NFP = non farm payroll (USA)

Why is NFP Important for CFD Trading?

Non-Farm Payroll or NFP is a critical economic news print, here’s a quick guide on understanding and trading NFP with CFDs. The great recession was another name given to the 2008 Global Credit crisis that caused a massive sell-off of the stock market. The reason the recession was named so was that, while not technically a depression, the global loss of jobs, many of which were in finance, brought back memories of the Great Depression of the late 1920’s and majority of 1930s with many unemployed standing in bread lines and being forced to sell nearly all their possessions to make ends meet.

The selling of stocks saw one of the sharpest rises in the US dollar as risk-sentiment went south in a hurry and caused most investors big and small to buy the safest investment they could find, US Treasuries through the US Dollar. When investors and non-investors alike looked around the global economic landscape to find a symbol to hold on to that the global economy was recovering, they landed on two specific items, employment and inflation. Since then, we’ve found employment and inflation economic readings like Non-Farm Payrolls to be a critical component to central bank rate announcements and press conferences to help people understand the progress or regressing of the economy since the 2008 downturn.

Because the drop in jobs created a vacuum of poor economic data, jobs or payroll numbers have been looked to in the once-a-month Non-Farm Payroll by the Bureau of Labor Statistics or BLS.

The release of the monthly Non-Farm Payroll figures is a highly anticipated moment for CFD traders. Due to the importance of NFP described above, NFP often brings volatility and opportunity. As with other news releases on the economic calendar, traders will use this data to determine the strength or weakness of the underlying economy.

What Do the NFP Numbers Mean?

