Daily Analysis of Major Pairs for April 7, 2016

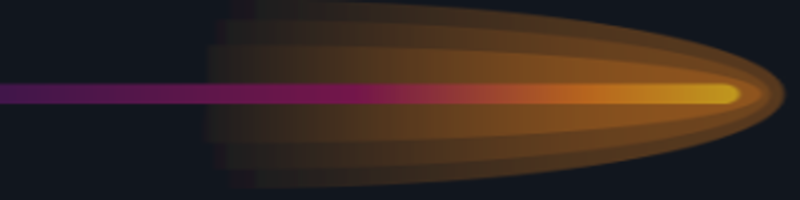

EUR/USD: Since the EUR/USD tested the resistance line at 1.1400, it has been difficult for the price to go above that line. The bulls have continued battering that line of defense (an action that started last week). A closer look at the market, especially on the 4-hour chart, shows that the bulls have almost breached the resistance line to the upside. They would eventually push the price towards another resistance line at 1.1450. There are also some fundamental figures which would be released today. They would have an impact on the market.

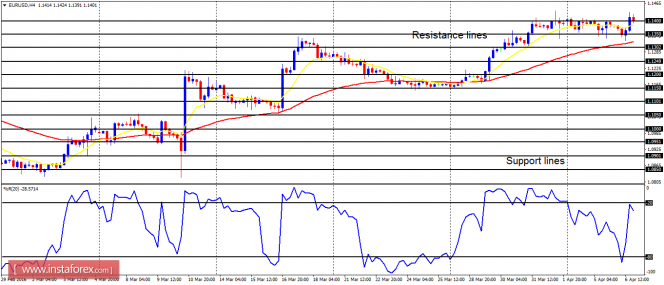

USD/CHF: The USD/CHF has been consolidating to the downside so far this week. The support level at 0.9550 has been tested and it would soon be breached to the downside. This is because the outlook on the market is bearish for this week: as long as the EUR/USD continues to show its bullishness, the USD/CHF would remain under bearish pressure.

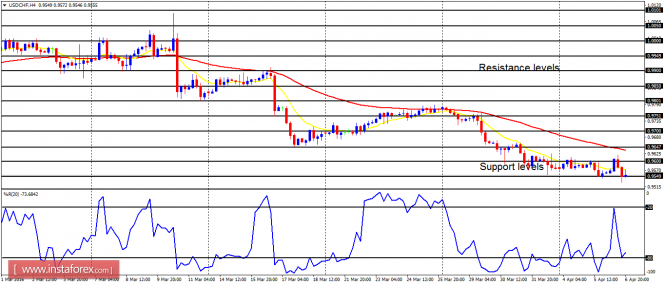

GBP/USD: The Cable went downwards on Wednesday, plus the market has become volatile. There is a Bearish Confirmation Pattern in the market, and as a result of that, it is assumed that further southwards movement is possible. This is because the EMA 11 is below the EMA 56, while the RSI period 14 is below the level 50.

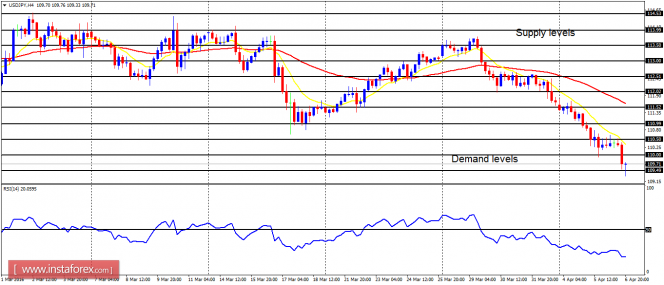

USD/JPY: The USD/JPY has tested the demand level at 109.50. Since March 29, 2016, the price has come down by 420 pips. A drop of 220 pips has been witnessed this week alone. Owing to the ongoing selling pressure in the market, the bears would now target the demand levels at 109.00 and 108.50, which would be tested today or tomorrow.

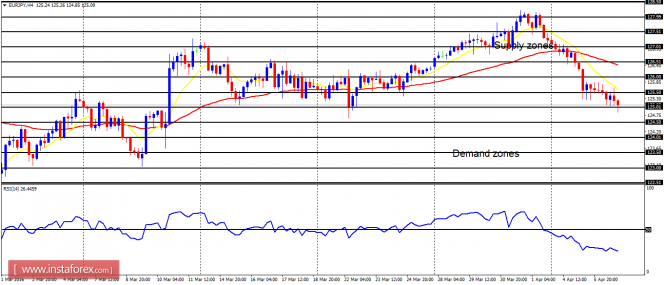

EUR/JPY: According to the ongoing bearish signal in this market, the price has gone down by 220 pips. There is a lot of trading activity around the demand zone at 125.00; and it is assumed that the price would go below that demand level as the bears target another demand level at 124.50.

The material has been provided by InstaForex Company - www.instaforex.com