The Fed has repeatedly been upbeat on consumers

The US GDP Q1 final revision was slightly higher than expected but it raises fresh questions about future growth.

Consumer spending was revised down to +1.5% from +1.9%. Economists had expected a boost to 2.0%.

When confronted with the softening jobs picture, Fed officials had repeatedly balanced it out by pointing out to strength from consumers. They expect that strength to result in economic activity and a sustained pickup in growth.

Instead, we find that the consumer wasn't as robust as believed.

The good news is that Q1 is nearly ancient history. Retail sales ex autos and gas rose 0.6% compared to 0.3% in April and continued another 0.3% higher in May to match the consensus forecast.

Meanwhile, the good news in the GDP report was a major revision to corporate profits to +2.2% from +0.6%. That should ease fears that the corporate sector will retrench and cut jobs.

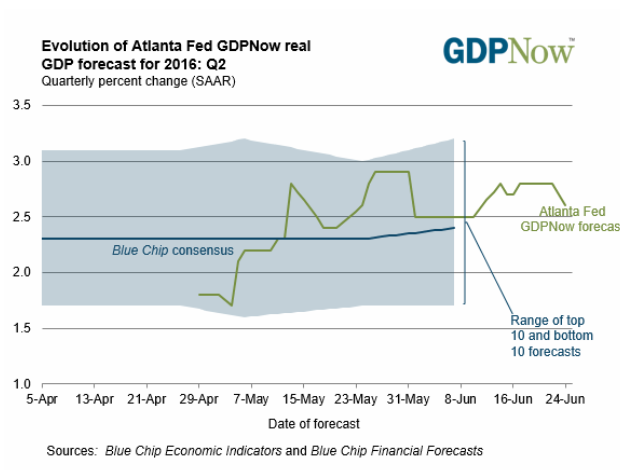

The far more important GDP report this month comes on July 29 with the

first look at Q2. The current tracking estimate from the Atlanta Fed is

+2.6%.