Several argument for a lower EUR/USD near term…:

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105

Relative rates: still in favour of USD.

A Brexit will weigh on EUR/USD given prolonged political uncertainty.

The US business cycle now looks stronger than the Eurozone’s.

…but several arguments for a higher EUR/USD medium-term:

Valuation: EUR/USD remains substantially undervalued.

External balances: the EU/US CA differential is at its widest level since 2004-06

Medium term, the ECB will become more tolerant of EUR strength as CPI picks up.

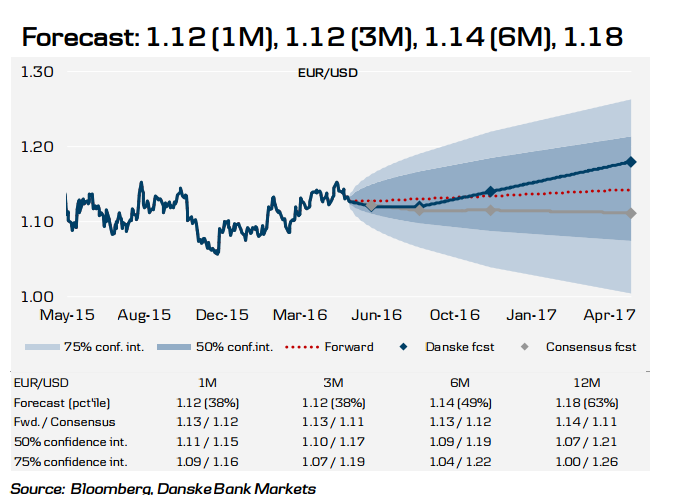

FX outlook

1-3 months: we expect EUR/USD to fall on relative interest rates, Brexit risks and cyclicals

6-12 months: we expect EUR/USD to rise on valuation and external balances.

FX strategy

• USD income/assets:

− Up to 3M: Hedge USD income via risk reversal strategies that utilise the extreme option skew.

− Beyond 6M: gradually increase hedges via forwards – beware that higher US rates should make forwards less attractive over time, i.e. don’t wait too long.

• USD expenses:

− Up to 3M: we recommend hedging USD expenses via forwards.

− Beyond 6M: hedge against USD weakness through options (e.g. knock-in forwards).

Long-term investors should stay long EUR/USD.