Benefits of Keeping a Trading Journal

Trading is exciting. The idea of making money by outsmarting other traders and beating the market is something many strive for but few are able to achieve. In order to be successful, we need to trade at our highest level and be able to maintain it. This requires not just a good strategy, but a proper game plan and study regiment away from our trading platforms.

Today we take a look at the benefits of keeping a CFD trading journal.

Keeping Ourselves Accountable

The first benefit to a trading journal is accountability. Whether we keep our trading journal private, or share it with other traders, keeping track of every trade that we place and reviewing it will make deviating from our strategy in real time much more difficult. This is because we know that we will later have to face the fact that we broke our own rules or fell victim to our emotions in the moment. Without journaling, it’s easy to block out the times where we made mistakes or bent our own trading rules. But knowing we will have to face the music at the end of the week when we review our trades encourages us to follow our system to the letter in real-time. Whenever we hold ourselves accountable, this encourages trading consistency, another important benefit of journaling.

Increasing Trading Consistency

Some trading strategies are composed of complex layers of signals and rules that can be tough to manage in the heat of the moment. A big benefit of keeping a journal is that we can then look at each trade after the fact when we are not as stressed and really break down each and every opportunity. No one is perfect. We will all make mistakes, and being able to see what our largest mistakes are and fixing them will produce increased consistency. Hopefully, when we look at previous charts, we have no regrets on the trades that were placed. We want to see setups that were so good, we would place the exact same trades again right now if we could. It is also recommended to take screenshots ofn the CFD charts for our trade entries and exits to keep an accurate record of exactly what we were seeing during the trade. We do not want to fall victim to hindsight while reviewing trades. We only want to see the available information we had during the trade in real time. When we have trading consistency, this allows us to accurately evaluate our strategy’s effectiveness. Not all systems will be winners. It is likely that we can do everything right, and some strategies will be the source of bad trades. We can identify our losing strategies and throw them away, or try to make adaptations we think will increase performance.

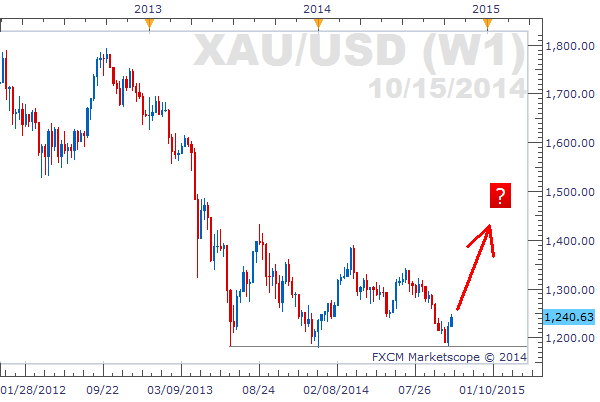

Gold Chart Hitting Support

Improving Our Trading Strategies

The final (and probably the most exciting) benefit of keeping a CFD trading journal, is how it can improve our trading strategies.The more we look at our past trades and analyze each entry and exit, the greater the chances we can identify areas where adjustments can be made to improve profitability. Consistently making small improvements will improve the proficiency amongst new and professional traders alike. We all need to be on the lookout for fresh angles and sources of a trading edge.

There are unlimited amounts of ways we can change our strategies, but here is a short list of different ways that a strategy could potentially be improved: