USD/JPY: monetary policy remained unchanged until January 29. Trading Recommendations

Trading recommendations

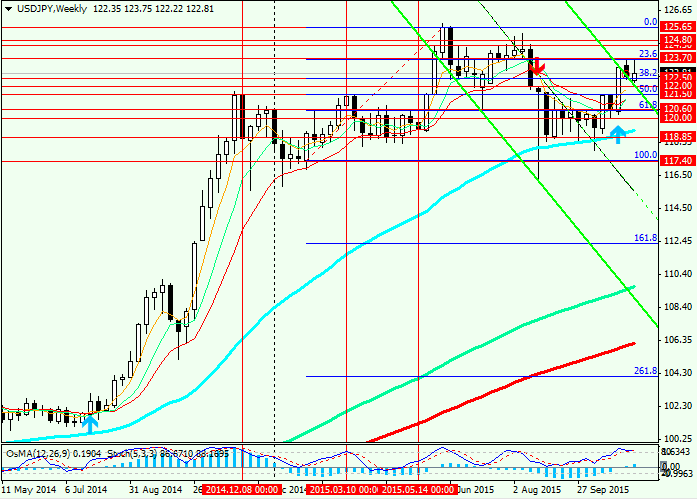

Buy Stop 123.20. Stop-Loss 122.70. Take-Profit 123.70, 124.00, 124.50

Sell Stop 122.40. Stop-Loss 123.10. Take-Profit 121.90, 121.50

Indicators and Levels

Moving in an upward channel on the daily chart the pair came close to the resistance level of 123.70 (Fibonacci level of 23.6%), however, the decision of the Bank of Japan on Thursday bounced from it to support level is at 122.50 (Fibonacci level of 38.2%). Probably until the fed meeting in mid-December, the pair USD/JPY will trade near these levels in the range with a tendency to decrease.

The OsMA and Stochastics on 4-hour and daily charts moved to the side of the sellers.

In case of breakdown of the level is at 122.50 couple is at risk to fall below the support level 122.00, 121.50 (EMA on 4-hour chart and the 50% Fibonacci level).

However, in the medium term, preferred long position.

In case of breaking the resistance level of 123.70, the pair will head to the levels 125.00, 125.65 (highs).

The OsMA and Stochastic on the weekly chart recommend buy.

Support levels: 122.50, 122.00, 121.50

The resistance: 123.50, 123.70, 124.00, 124.50

Overview and dynamics

At its meeting, held on Thursday, the Bank of Japan left monetary policy without changes. In a statement following the meeting, the head of the Bank of Japan Kuroda said that the reduction of Japan's GDP in the 3rd quarter of 0.8% is negligible, was mainly due to the reduction of stockpiles, and there is no need to revise the assessment that the economy continues to recover moderately. In annual terms the GDP decline was 0.8% versus the forecast of 0.2%.

In the previous three months GDP fell by 0.7%. The reduction in GDP the last 2 quarters is generally viewed as a recession. And the Bank of Japan, according to many economists, may return to the issue of easing monetary policy in the country for its meeting to be held January 28-29.

For 2017, the Bank of Japan has lowered the forecast of inflation (to 1.4% from the previous value of 1.9%) and GDP growth (to 1.4% instead of 1.5%).

The probability of monetary policy easing, which has repeatedly said Kuroda, now appears to be moving end of January 2017.

Meanwhile, market participants preparing for higher interest rates in the US in December, despite the modest optimism of fed officials, according to the last FOMC Protocol.

So, the US stock indices on Thursday closed lower. DJIA fell by 0.02%, S&P 0.1%. Crude oil futures on the Nymex have fallen in price on 0,5%. According to the futures prices in the fed rate, financial market participants assess the probability of a rate hike in December in 72% vs. 58% two weeks ago.

Thus, with Friday and in anticipation of a three day weekend in Japan, many traders will likely begin the profit taking in short positions in the pair USD/JPY closer to the middle of the American session, which will support the USD/JPY pair, however, the main motion will be in the range.