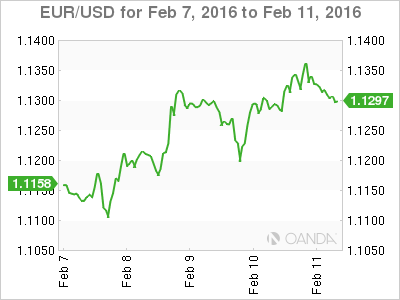

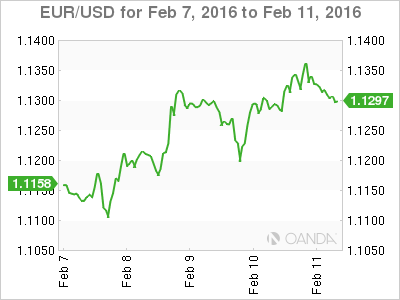

The week from February 5 to 12 was defined by a flight to safe havens. The biggest winners versus the USD were the JPY and the CHF as investors looked to less risky assets. Oil had another rollercoaster of price changes as comments from the International Energy Agency (IEA) put downward pressure until the Organization of the Petroleum Exporting Countries (OPEC) via the United Arab Emirates energy mister made a comment about a possible production cut agreement that helped the price of crude bounce on Thursday.

Chinese markets will reopen after the Lunar Holiday and they are expected to catch up to global stock market losses, which could trigger another, sell off. The United States and Canada markets will be closed on Monday for holidays. The Fed will release the minutes from its January meeting. Going by Fed Chair Janet Yellen’s testimony the central bank is bullish on the U.S. economy, but concerned about global growth the combination of factors could result in no rates U.S. interest rate hikes in 2016. Retail sales out of the U.S. on February 12, validated the Fed’s view of a moderate recovery.

There will be a vast number of economic releases this week. Inflation data from the United Kingdom will be released on Tuesday, February 16 at 4:30 am. The FOMC minutes will be published on Wednesday, February 17 at 2:00 pm EST and inflation figures will be available for Canada and the United States on Friday, February 19 at 8:30 am EST. >> Read More