Waiting for the Dollar to Take Off

Outlook:

It was a holiday in the UK and US yesterday but the rest of the week is packed. The ECB holds a policy meeting on Thursday and we get a Draghi press conference, but the US payrolls report the next day is probably still the big event. Draghi can easily fob off ques-tions about any possible policy change by pointing out that ECB corporate bond buys are just starting in June.

Before then, we get personal income and spending today, along with Case-Shiller. The PCE deflator is the thing to watch, forecast up 0.2% from 0.1% last month. This is probably not enough to paint a totally clear picture at the Fed, which remains "data dependent."

Wednesday is the Beige Book, auto sales and (of course) the ADP estimate of private sector payrolls.

The current thinking on payrolls is a number of about 161,000 (Reuters),

albeit with plenty of hemming and hawing about seasonal adjustments,

strikes, the natural trajectory of a mature job cycle, etc. Never

mind—it's the number that counts.

And Reuters reports that the OPEC meeting in Vienna on Thursday may be contentious. New Saudi Energy Minister Khalid al-Falih already turned up today, but any real action on output is unlikely. "OPEC last decided to change output in December 2008, when it cut supply amid slowing demand due to a global financial crisis. By contrast, between 1998 and 2008, OPEC made 27 changes to output." As noted above, the WSJ survey has prices holding gains and continuing to rise, while the Reuters poll shows a rise to an average of $56.40 in 2017, and vulnerable to a downturn if production comes back in places where it has been disrupted, chiefly Canada. The failed state of Venezuela is of concern but nobody can see the end-game.

Let's not forget the potential of Chinese data, due tonight around 9-10 pm ET, to upset various apple carts. We get May PMI (both official and the Markit/Caixin), retail sales, and investment data. Official PMI is forecast to slip back a bit to 50 from 50.1 (Market News).

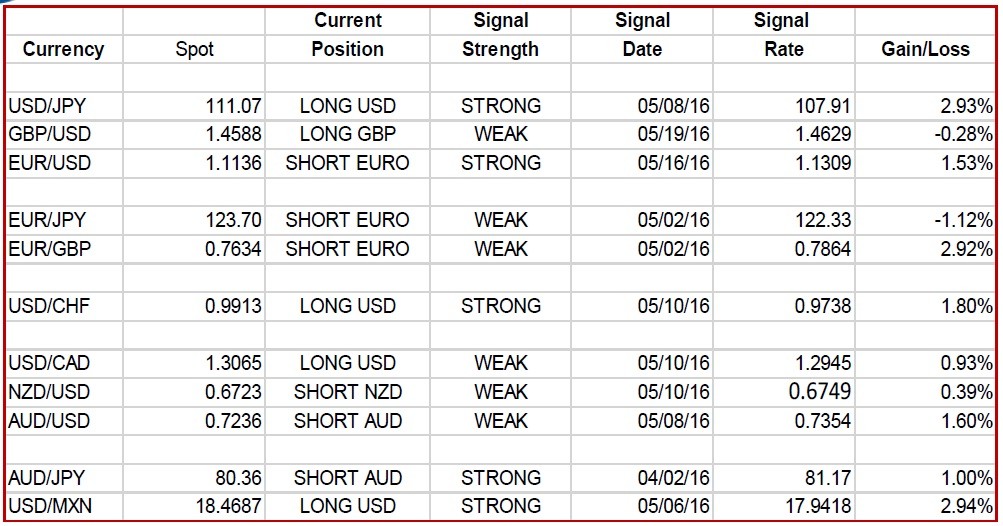

We all keep waiting for the dollar to take off like a rocket, or at least break long-standing ranges, on the Fed deciding to hike again. At the moment it looks like July and not June, but you'd think that if the hike is getting baked in the cake, we'd see stronger evidence of a lasting dollar rally. Instead, we are getting currency moves on domestic events unrelated to the dollar. The euro is the benchmark, and ever there it's not 100% certain we are getting the downside breakout. It looks more like a breakout on the 8-hour chart shown here, but you have to admit it's not dramatic. But the second hike should be dramatic, shouldn't it? We continue to worry the moment is not here. What if PCE and payrolls stink? We could get a euro rally no matter what Mr. Draghi says. Be careful.