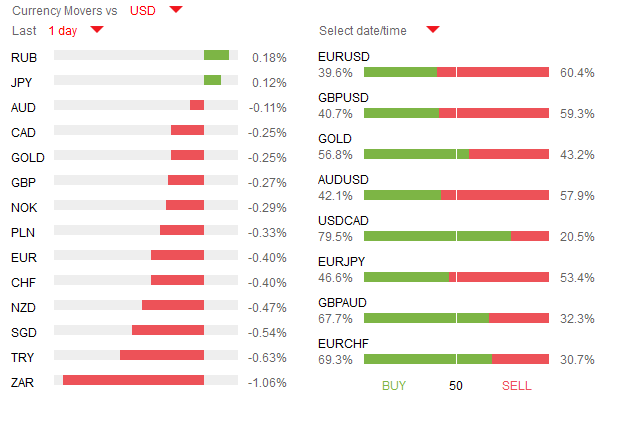

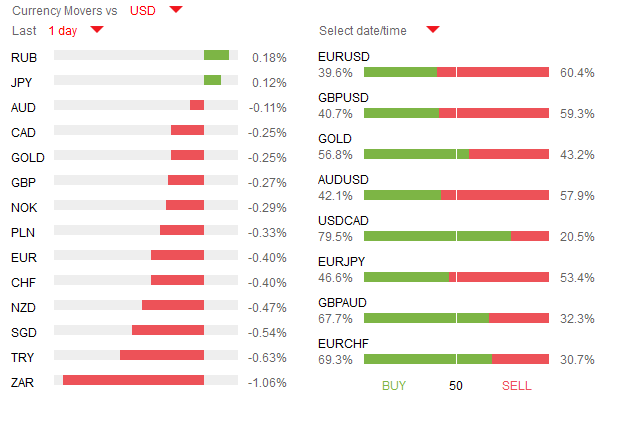

We’ve seen a change in the tone to FX markets this week, with the dollar index moving to new lows for the year, and is now down a cumulative 5% since the start (calculation helped by close at 100.0!). Remember, once again, many started the year with a bullish dollar view, based on the Fed continuing its tightening cycle and other central banks (such as the ECB and BoJ) continuing to ease in varying different ways. The Fed’s forecast revisions this week reinforced the already weakening dollar. This has been against the backdrop of rising risk appetite, the Aussie propelled towards the 0.77 level, helped by better jobs data. At the same time, US indices (S&P 500) have now erased the losses for the year, with European bourses not that far behind. We’ve also seen emerging market currencies push further ahead from the lows seen in January, with the Russian Rouble and Brazilian Real leading the way. For today, the data calendar is relatively light, apart from the inflation data in Canada and the provisional Michigan confidence data in the US and a few Fed speakers scattered through the day. In essence, we should see a calmer end to the week in FX after the volatility seen earlier, but this is a flows driven market, so as always keep the risk parameters in mind. Looking ahead, we are heading into a shortened week next week (owing to the Easter holiday in some markets), so we could see choppy markets on reduced liquidity. |