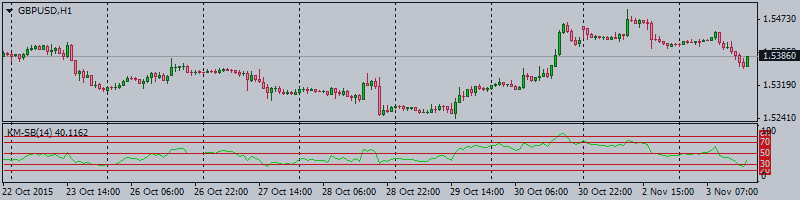

The slide in the GBP/USD

stalled, making way for a minor correction after the US reported a drop in its

factory orders in October, along with a fall in IBD/TIPP economic optimism

index.

Back above hourly 100-MA

The spot is now

back above its hourly 100-MA at 1.5366 after having dipped for a brief moment to

a low of 1.5359. The US factory orders contracted 1% as expected, thereby

offering no surprise to the markets. However, the cable has responded by ticking

slightly higher to 1.5380.

Next on tap is ECB Draghi’s speech due later

today, which may trigger volatility in the EUR/GBP cross and thus influence the

GBP/USD pair.

GBP/USD Technical Levels

At 1.5380,

the immediate resistance is seen at 1.54, followed by a major hurdle at 1.5408

(38.2% of Apr-Jun rally). On the other side, hourly 200-MA and 38.2% of Oct

low-high at 1.5355 could offer strong support, under which the pair could test

1.53 handle.