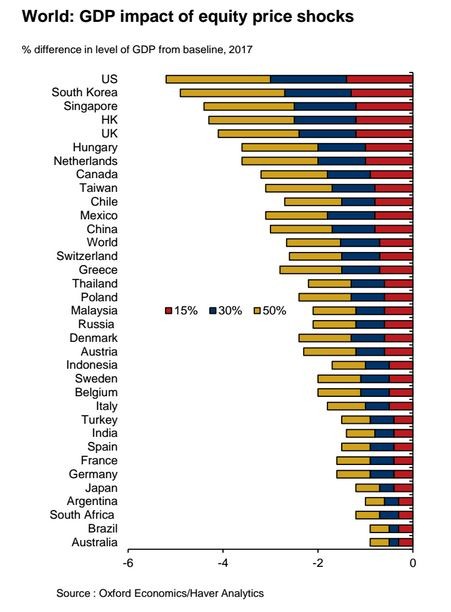

World growth is under danger if global stocks slide again - Oxford Economics

Oxford Economics has made some calculations to figure out what a steep correction in equity prices would do to global growth. The consultancy noted that the recent slide in stocks is similar in scale to that seen in 1998.

The Global

Economic Model presented by the consultancy suggests a 15% fall in global stock prices could knock

0.4% to 0.7% off world GDP after two years. And a 30% stock shock could slash growth by 1.1% to 1.5%.

“It is unclear whether the sell-off is over or has slightly paused; in

the latter case we could be headed for a potentially very serious equity

slump by historic standards,” economists Adam Slater and Melanie Rama

said in their report.

“A sharp correction in global equity prices would pose a significant threat to the global economy.”

Developed markets would take a harder hit than emerging ones, they say, as their percentage GDP is bigger. The ratios in the U.S., the U.K., Switzerland and Canada all top 100 percent, according to Oxford.

Consultancy reckoned central banks can only offset some of a drop.

Keeping interest rates at current levels in the U.S. or cutting them elsewhere could cap the decline in world GDP to 0.4 percent from 0.7 percent if stocks fell 15 percent.

But even in the case of a 15% shock and monetary easing, world GDP would still drop by 0.4%. With a 30% shock, the fall would be 1.1%, and 2.2% for a 50% shock, the economists say.

“In these latter cases, interest rates in the major economies would remain stuck near zero, with Fed rate rises canceled.”