Euroglut is Real: EUR/USD weakness with a forecast of 0.85 by 2017 - Deutsche Bank

Many investors of Eurozone fixed their profit and it hepls to will drive down

the EURUSD conversion. Analysts at Deutsche Bank have confirmed the warnings: the euro

to dollar exchange rate will decline significantly over the longer-term.

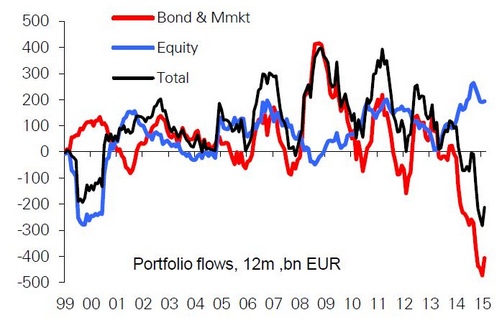

In October 2014 Deutsche Bank introduced their Euroglut theory predicted a wave of European capital outflows to the rest of the world would with dramatic euro weakness. Euroglut theory has drawn criticism: as Thomas Klitgaard and David Lucca stated - any outflow from the euro area to be matched by a similar-sized inflow. Besides, those Fed Analysts are suggesting to focus on cross-border financial flows: the euro and global asset prices can move without any change in financial outflows.

And because of that the theory's author (George Saravelos at Deutsche Bank) has taken time to review the evidence and made a conslusion that Euroglut is no longer a theory but a reality. For example, flows are mostly directed towards US bond markets exceeding the Eurozone account surplus.

As a result, Deutsche Bank revised their forecast concerning long-term movement for EUR/USD price: the weakness of EUR/USD will be continuingwith a move below parity in 2016 and a forecast of 0.85 by 2017.