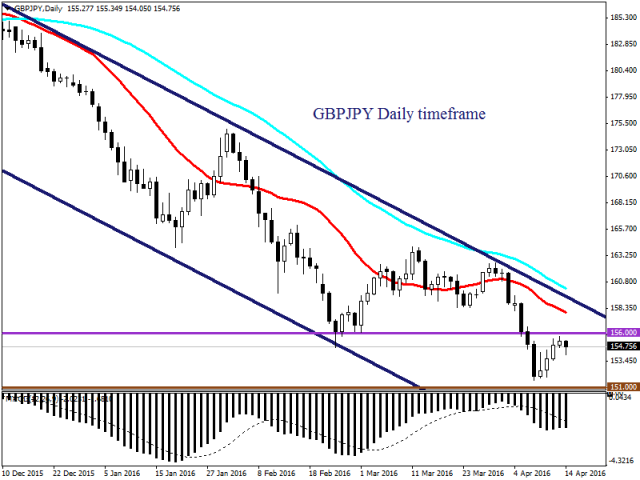

GBPJPY

GBPJPY bulls displayed resilience during trading on Thursday following the Bank of England’s dovish stance on future UK rate hikes which left the Sterling heavily pressured across the board. Regardless of this resilience, with mounting Brexit concerns eroding investor attraction towards the pound, bearish investors may be encouraged to send the GBPJPY lower in the near term. From a technical standpoint, the GBPJPY remains bearish and the volatile combination of Sterling weakness and Yen appreciation could send the pair towards 151.00. A decisive breakdown and daily close below 154.00 may encourage a further decline towards 151.00.

EURGBP

Sterling bears have acted as a motor that continues to provide the EURGBP with enough momentum to venture towards the 0.80 resistance. This pair has become increasingly bullish on the daily timeframe as there have been consistently higher highs and higher lows while the MACD trades to the upside. Prices have found comfort above the daily 20 SMA and a breakout above 0.80 again should open the gates to 0.82. This catalytic combination of EUR strength and Sterling weakness continues to provide bullish investors the inspiration to keep this pair buoyed.

NZDUSD

The struggle is visible but the NZDUSD bulls are prevailing in this tug of war which has caused prices to move erratically. This pair is more skewed to the upside and Dollar weakness may act as a catalyst which could provide the foundation for buyers to send this pair back towards 0.7100 in the medium term. From a technical standpoint, prices are above the daily 20 SMA while the MACD trades to the upside. A decisive break back above 0.6950 should open a path towards 0.7100. This bullish outlook remains valid as long as bulls can defend 0.6750.

GBPCHF

The growing anxieties over the immeasurable impacts of a Brexit to the UK economy have offered enough encouragement for bearish investors to continually attack the Sterling and this can be viewed in the GBPCHF. This pair is quite bearish on the daily timeframe as prices are trading below the daily 20 SMA while the MACD also trades to the downside. A breakdown below 1.355 should open a path towards 1.340. This bearish setup remains valid as long as prices can keep below 1.3950.