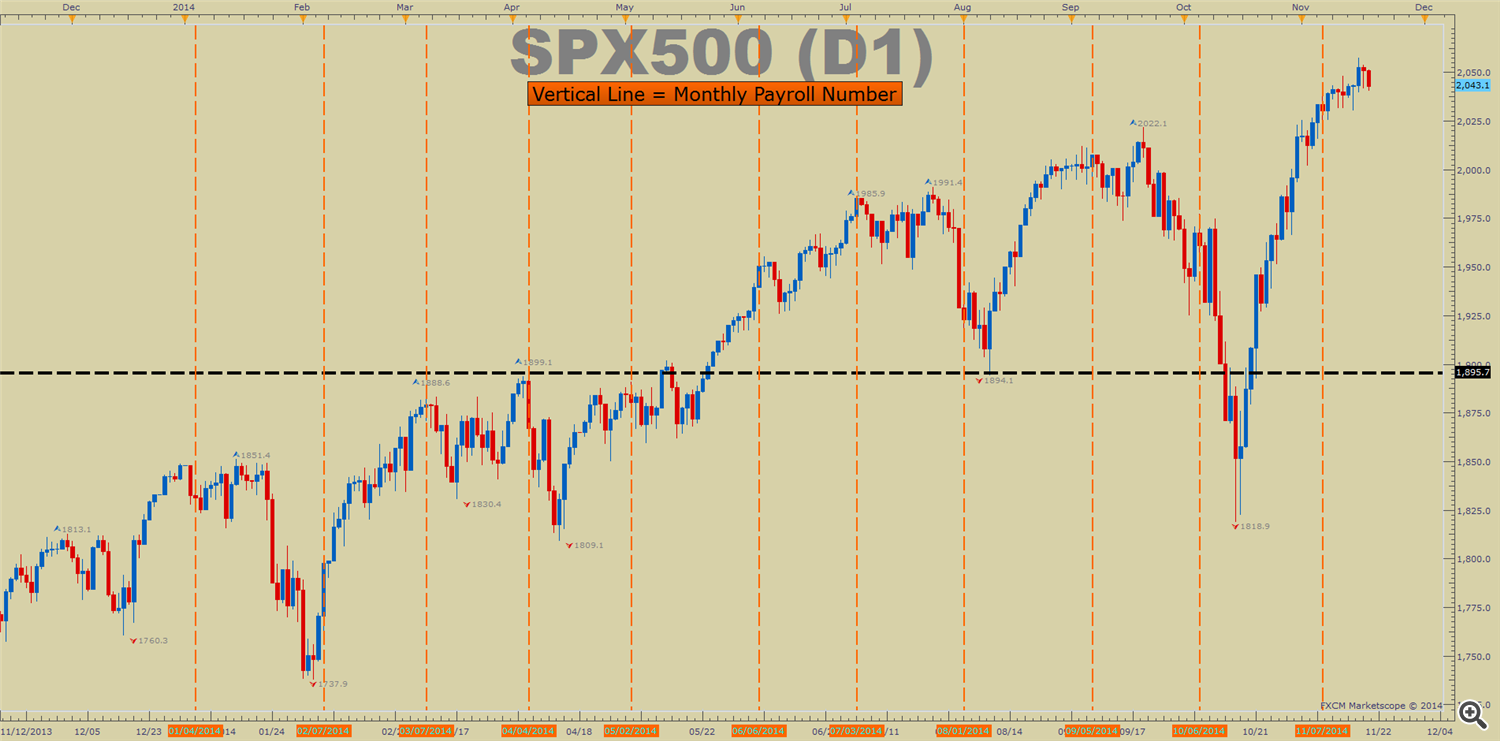

The NFP numbers are in thousands and looks specifically at net changes in employment as jobs are created or subtracted in an economy for the prior month. The term Non-Farm is used since farm / agricultural workers are no-longer included in the employment count. The decision to not include agricultural jobs lies in these jobs being largely seasonal that could possibly produce small temporary shifts in labor reporting. Below we can see a composite of past NFP events from September 2012 through last month’s release. Through graphing we can see that employment figures have been steady for 2014 and could show the economy is recovering, which has allowed the SPX500 to rise steadily to all-time highs.

Non-Farm payroll is quickly showing the health of the world’s largest economy in terms of jobs added. The thinking is that if publicly traded companies are adding employees, they must be healthy and confident enough in the outlook of the economy to continue hiring people. Inversely, if the number misses estimates or is negative, the message often received is that the largest employers in the United States are collectively not as confident in the future of their company or the economy and that could send a warning signs to investors, especially if this becomes a trend.

SPX500 & CFD Indices Have Benefitted From Steady NFP Numbers

Past performance is no guarantee of future results.

There hasn’t been a negative NFP print since 2010 but there have been some good misses from the overall consensus. As one can see from the chart above, while price of the SPX500 has continued to print all-time highs, the NFP print that is the orange vertical line, tend to begin, end or accelerate a move. This helps traders see the importance of NFP to overall sentiment.

