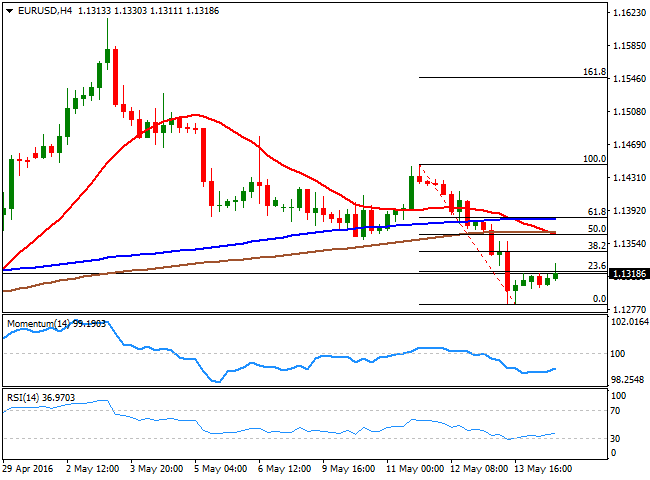

EUR/USD Forecast: Bouncing, but Downward Risk Prevails

The EUR/USD pair has bounced modestly from the 1.1285 low posted last

Friday, so far struggling to overcome the 23.6% retracement of the

latest daily decline between 1.1446 and the mentioned low around

1.1320.

Many European countries are seeing local bank holidays, due to Whit

Monday, which means volume will remain low, and there will be no

macroeconomic releases in the region. Later on the day the US will offer

some minor figures, including the New York Empire State manufacturing

index, expected at 6.5 from previous 9.56, and the NAHB Housing market

index, expected to have tick higher in May.

From a technical point of view, and according to the 4 hours chart,

technical indicators are accompanying price, recovering modestly from

oversold readings, but with no actual upward strength, whilst the 20 SMA

has crossed below the 100 and 200 SMA well above the current level,

indicating the downside is still favored.

Nevertheless a break below 1.1280 is required to confirm a bearish continuation, with the next short term supports at 1.1240 and 1.1200.

The 38.2% retracement of the mentioned decline stands at 1.1345, and is

the level to overcome to see the pair offering a more constructive

outlook, and advance towards the 1.1380/1.1400 region.