-lived as Australia Retail Sales are projected to increase another 0.3% in June following the 0.2% expansion the month prior, but another failed attempt to close above 0.7650 (78.6% retracement) may continue to produce a tightening range as the aussie-dollar appears to be stuck in an ascending triangle formation.

- After cutting the benchmark interest rate to a fresh record-low of 1.50% in August, a positive development may encourage the Reserve Bank of Australia (RBA) to endorse a wait-and-see approach at the next policy meeting on September 6 especially as Philip Lowe is scheduled to replace GovernorGlenn Stevens on September 18.

- Will retain a constructive view for AUD/USD as it largely preserves the upward trend from the end of May, but need a closing price above 0.7650 (78.6% retracement) to open up the next topside target around 0.7740 (78.6% expansion).

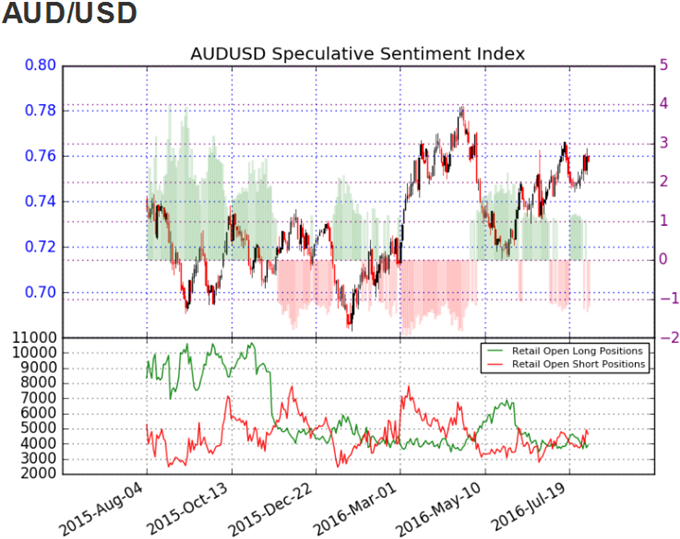

- The DailyFX Speculative Sentiment Index (SSI) shows more back and forth in retail positioning, with the FX crowd flipping net-short AUD/USD ahead of Australia’s Retail Sales report.

- The ratio currently sits at -1.18 as 46% of traders are long, with short positions 28.7% higher from the previous week, while open interest stands 5.7% above the monthly average.

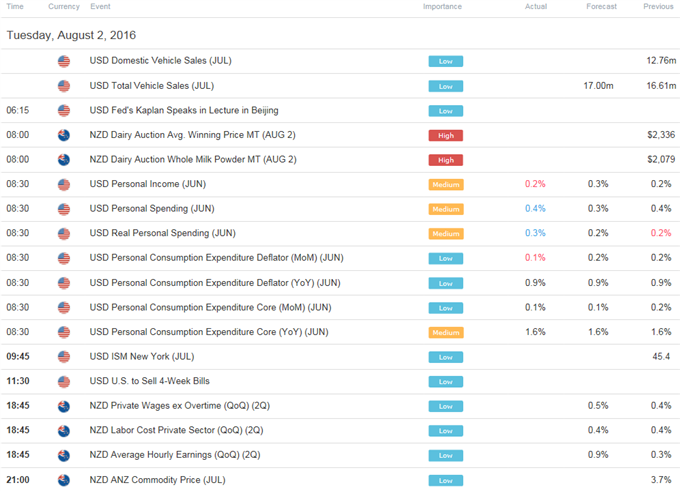

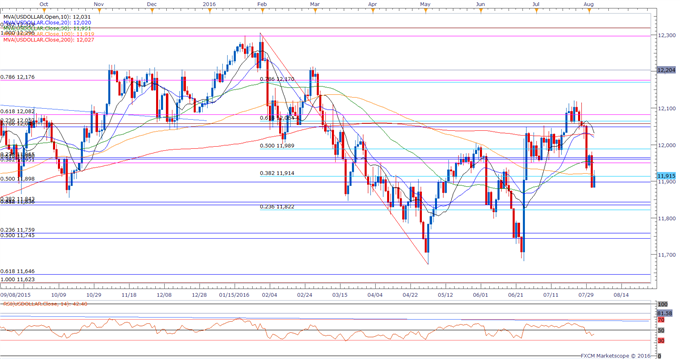

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 11915.43 | 11930.49 | 11890.73 | 0.25 | 71.75% |

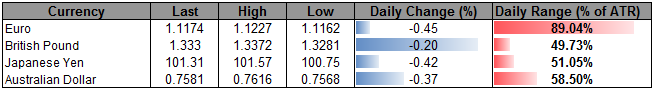

- The USDOLLAR pares the sharp decline from earlier this week even though the mixed data prints coming out of the U.S. economy dampens the outlook for growth and inflation, with the greenback at risk of facing further losses over the near-term as Fed Funds Futures continue to highlight waning expectations for a 2016 Fed rate-hike.

- Despite the 179K expansion in ADP Employment, the downtick in the ISM Employment component may dampen expectations for a better-than-expected Non-Farm Payrolls (NFP) report amid signs of a slowing recovery.

- The closing price below 11,898 (50% retracement) to 11,914 (38.2% retracement) keeps the door open for a further decline in the USDOLLAR, with the next downside region of interest coming in around 11,822 (23.6% retracement) to 11,843 (38.2% retracement), but will keep a close eye on former-support around 11,951 (38.2% expansion) to 11,965 (23.6% retracement) for new resistance.