How to Trade NFPs

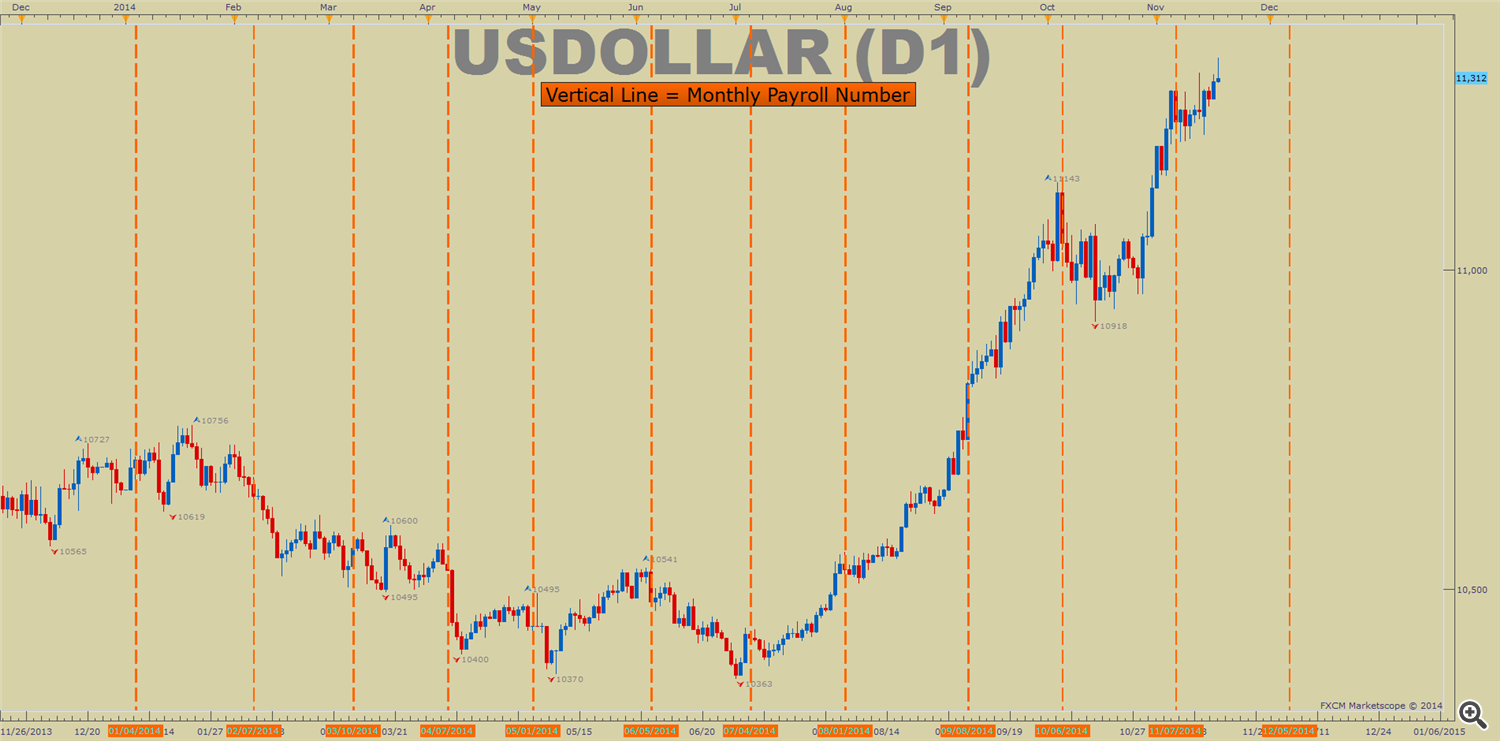

First, a trader should know when NFP is going to happen and settle on a good economic calendar. The good news is that it comes out like clockwork as mentioned at the bottom of the article. Second, let’s look at what CFDs are affected by Non-Farm Payroll and then discuss how to prepare when NFP Friday comes. Because NFP is an important news print, most CFDs will be effected to some extent and show volatility. However, XAUUSD, US equities, and USDOLLAR is a great place to start.

USDOLLAR with NFP Dates Shown in Orange Vertical Lines

Once a trader knows when NFP will release and what CFDs are affected like XAUUSD, US equities, USDOLLAR, they can then look at the chart and look to see if there is a strong trend and to trade in its direction. Ideally, NFP will produce volatility that provides a better price to enter the overall trend without damaging or reversing the trend, which is rare.

A trader looking at the chart to enter in the direction of the trend can use a chart indicator to help CFD traders identify a price floor or support. One tool that can be used is a shorter-term moving average like an 8-day or 13-day moving average or a shorter-term trader could use an hourly moving average like a 20-hour or 50-hour moving average. The idea is to see if the price touches this line to provide an entry without damaging the overall trend. A touch of support after a news release can provide a buying opportunity with a limited risk scope, often the prior low, while trading in the direction of the overall trend.

Notes:

NFP Release Time: 1st Friday of Each Month at 8:30am EST

Regardless if a trader intends to trade CFDs by focusing on the news or maybe just sit on the sidelines, NFP can be exciting and will often bring volatility and opportunity. If one decides to trade, stick with a news trading plan and always keep an eye on risk / reward levels while minimizing the use of leverage. Keep an eye on economic calendars to see NFP releases times in your local time.