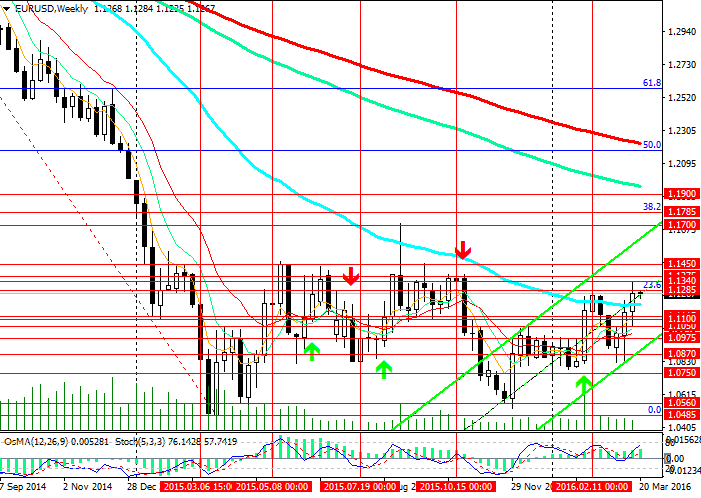

EUR/USD: Stochastic is Leaving Overbought Zone

Following the US Fed decision on 16 March, the pair EUR/USD has grown over 200 points, exceeding Fibonacci retracement of 23.6% to the last wave of decline with the highs of 2014 crossing the level of 1.1285, over 60 points.

Since last Thursday the pair has been declining.

On the daily chart the indicators OsMA and Stochastic started to reverse towards short positions. At the same time, starting from 9 March Stochastic has been in the overbought zone on the daily chart.

On 4-hour chart the indicators give sell signals; the pair EUR/USD has rebounded from the upper limit of the ascending channel and is declining to support level of 1.1100 (bottom limit of the channel, ЕМА144, ЕМА200).

If the management of the ECB learns a lesson from their contradicting statements and actions and continue QE program in Eurozone, the pair EUR/USD will accelerate the decline.

Breakout of resistance levels of 1.1340, 1.1375 and 1.1450 will cancel the current scenario and the pair EUR/USD will go to 1.1700 and 1.1785 (Fibonacci 38.2%) and 1.1900 (ЕМА144 on the weekly chart).

Support levels: 1.1190, 1.1115, 1.1100, 1.1050, 1.1000, 1.0870 and 1.0750.

Resistance levels: 1.1285, 1.1340, 1.1375 and 1.1450.

Trading Tips:

Sell Stop: 1.1230. Stop-Loss: 1.1270. Targets: 1.1100, 1.1050, 1.0870 and 1.0750.

Buy Stop: 1.1310. Stop-Loss: 1.1270. Targets: 1.1375, 1.1450, 1.1500 and 1.1700.